Podcast 🎙 ↑↑↑↑ Scroll down for the script.

Morning, it’s Monday 22nd of April,

-Israel’s limited strike on Iranian military sites and Tehran’s mute response brought a few days of calm in the Middle East.

-Washington finally approved a $60bn military aid package for Ukraine but the political delay has benefited Russia and Ukraine President Zelensky said it will take time to deploy the cash and weapons.

-The three main sentiment drivers at the moment are the geopolitical situation, weak earnings reports and a hawkish tone from the Fed.

Although Netflix beat revenue and profit estimates last week, its Q2 guidance and the decision to stop reporting details on subscribers from 2025, was badly taken by investors. Shares fell 9% on Friday, their worst day in two years, pulling the technology sector sharply lower.

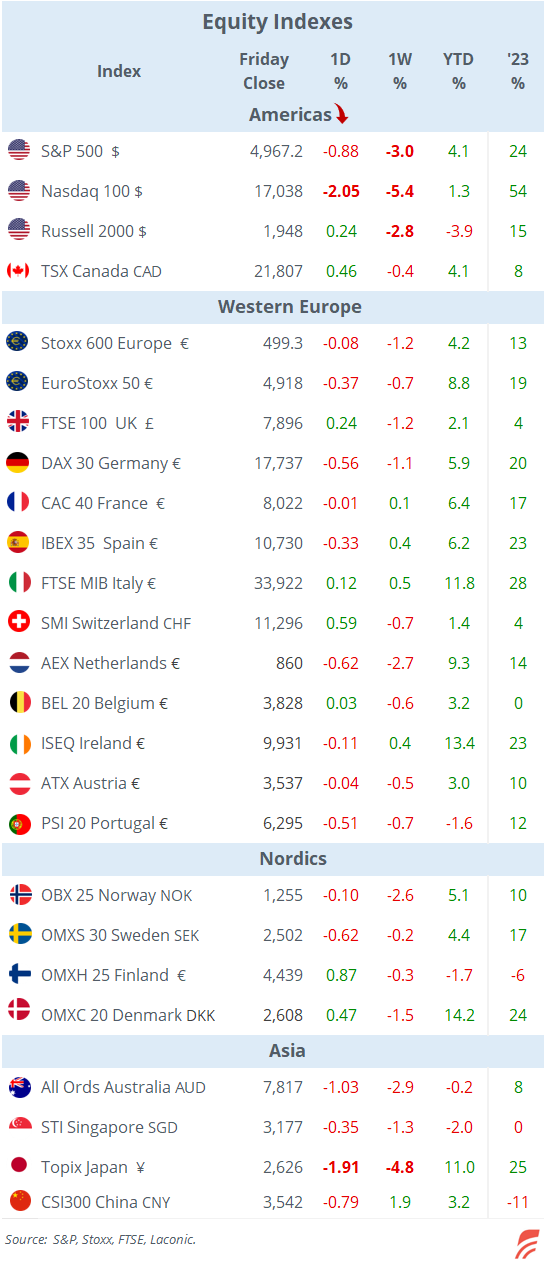

The S&P and Nasdaq indices have fallen for six straight sessions, the longest streak of declines in 18 months. The Nasdaq 100 index lost 2% on Friday and 5% on the week. The S&P 500 is now 4% higher year-to-date following this steep reversal. European indices are outperforming in local currency, with the EuroStoxx 50 up by 9% this year, but are matched in dollar terms.

Microsoft and Apple fell around 6% on the week and chip makers plummeted. Nvidia finished the week 14% lower, and is down 21% from its recent peak, Micron Technology lost 13%, Broadcom and ASML down 10%. Also, Tesla plunged 14% while United Healthcare and Adidas advanced 14% on the week.

Regarding Tesla, Musk cut vehicle prices in China and Germany following the recent reduction in the US as it faces increasing competition. Its Robotaxi technology price was slashed by a third. The stock is down 41% YTD to the lowest since late 2022 and is trading at 31 times one-year trailing earnings. Tesla reports results tomorrow.

In interest rate markets, Treasury yields have gained significantly in the past few weeks as traders price in an expected delay of a rate cut by the Fed. 10-year yields added 42 basis points in 3 weeks to 4.62% as the spread over Bunds, which closed at 2.51%, widens (to 211bp) on the back of the divergence between the ECB and the Fed signals.

Today, China left its Loan Prime Rates unchanged as expected, 3.45% for the 1Y and 3.95% for the 5Y. Asian equities are trading firmer with most markets up by around 1%. Crude oil is a touch weaker with Brent falling below $87. Bund futures are lower while European equity futures are pointing to a higher open.

In corporate deals, US engineering software company Bentley Systems, which was listed in 2020 and has a market cap of $16bn, is considering strategic partnerships including a potential sale, attracting interest from France’s Schneider Electric and Cadence Design Systems of the US.

In IPOs, French software company Planisware raised more than €240mn on Euronext Paris on Thursday. It was priced at €16, shares rallied 33% on their debut and ended the week at €19.90 for a €1.4bn valuation. Planisware offers SaaS for businesses.

In credit ratings, Colgate-Palmolive was downgraded one notch by S&P to A+, stable outlook. Greece’s outlook was upgraded to positive and Israel’s rating was downgraded one notch to A+.

In business news, French artificial intelligence start-up Mistral is in talks to raise €500mn at a €5bn valuation, only four months after a €400mn funding round.

In the crypto world, a significant event took place on Saturday, with Bitcoin’s halving which happens every four years and means that fewer coins can be mined, leading to a higher scarcity effect. Bitcoin is firmer this morning at $65,600.

On the earnings front, we’ll hear from SAP and Verizon today, while tomorrow will be active with Tesla, Novartis, GE, Visa, Lockheed, UPS and Pepsico among others.

Today will be light on data releases with consumer confidence in the €-zone and producer prices in Canada. In monetary policy meetings this week, China reported loan prime rates today, Indonesia’s central bank meets on Wednesday, Turkey on Thursday, and Japan and Russia on Friday. The key data comes on Thursday with the US GDP update and on Friday with PCE inflation and consumption.

That’s all for today, have a good week.