Podcast script: Estimated reading time ⏲ ~4 mins

Good morning, it’s Monday 20th of May,

Iranian President Ebrahim Raisi and the country’s foreign minister were confirmed dead this morning following a helicopter crash in the northwest of Iran amid bad weather yesterday evening.

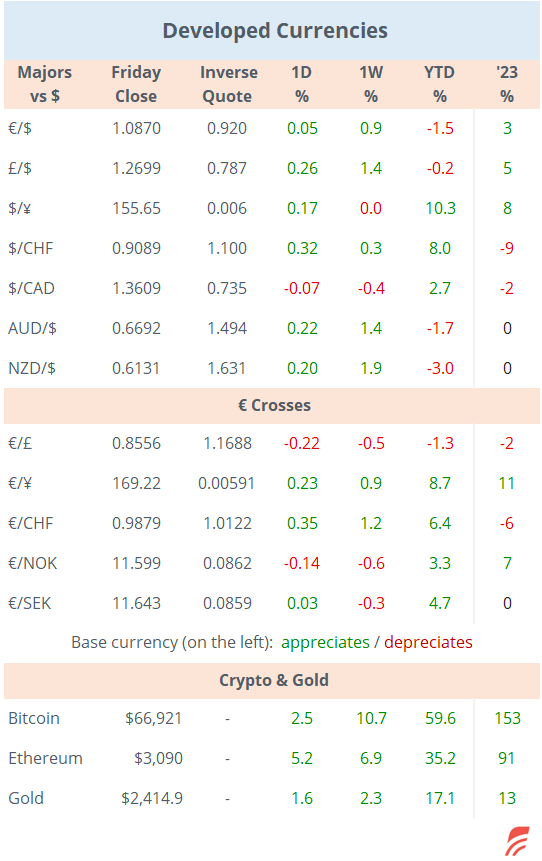

Asian equity markets are trading firmer today and European stock futures are 0.3% higher this morning while Bund futures are marginally lower. Crude oil is above $84, Bitcoin is north of $67,000 and the British pound is dealing above 1.2700.

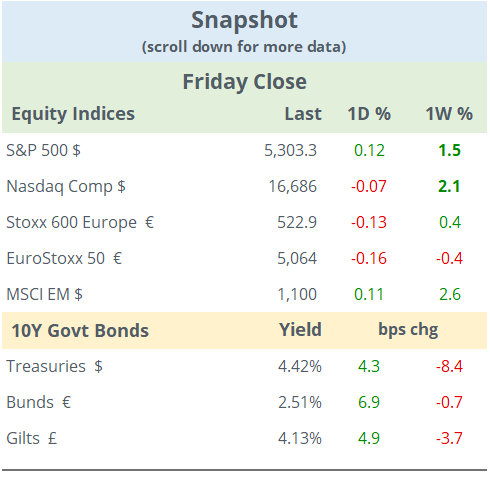

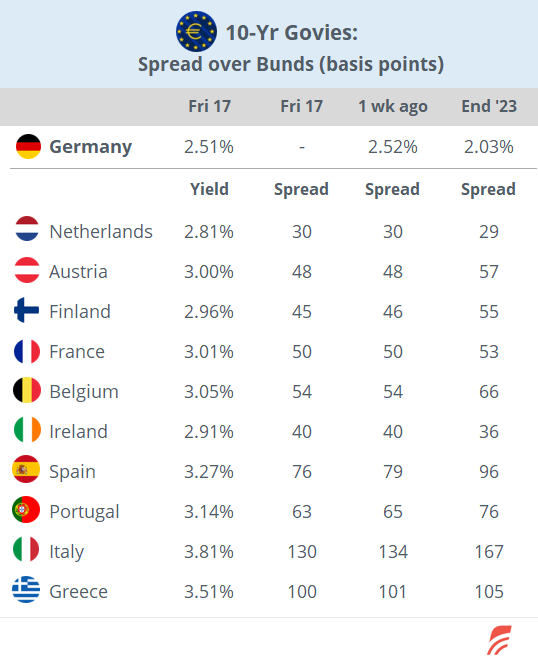

Markets had a relatively quiet end of the week on Friday with benchmark yields shifting a few basis points higher with Bunds closing up by 7bp at 2.51%, Gilts at 4.13% and UST at 4.42%. All three markets finished little changed on the week and yield curves remain in inverted mode. There are no major monetary policy meetings scheduled for this week. The DXY $ index fell nearly 1% last week driven by sterling’s recovery and accumulated a 2% drop from this month’s high.

Equities were little changed on both sides of the Atlantic on Friday and ended the week higher in the US, with gains of at least 1.5% for leading indices while European benchmarks were mixed. The Stoxx 600 ended 0.4% higher WTD, the blue-chip Eurostoxx 50 finished lower by the same amount and the notable gainers were Swiss, Italian and Spanish indices with gains of around 2%. Europe’s best sectors were telecommunications and real estate while oil and gas fell the most. In the US, the information technology and real estate sectors were the outperformers.

More headlines:

-G7 countries are considering providing loans to Ukraine of up to $50bn backed by the $350bn worth of Russian assets seized by Western nations following the invasion. Meanwhile, a Russian court seized €700mn from European bank assets including Deutsche, Unicredit and Commerzbank.

-Several European power companies are scaling back their renewable targets due to higher interest rates and lower prices for conventional electricity generation. Giant utilities such as Iberdrola, Enel, Orsted and Statkraft have reduced their 2030 goals for clean energy generation while remaining committed to the transition in future years.

China left its benchmark Loan Prime Rates (LPR) unchanged today, keeping the 1-year fixing at 3.45% and the 5-year, used as a reference for mortgages, at 3.95%, in line with expectations and follows a similar decision by the Central Bank last week to maintain the MLF or medium-term lending facility, unchanged at 2.5%. The yuan is trading at 7.23, a 1.8% depreciation YTD.

On Friday, €-zone’s final headline inflation reading for April confirmed a rise of 0.6% MoM and 2.4% YoY, and core inflation at 2.8%, all reading as expected and marginally lower than in March.

In corporate deals, Spanish utility Iberdrola is acquiring the 18% stake it still does not own in its US subsidiary, Avangrid Inc, for $2.6bn valuing it at nearly $14bn. Iberdrola is bidding $35.75 per share, below where shares were trading and fell 4.5% on Friday. Avangrid controls renewable power assets in 24 US states and provides power to 3.3mn customers.

In the oil & gas sector, US Crescent Energy has agreed to acquire rival SilverBow Resources for $2.1bn in a stock-and-cash transaction to create the second-largest operator in Texas’ Eagle Ford basin.

Exchanges in Switzerland, Denmark, Norway and Canada will be closed on holiday today.

In data releases this week, we’ll get inflation in Canada tomorrow, British inflation and New Zealand’s monetary policy decision (5.5% unch expected) on Wednesday, preliminary PMIs for May in most developed nations on Thursday, UK retail sales and Japan’s inflation on Friday.

Palo Alto Networks (PANW, software, mcap $103bn) reports earnings today.

That’s all for today, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. Please share using the button below, as access is free to all.