Good morning,

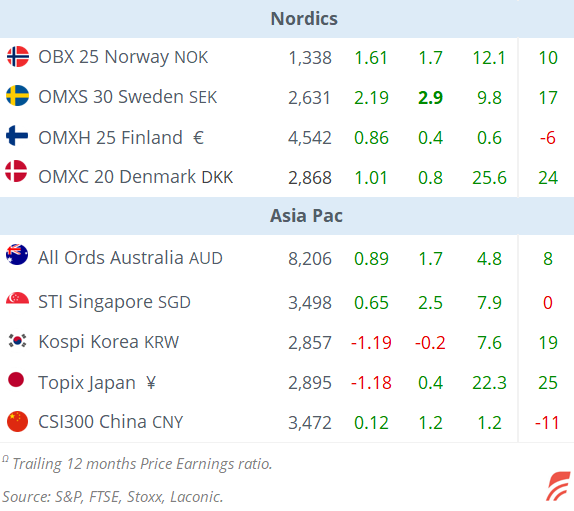

Asian equities are mostly weaker following Trump’s assassination attempt with Hong Kong leading the decline, -1.4%. Other markets are marginally lower and Japan is closed for a holiday. The $ is appreciating modestly, European futures are pointing to a lower open and Bitcoin is rallying 8% to $62,500. Brent oil is a touch firmer at 85.20. There are no significant market moves as a result of the historic incident in Pennsylvania.

In data today, China’s GDP in Q2 came in lower than expected, expanding 4.7% YoY a clear slowdown versus the 5.3% expansion in Q1. Retail sales also decelerated to +2.0% YoY in June while industrial output rose by 5.3% YoY, better than anticipated but also below the previous month.

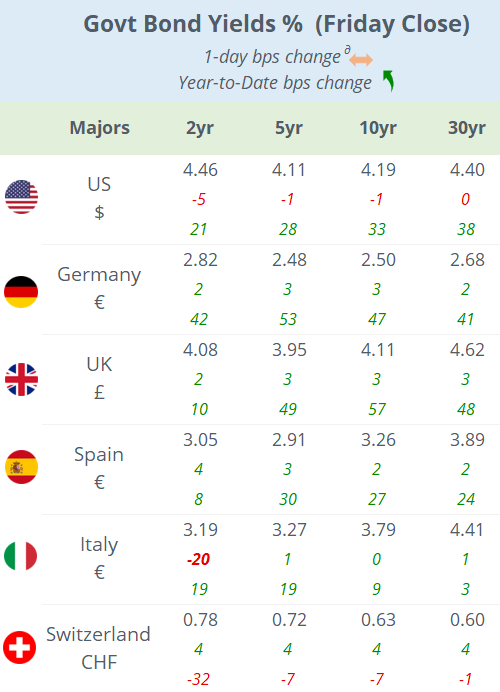

US producer price inflation, released on Friday, increased 2.6% YoY in June after advancing 2.4% in May.

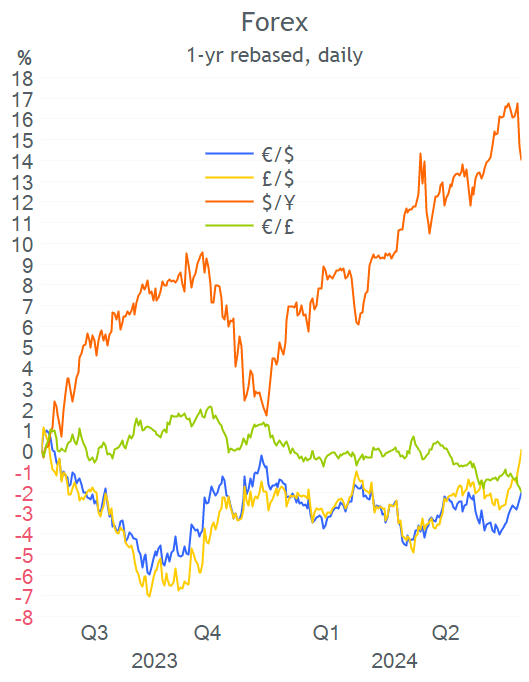

Reviewing last week’s market performance, equities rose across regions with European benchmarks outperforming and the US small-cap sector rallying 6%. The $ ended notably lower against majors as the ¥ recovered nearly 2%, cable appreciated 1.4% and the € closed at the highest level in four months. Sovereign bond yields fell last week as traders became more confident that central banks will continue to cut policy rates. The short-end of the Italian BTP curve was the notable mover with 2-yr yields dropping 20bp to 3.19%, the lowest in five months.

US bank earnings were mostly strong with JP Morgan beating sales ($51bn, +20% YoY) and profit ($18bn, +25% YoY) estimates for Q2 on solid investment banking results. Shares dropped 1%. Wells Fargo also beat revenue ($20.7bn) and profit expectations but missed net interest income ($11.9bn) and shares plunged 6%. Citigroup beat estimates but shares fell 2% while Bank of New York Mellon advanced 5%.

Other movers last week among US large caps include Meta’s 7.6% WTD fall, Netflix's 6% drop and Home Depot’s 7.5% gain.

Headlines:

-President Biden called on Americans to “stand together” and lower the political temperature while Trump prepares to attend the Republican convention in Wisconsin. The 20-year-old shooter was a registered Republican. Trump’s odds to win in November improved.

In new bond issues, Mizuho International, the British subsidiary of Japan’s Mizuho Financial (mcap $54bn) will soon price £2bn of 5-yr Sr unsecured bonds rated A1/A.

In IPO updates, StubHub, the American ticket exchange and resale co targeting a $16.5bn valuation, delayed its planned listing due to choppy market conditions.

On the monetary policy front this week we’ll learn from Indonesia on Wednesday, from the ECB and South Africa’s Reserve Bank on Thursday. Markets are pricing in a 94% chance for the ECB’s deposit rate to remain steady at 3.75% but an 80% probability for a cut at the following meeting. It will be an active week for Fed speeches starting with Powell’s participation at the Economic Club of Washington today.

Economic data updates this week include industrial production in the €-zone today; inflation in Canada and Italy and retail sales in the US tomorrow; inflation in the €-zone and the UK on Wednesday; employment figures in the UK on Thursday; PPI inflation in Germany and CPI inflation in Japan on Friday.

This week’s earnings reports will continue to be dominated by financial names, with Nordea Bank, Goldman Sachs and Blackrock reporting today. Tomorrow, we’ll hear from Bank of America, Morgan Stanley, Charles Schwab, United Health, Richemont and America Movil. Mega-cap technology companies' reports begin next week.

Today is a holiday in Japan and Turkey.

See you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.