Est reading time: 5 min

Morning,

Asian markets are trading mostly in red today with stocks in Tokyo dropping by more than 2% at one point before recovering partially, driven by concerns about the economy following a poor update on machinery orders. Blue-chips Toyota and MUFG are down by 2%. Chinese and Korean markets are down by 0.3% but Hong Kong and Taiwan begin the week with small gains. Singapore and India are closed for holidays.

China’s central bank left its medium-term lending facility rate unchanged as expected at 2.5% and removed some funds from the banking system. A weakening currency and narrowing interest margins prevent the PBoC from easing monetary policy. China reported somewhat negative data, with retail sales rising by more than expected in May, +3.7% YoY but industrial output disappointed by expanding 5.6%, a steep slowdown from the previous month.

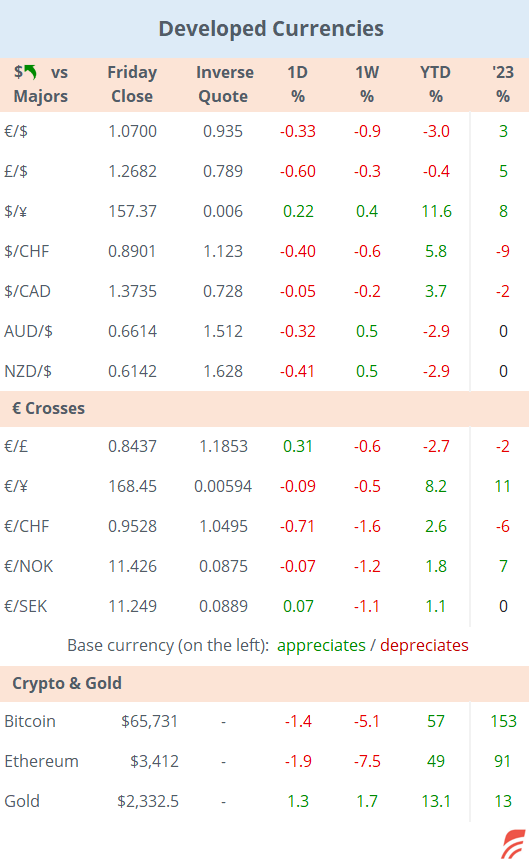

Currencies are little changed this morning with gold a touch weaker while Brent crude oil is marginally lower at $82.30. European equities are pointing to a positive opening with the FTSE and €Stoxx50 futures up by 0.5% in early trading.

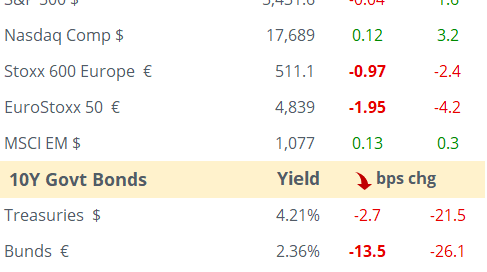

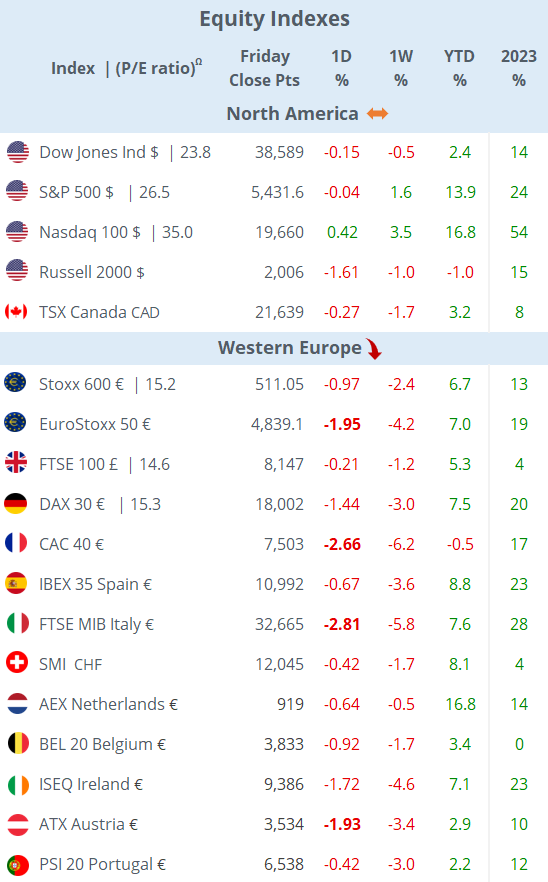

European markets sold off again on Friday driven by the political turmoil in France. The CAC 40 was the clear underperformer and ended the week 6.2% lower, its worst week in more than two years. The French and Finish benchmarks are now the only European indices down for the year. The broad Stoxx 600 dropped 2.4%, its worst week since October but is still up by 6.7% YTD, half the performance of the S&P 500 in local currency. Plus, the € has depreciated 3% this year and is at its weakest level in six weeks. The worst European sectors of the week were banks and autos.

Wall Street had a positive week with technology mega-caps trading at all-time highs, including Apple advancing 8% WTD, Nvidia +9%, and the notable gainer, Broadcom, rallying 23% on the week on a solid earnings report. The IT sector (P/E 41x) had its best week since November (+6.4%).

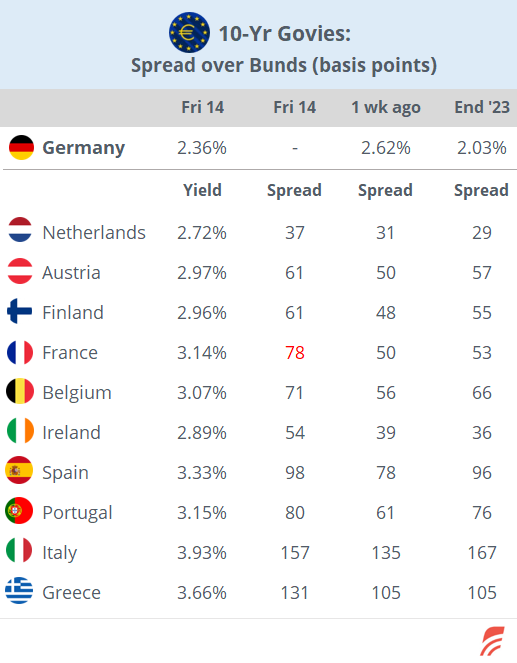

On interest rate markets, German yields plunged on Friday, with the yield curve shifting 13-15bp lower with 2-yr yields closing at 2.76% and 30-yr at 2.51%. However, the highlight was the steep sell-off on the French sovereign market with the 10-yr OATs spread to Bunds widening to nearly 80bp, the most in 12 years, for a 3.14% yield, the same as Portugal. French Finance Minister, Bruno Le Maire, warned investors of the risk of a financial crisis should either the far right or left win the snap election, mostly due to their heavy spending plans.

Headlines,

-The weekend’s ‘Peace in Ukraine’ Summit in Switzerland ended with several nations, including India, Indonesia, Mexico, South Africa and Saudi Arabia, not signing the final statement in support of Kyiv. China and Brazil didn’t participate. Although more than 80% of the countries that attended the Summit signed the joint agreement, the sentiment was mixed.

-In French politics, several large and small leftwing parties reached an agreement to run as a big alliance to face Macron and Le Pen at the snap legislative election. The coalition is called New Popular Front (LFI, Greens, Communists, Socialists, Generation.S, GES, GRS) and was endorsed by former socialist president François Hollande, with the candidate for prime minister to be announced soon. The move increases the chances of a historic defeat for Macron’s RE party as projected by several polls.

-The latest in South African politics, following a fragmented general election, the ruling African National Congress party has reached a historic coalition agreement with its former adversaries in the Democratic Alliance, under the leadership of Cyril Ramaphosa. South African markets are closed today.

In economic data, French (HICP) inflation in May was revised a touch lower to 2.6% YoY from the preliminary reading but still higher than a month earlier, mainly on rising energy prices.

In corporate deals, Spanish infrastructure group Ferrovial (mcap €27bn) sold most of its stake in London’s busiest airport, Heathrow, to private equity firm Ardian which acquired a 22% stake and the Saudi SWF Public Investment Fund which will control 15%, for a total of £3.3bn, valuing Heathrow at £8.7bn. Ferrovial will retain a 5.3% stake while Qatar’s QIA maintains its 20% shareholding.

Media sources suggest that Vodafone Group (mcap £18bn) is planning to raise more than $2bn by selling its entire stake in Indus Towers (India, mobile-tower operator, mcap $11bn) via a stock market block sale.

In IPOs, the Softbank-backed biotech co Tempus A.I. (TEM) raised $411mn by listing on Nasdaq at $37/share and closed the week at $40.25, for a market value of $6.5bn.

It will be a busy week in central bank action and economic data releases. Monetary policy meetings will be held by Australia, Hungary and Chile tomorrow, Brazil on Wednesday, the UK (unch at 5.25% expected), Switzerland, Norway, China (LPR rates) and Indonesia on Thursday.

On Wednesday we’ll get inflation in the UK and PMIs for developed countries will be released on Friday. The Eurogroup meets on Thursday and several Fed officials will participate in conferences during the week, starting with Williams and Harker today.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. Please share using the button below, as access is free to all.