Morning,

Wall Street sold off on Friday driven by a shift in investor’s interest rate outlook following Jerome Powell’s cautious remarks regarding the future pace of rate cuts. The Fed chair cited ongoing economic growth, robust labour conditions and above-target inflation as reasons to be careful with policy decisions. Economic data released on Friday showed strong retail sales and rising prices for imported goods, leading to a sharp drop in the probability of a Fed interest rate cut implied by futures markets to 60%.

Benchmark stock indices declined between 1-2.5% on Friday to end the week lower by 2-4% with the healthcare sector being the biggest loser following Trump’s decision to nominate Rob Kennedy as health secretary. Some sharp moves in pharma large-caps last week include AbbVie’s 17%, Bayer’s 16%, Amgen’s 13% and Eli Lilly’s 10% declines. European indices fell on Friday to end the week a touch lower but outperformed US indicators with basic resources and healthcare names as the main losers.

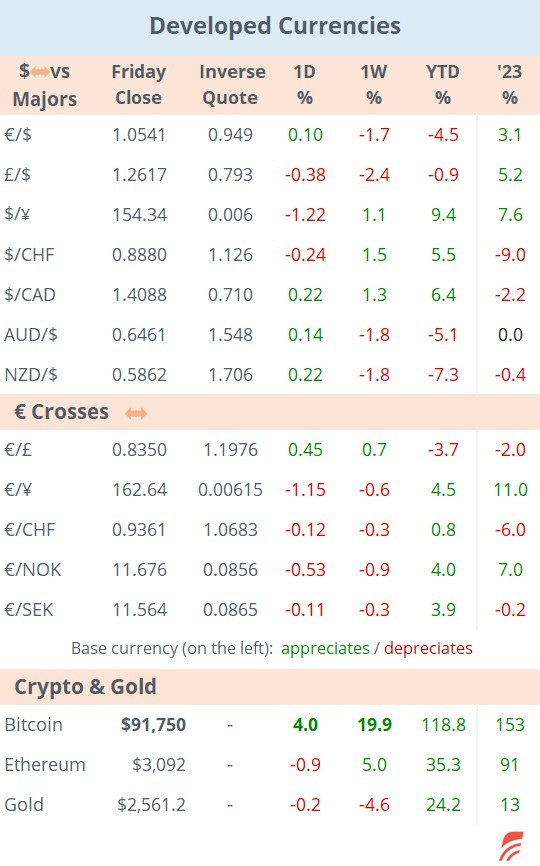

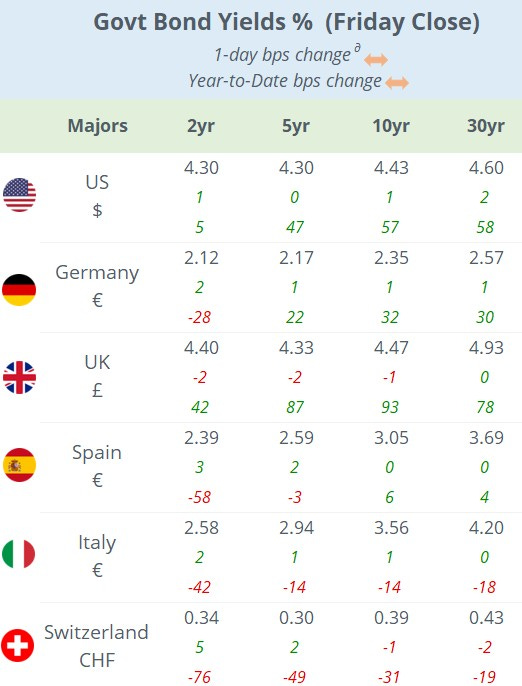

The $ appreciated for a 7th straight week with £ losing 2.5% last week to 1.2617, its steepest weekly drop since February last year. Bitcoin rallied 20% and Gold lost 5% WTD. Benchmark bond yields were little changed last week.

In geopolitics, the Biden Administration allowed Ukraine to use American-made long-range missiles to strike inside Russian territory for the first time leading to an escalation of the war. Moscow responded with a massive air attack on Ukraine's power infrastructure causing a widespread blackout today. The battleground has moved to the city of Kursk in Southern Russia where North Korean troops are fighting to regain control from Ukrainian forces.

Asian markets are trading mixed at the start of this week with equities in China and Korea gaining more than 1% while Japanese stocks are a touch weaker. Nasdaq futures are pointing to a partial recovery from Friday’s losses and European futures are firmer in early morning trading.

In ECB updates, Italian central bank official Piero Cipollone called for more easing measures to support the recovery of the €-zone’s economy and to prepare the continent to face new trade tariffs. Traders fully expect the ECB to cut rates again on Dec 12.

In IPO updates, Spanish clean energy and water company Cox ABG Group raised €175mn after reducing its target size and was priced at €10.23. Shares fell 7% on Friday to a market value of €740mn.

In debt capital markets, French lottery company, La Francaise des Jeux (mcap €7bn) placed € senior bonds in 6-yr (at 3.13%), 9-yr (3.78%) and 12-yr (3.63%) maturities.

In credit ratings, JP Morgan (mcap $690bn) was u/g one notch by S&P to ‘A’, stable outlook. Argentina’s foreign rating was u/g to CCC by Fitch. The outlooks for Ireland and South Africa were u/p to positive while Latvia’s was d/g to stable.

Today will be light on the data front with the trade balance in the €-zone and house prices in Britain.

Xiaomi Corp (China, smartphones, mcap $90bn) is the only global large-cap reporting today.

The G20 Brazil Summit in Rio de Janeiro with a focus on social inclusion, global reform, and sustainability and the Frankfurt Euro Finance conference begin today. It’s a holiday in Mexico and Argentina.

Thanks for your time, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.