Morning,

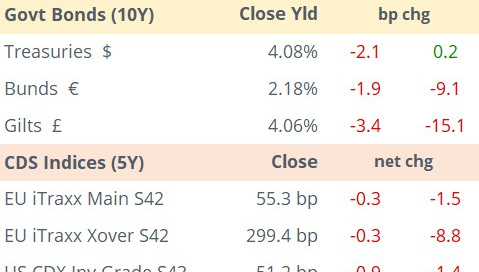

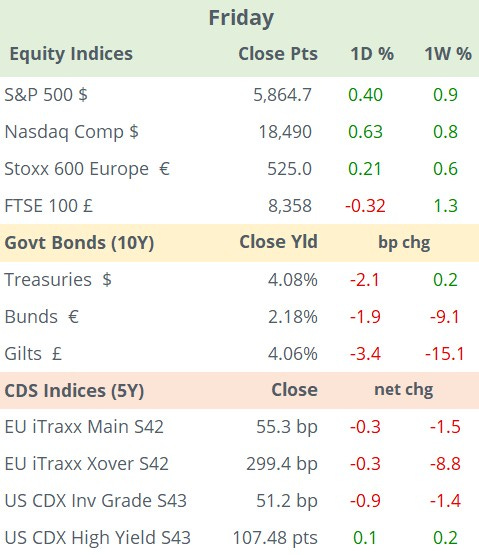

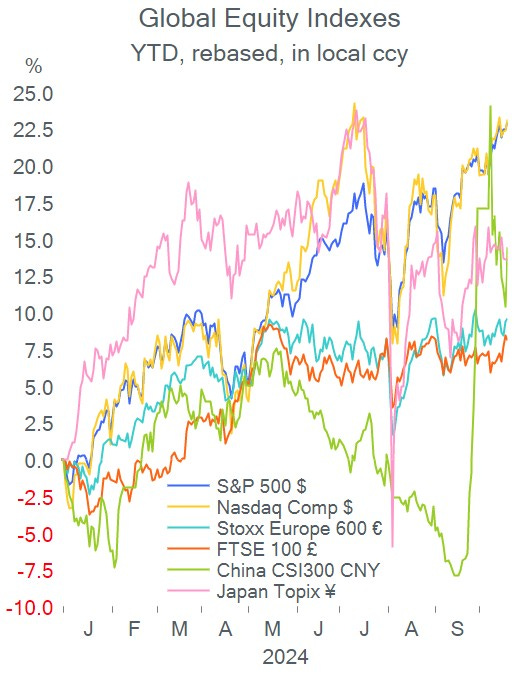

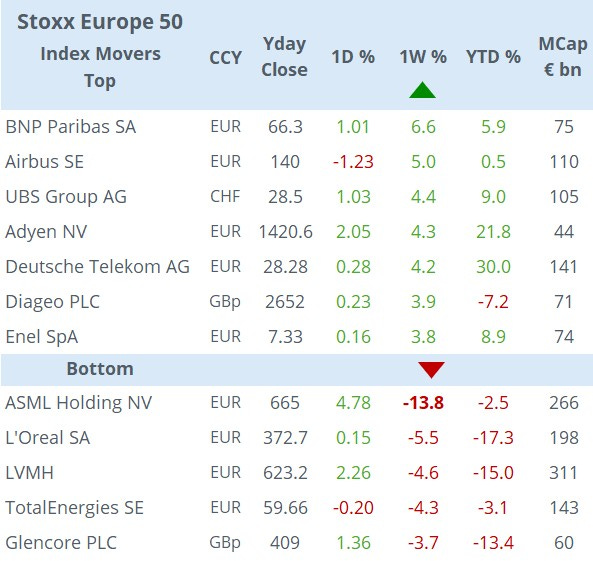

Equities ended marginally firmer on Friday on both sides of the Atlantic with the S&P 500 accumulating its sixth straight week of gains to a new record (5,864 pts). European equities were supported by the ECB’s rate cut and dovish stance with Italian, Spanish and German stocks as the outperformers of the week.

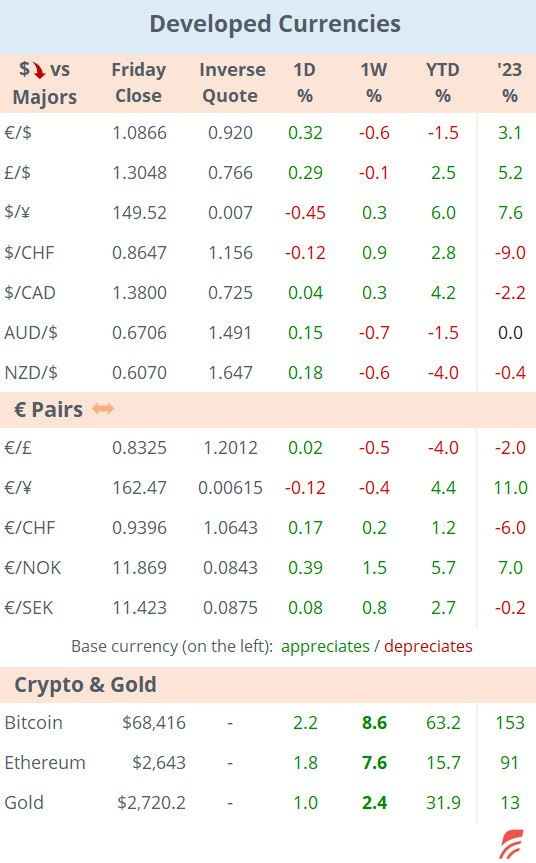

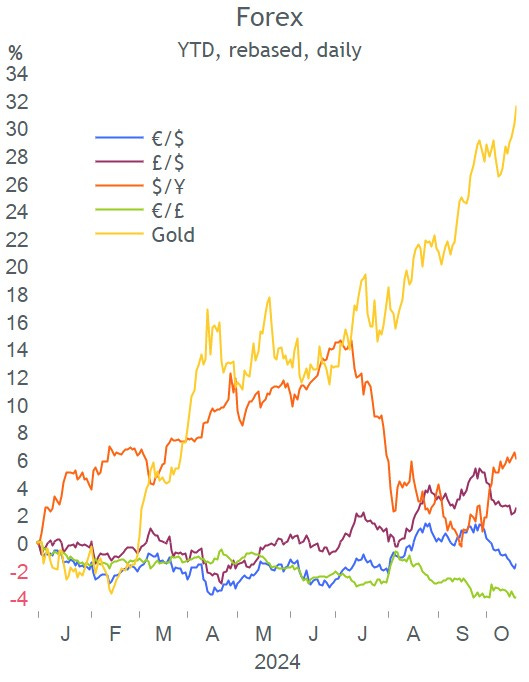

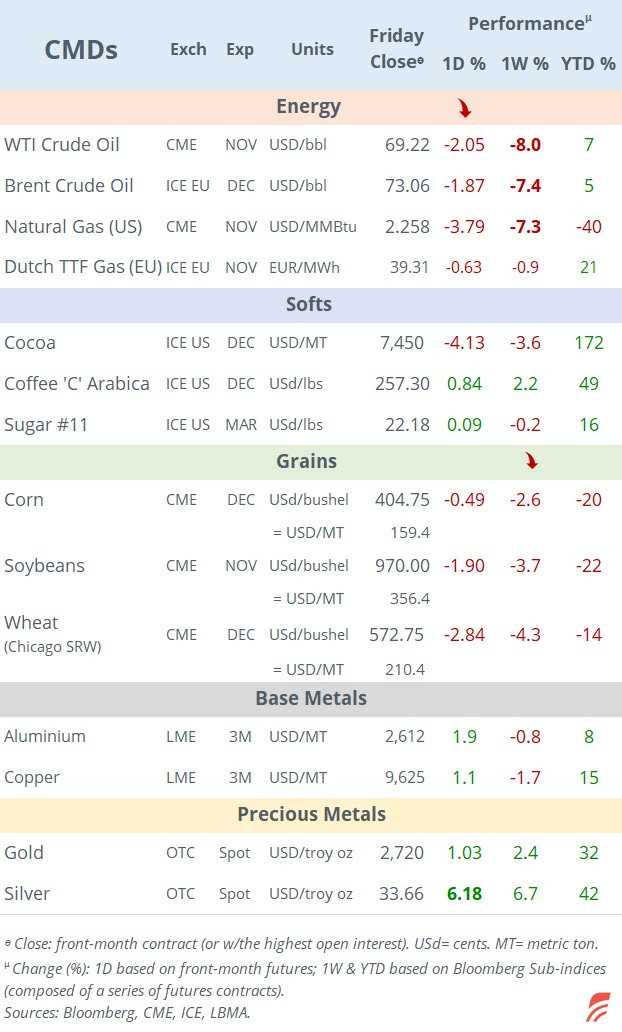

Gold added 2.4% to an all-time high of $2,720 to accumulate a 32% YTD rally driven by increased turbulence in the Middle East and the so-called ‘Trump trades’ and the tariffs scenario.

In earnings announcements on Friday, Swedish truck maker Volvo AB (mcap $53bn) missed forecasts for the first time this year and predicted a flat 2025 in terms of vehicle sales in Europe and the US (590k units). Yet, shares gained 3.5% and are 5% higher YTD.

Also, Netflix (mcap $326bn) jumped 11% after beating top ($9.8bn sales, +15% YoY) and bottom ($2.3bn profits) estimates as its advertising business continued to grow (+35% QoQ) and it added 5.1mn subscribers during Q3. Shares are 57% higher YTD and trade at a trailing P/E ratio of 42 times.

Goldman Sachs downgraded this year’s annual earnings growth estimate for Europe's STOXX 600 members to +2% from 6%, on the back of increased risks from higher corporate taxes in France and Italy, and potential trade tariffs. The bank still sees an improvement in earnings for Europe’s blue-chips in 2025 (+3%) and ’26 (+4%).

Crude oil finished its second-worst week of the year, with Brent losing 7.5% following the weaker reading for Chinese growth and record figures for US crude production (13.5mbp for the week ending Oct 11). On the grains complex, wheat, corn and soybean prices continue to drop driven by rainy conditions and changes in Russia’s export policies.

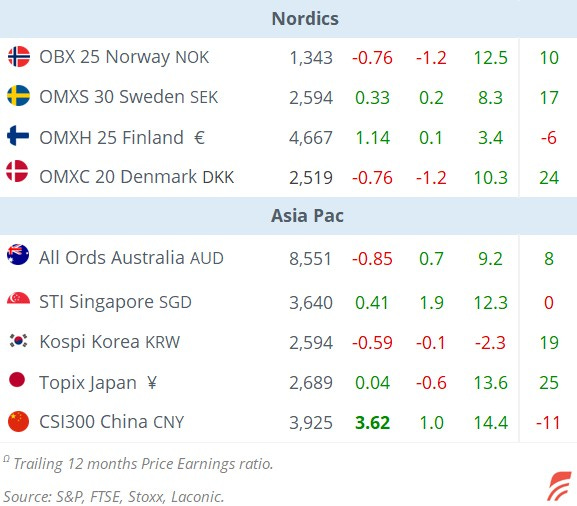

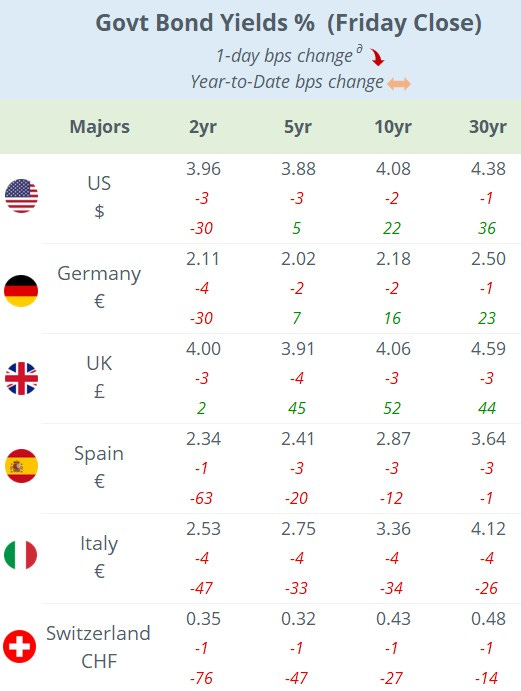

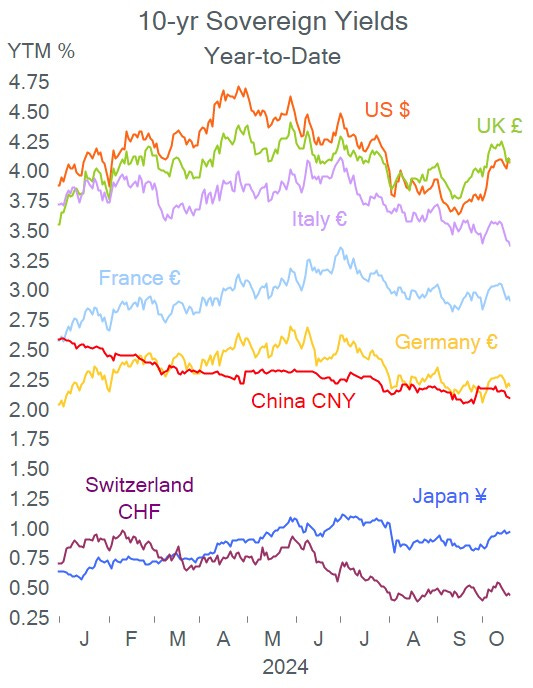

Today, China cut benchmark lending rates by 25bp as anticipated, bringing the 1-yr LPR (loans benchmark) to 3.10% and the 5-yr to 3.60% (mortgage benchmark), following the easing of the policy rates (reserve ratio and 7d repo) last month as it continues to implement its stimulus package to revive growth. Officials expressed confidence the economy could reach Beijing’s full-year growth target of ~5% and signalled another reduction to the banks' reserve ratio by the year-end. The CSI300 stock index rallied 3.6% on Friday and is advancing almost 1% today.

Most other Asian indices are firmer this morning by around 0.5% while Singapore and Hong Kong are a touch weaker. It will be a busy week for Asian IPOs including the listings of Tokyo Metro and Hyundai Motor India.

On Sunday, Moldova held the first round of presidential elections (prelim 42% for incumbent president Sandu) and a referendum on joining the EU with tight results in early counting.

This week will be relatively light on the data front with Germany’s PPI today and preliminary PMIs for October on Thursday. In central bank action, Hungary holds a meeting tomorrow, the Bank of Canada meets on Wednesday and Russia meets on Friday.

Companies reporting earnings today include Legal & General and Man Group. The week’s most significant release will be Tesla on Wednesday.

Thanks for your time, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.