Morning,

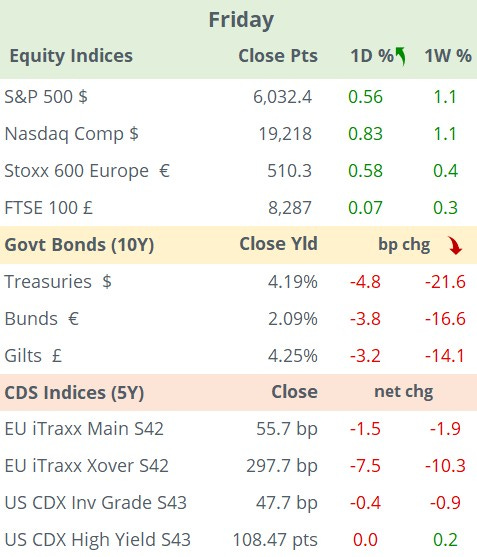

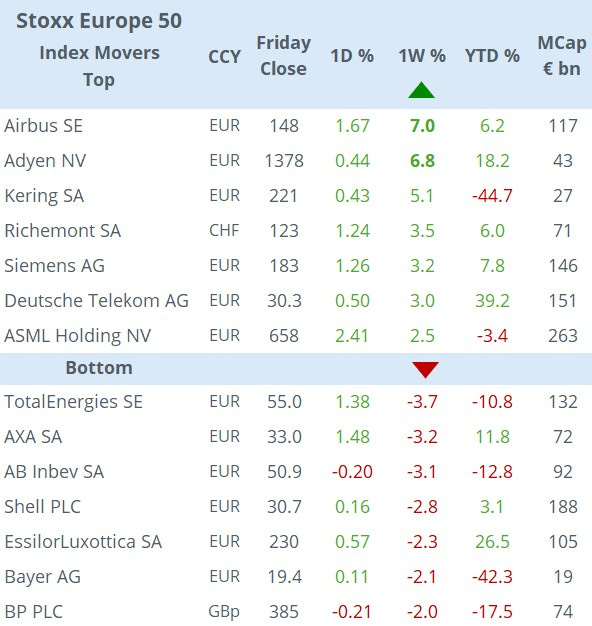

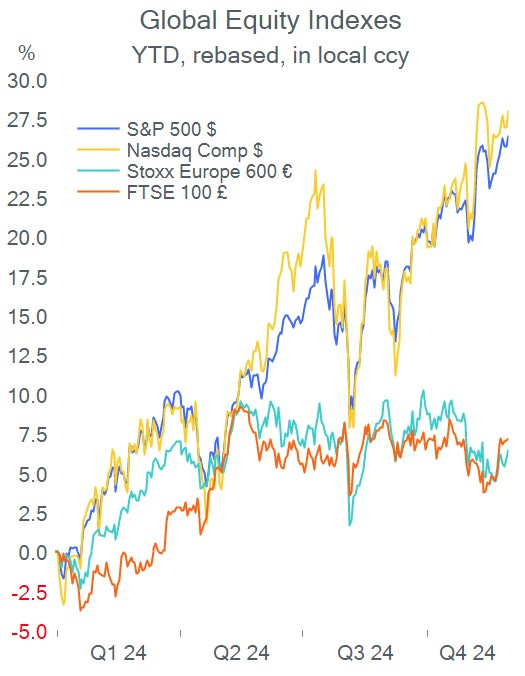

US stocks ended their best month in a year in November with the S&P 500 gaining 5.7% MTD to a fresh record in a half-trading day due to the Thanksgiving holiday with technology and retail stocks (Nvidia, Tesla) leading the gains. European indices also traded firmer on Friday driven by tech stocks to finish with small gains for the week (Airbus, Adyen, and Kering as the best blue chips). The Stoxx 600 closed the month with a modest advance.

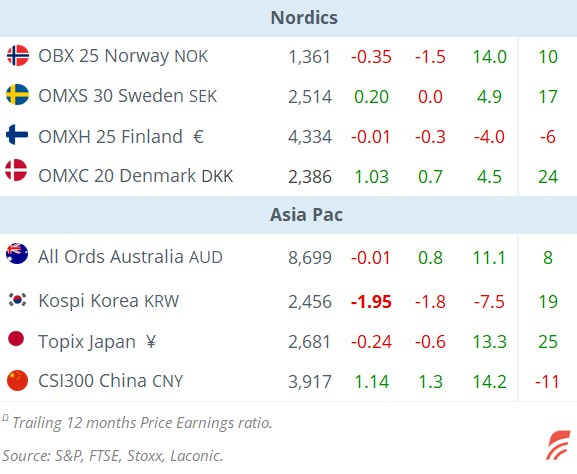

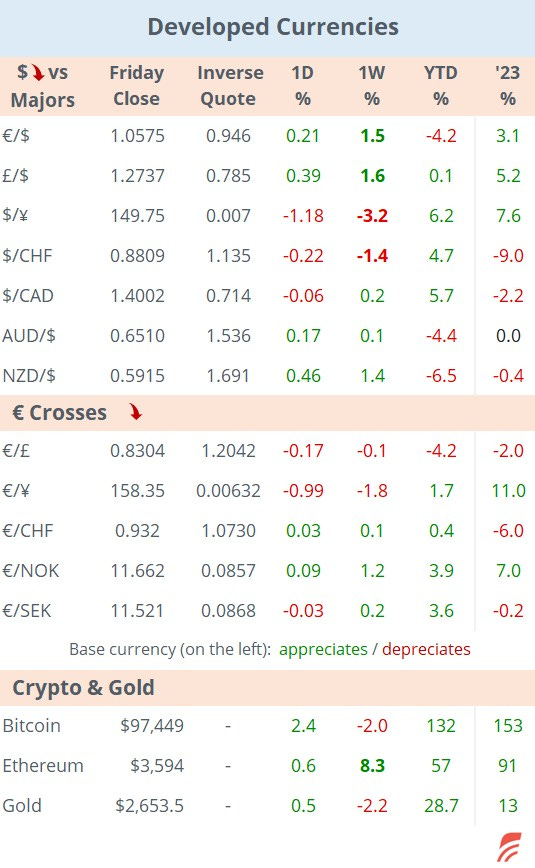

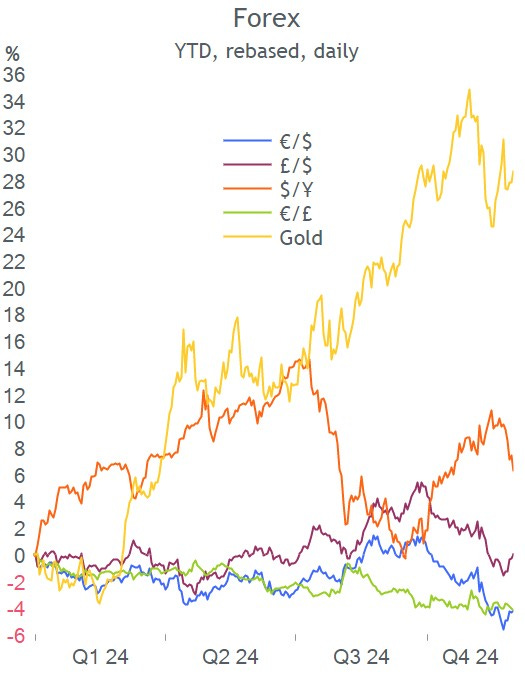

Asian equities are rallying today with Taiwan advancing 2.4% and Japan up 1.2% following Wall Street’s strong close on Friday while €-Stoxx 50 futures are pointing to a weaker open of about -0.8% in early morning trading. The $ is rallying today and Brent oil is a touch firmer at $72.23.

In data on Friday, as expected the €-zone’s preliminary inflation in November rose to 2.3% from 2% a month earlier and core inflation came in at 2.8% (vs 2.7% prior). Italian CPI surprised with a jump to 1.6% (still low), France marginally higher on the month at 1.7% and Austria at 2%. The ECB meets in ten days with futures fully pricing in a rate cut with a 24% chance of a large 50bp reduction from the actual 3.25% policy rate.

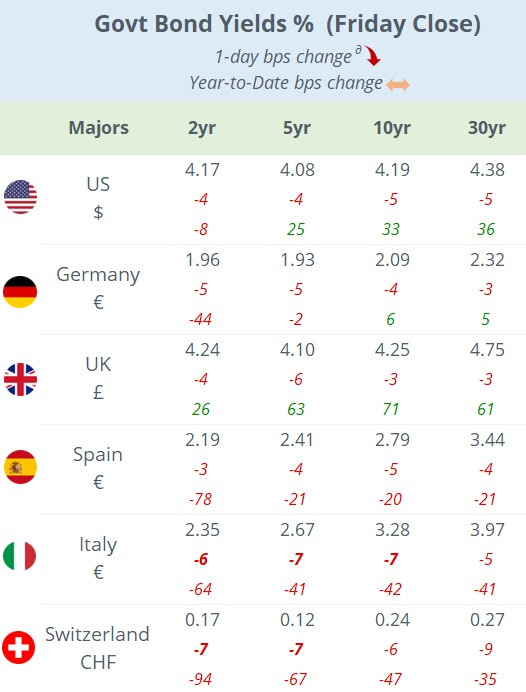

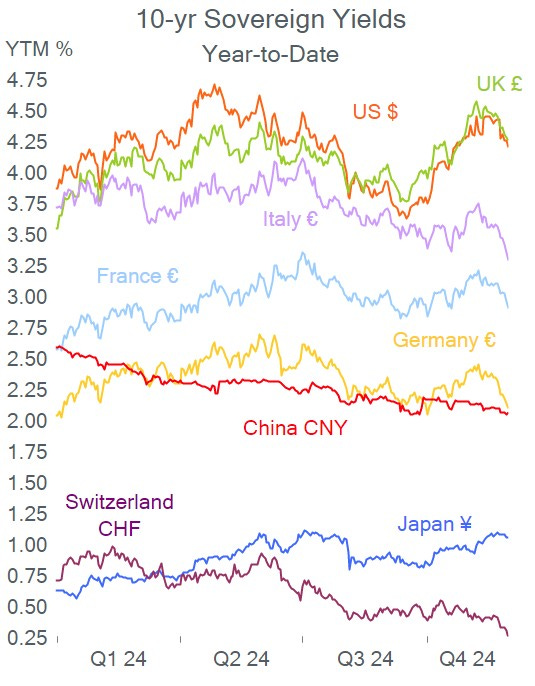

Benchmark bond prices finished firmer on Friday to end a month with a strong gain for Bunds and Gilts with 10-yr yields falling 30bp and 20bp MTD to 2.09% and 4.25%. Treasury yields fell last week but closed the month just 9bp lower at 4.19%. The DXY $ index accumulated two months of gains, up 1.7% in November.

In geopolitics, the crisis in the Middle East shifted north with Syrian and Russian jets striking the battered city of Aleppo now controlled by rebels in the biggest threat to Assad’s regime.

Romania’s exit polls from yesterday’s final round show a lead for the ruling party (PSD) to retain control of parliament as well as strong support for the nationalist far-right group (AUR) that won the first round.

Vote counting also continues in Ireland, with the country’s three largest parties projected to gain approx equal shares, with opposition party Sinn Fein marginally ahead at 21.1%, and ruling coalition parties Fine Gael on 21% and Fianna Fail on 19.5%.

In business news, the CEO at auto giant Stellantis NV (mcap €49bn), Carlos Tavares, abruptly left the company this weekend following a steep decline in vehicle sales and a share price drop of 40% YTD, compared to General Motors’ (mcap $62bn) 55% rally. Tavares led the mergers of Fiat, Chrysler and Peugeot to create Stellantis three ago.

In M&A deals, auto parts supplier TI Fluid Systems Plc (mcap £954mn) agreed to be taken over by ABC Technologies of Canada for £1bn (£1.8bn of EV).

In the mid-market space, British restaurant chain Loungers (mcap £316mn) is being acquired by Fortress Investment Group for £350mn, a 30% premium to Loungers' market price.

Also, German cement co Heildelberg Materials (mcap €22bn) is expanding its US presence with the acquisition of smaller rival Giant Cement Holding for $600mn from Spanish Inmocemento SA.

In credit ratings, S&P maintained its AA- rating for France with a stable outlook but warned of a downgrade subject to the budget deficit situation. France is rated Aa2 by Moody’s and AA- by Fitch. 10-yr OAT spread to Bunds closed at +81bp last week for a 2.89% yield.

In economics today, we’ll get the unemployment rate in the €-zone, retail sales in Switzerland, house prices in the UK and Mfg PMIs in the US, €-zone, UK, China and Japan. This week’s key data update will be US non-farm payrolls on Friday. The only large-cap reporting today is Prosus NV.

Thanks for your time, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.