Morning, we’re back from our summer break. It’s a holiday in the U.S. and Canada for Labour Day.

Today’s headline is the advance of the populist extremes in Germany’s regional elections with the far-right and hard-left winning in two states, well ahead of the governing coalition led by Olaf Scholz.

Markets closed on a positive note on Friday with inflation updates on both sides of the Atlantic that confirm the return to the disinflationary trend and support the scenario for imminent policy rate cuts, in line with the dovish tone by central bankers at Jackson Hole ten days ago.

August preliminary inflation in the €-zone fell sharply to 2.2% YoY, the lowest reading in three years. Traders are pricing in an almost certain 25bp rate cut of the ECB’s deposit rate to 3.5% at the September 12 meeting.

In the U.S., headline PCE inflation for July held steady at 2.5% YoY, marginally below estimates while core PCE, the Fed’s preferred inflation measure, rose by 2.6% YoY, also marginally lower than expectations. The Fed meets on the 18th of this month and futures are pricing in a 70% chance for a 25bp rate cut and a 30% chance for a 50bp cut.

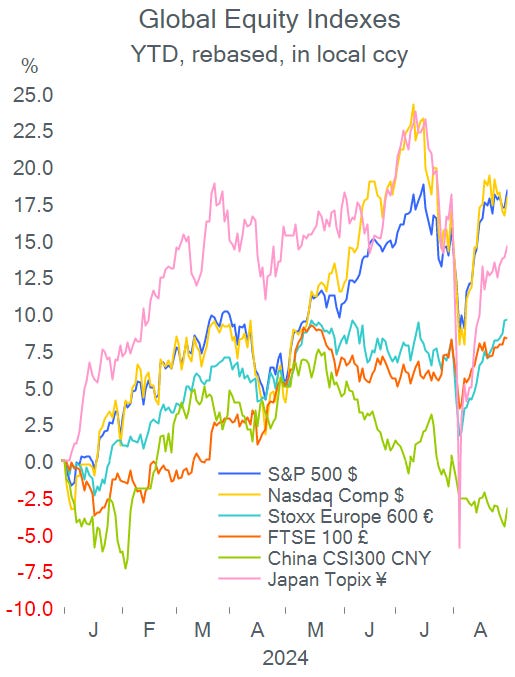

A quick recap of the volatile month of August in global markets. Leading equity indices rebounded strongly from the steep sell-off during the first week of the month when mega-cap technology stocks and the whole Japanese market plunged. The S&P 500 ended August 2.3% higher at 5,648 pts to accumulate an 18% YTD gain, while the Nasdaq Composite finished flat with consumer staples, real estate and healthcare as the best sectors.

Europe’s broad Stoxx 600 added just 1.3% on the month but closed at a record high on Friday with retail and telecommunications as the winning sectors in August while basic resources were the notable loser (-4%). The Dax is also trading at a record and the Footsie is less than a percentage point away from its all-time high.

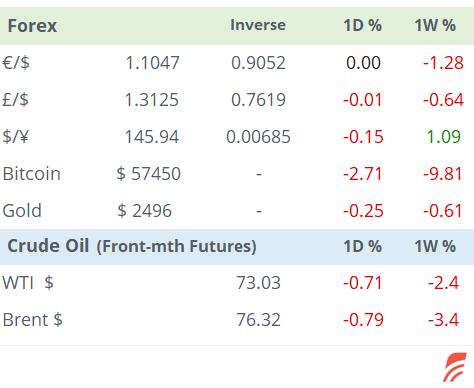

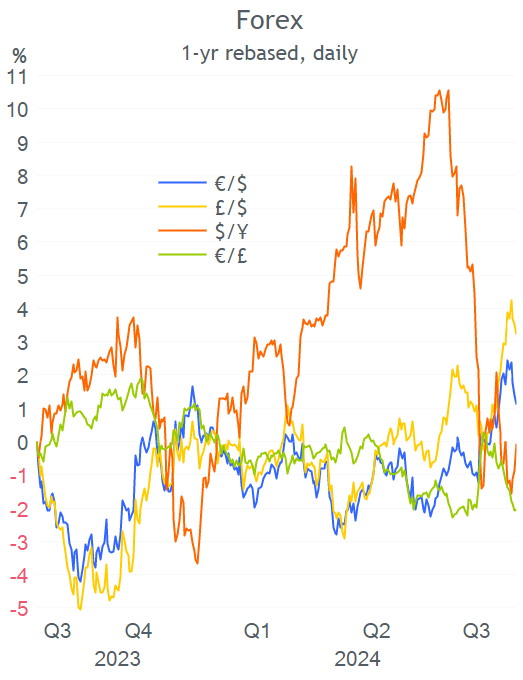

In forex markets, the DXY $ index fell 2.3% last month despite a rebound last week with the € and £ appreciating more than 2%, the Swiss Franc and the Aussie dollar advancing more than 3% and the Kiwi dollar as the best performer, up 5% last month. Gold added 2.2% to its nominal record last week of more than $2,500.

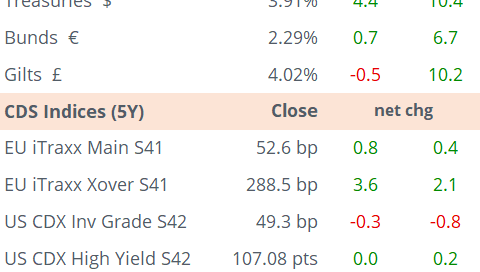

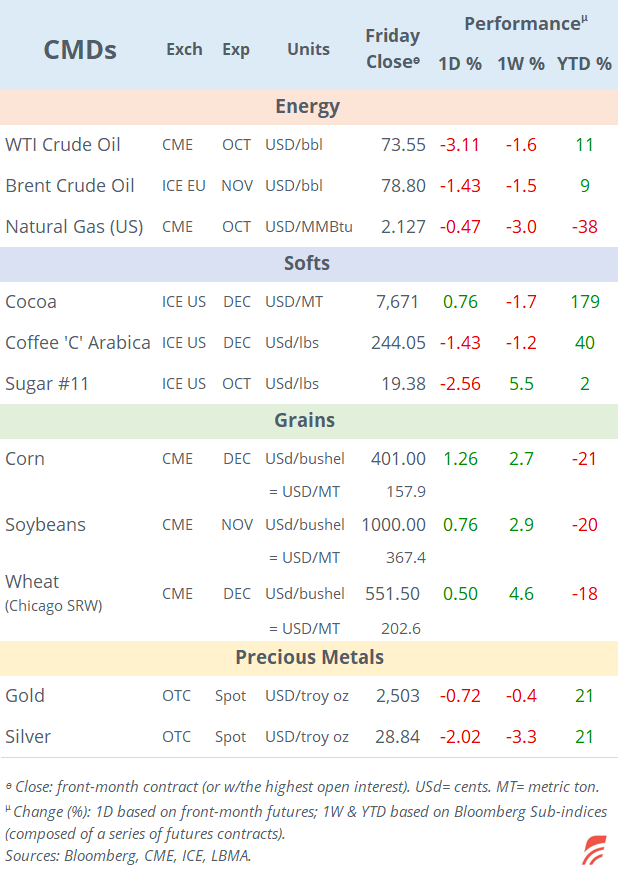

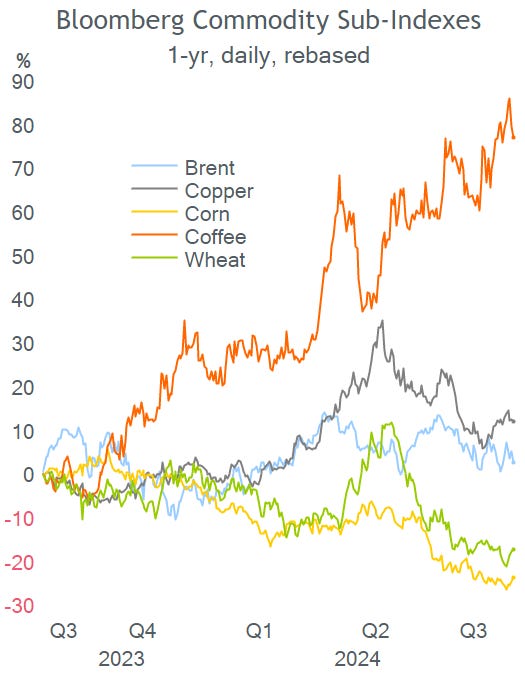

In interest rates, the 10-yr Treasury yield eased for a fourth straight month with a 19bp drop to 3.91% while Bunds and Gilts finished almost flat at 2.29% and 4.02%. Brent oil declined 2.4% in August following a sharp 6.5% fall in July.

In Asian markets today, stocks in mainland China and Hong Kong are falling more than 1% despite China’s Caixin manufacturing PMI expanding (50.4 pts) following a weak NBS PMI released on Saturday. Japan’s and Korea’s indices are little changed despite positive PMI updates. European futures are mixed in early trading with the Footsie pointing to a firmer open.

This will be an active week on the data front with manufacturing PMIs for several European countries and Italy’s GDP and wholesale inflation today; €-zone retail sales on Thursday and U.S. non-farm payrolls on Friday.

In monetary policy updates, the Bank of Canada meets on Wednesday with markets anticipating a rate cut of at least 25bp from the actual 4.5%. Also on Wednesday, Chile’s and Poland’s central banks hold meetings.

It will be light for earnings releases with HP Enterprises reporting on Wednesday and Broadcom on Thursday.

See you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.