Morning,

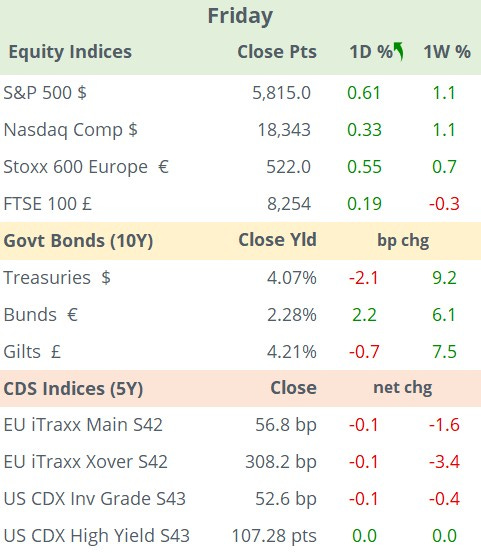

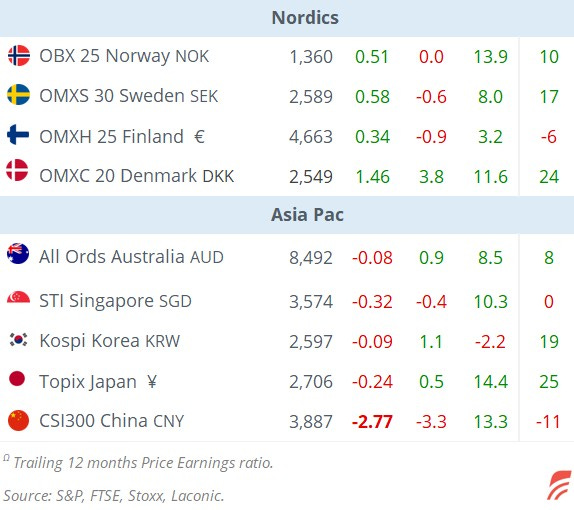

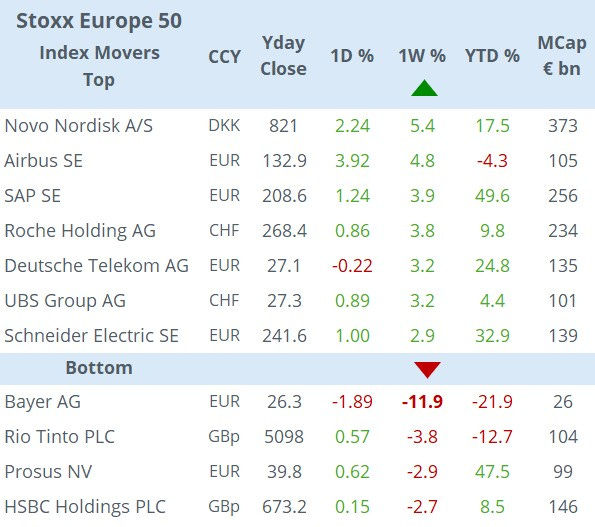

U.S. equity markets closed at a fresh record high on Friday driven by robust bank earnings in Q3. The S&P 500 finished above 5,800 points to accumulate a 22% YTD gain after JP Morgan (mcap $632bn), Wells Fargo, Blackrock and Bank of New York Mellon comfortably beat analysts' estimates as they kicked off the earnings season. The KBW Bank index had its best day since December (+3%) and closed at the highest level since May 2022. Shares in JP Morgan, Wells Fargo and Blackrock added between 3 and 5% on Friday and are trading at or near their all-time highs.

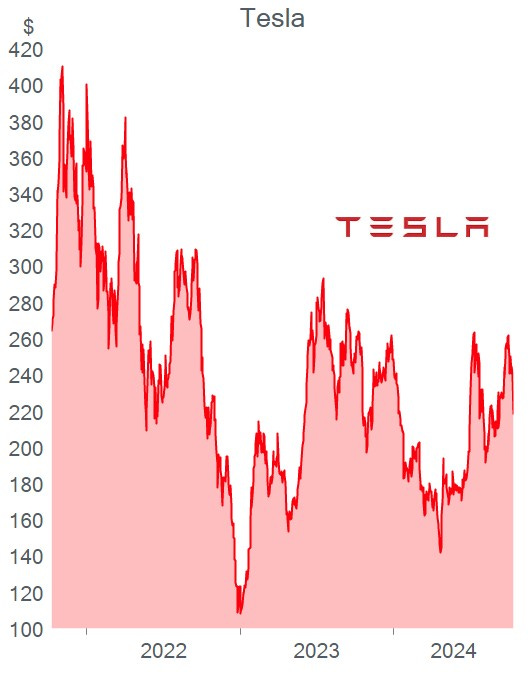

Tesla (mcap $694bn) shares fell 9% on Friday to end the week 13% lower (see chart) following the presentation of its robotaxi as it disappointed analysts with the lack of details on the new product line.

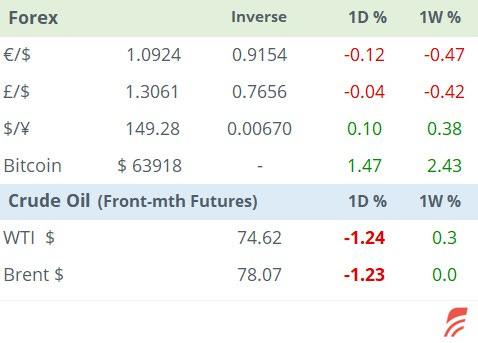

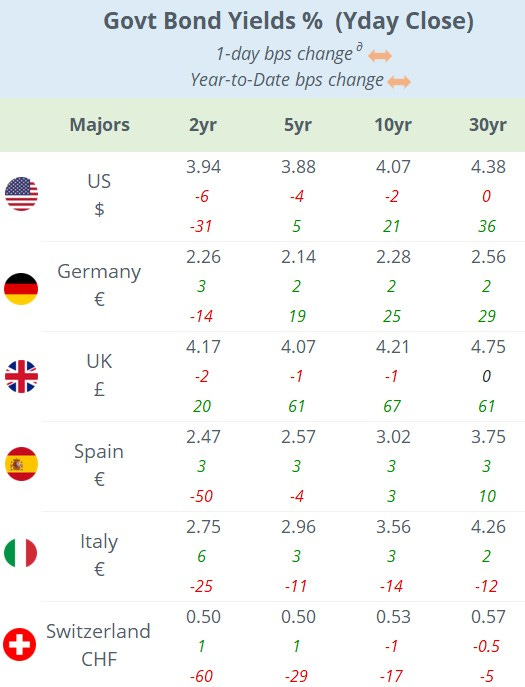

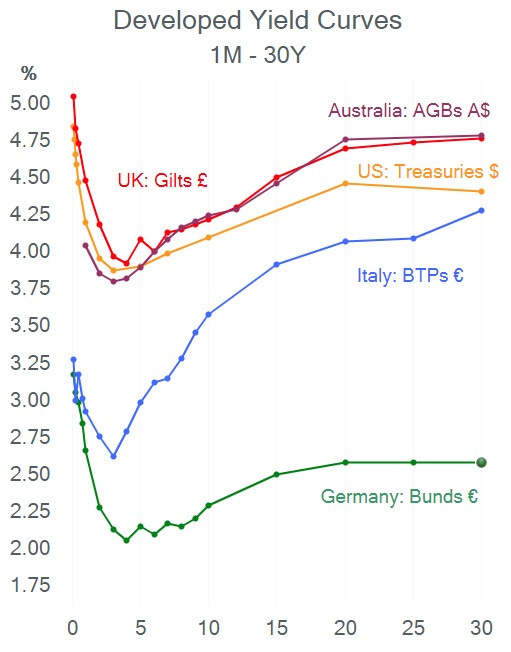

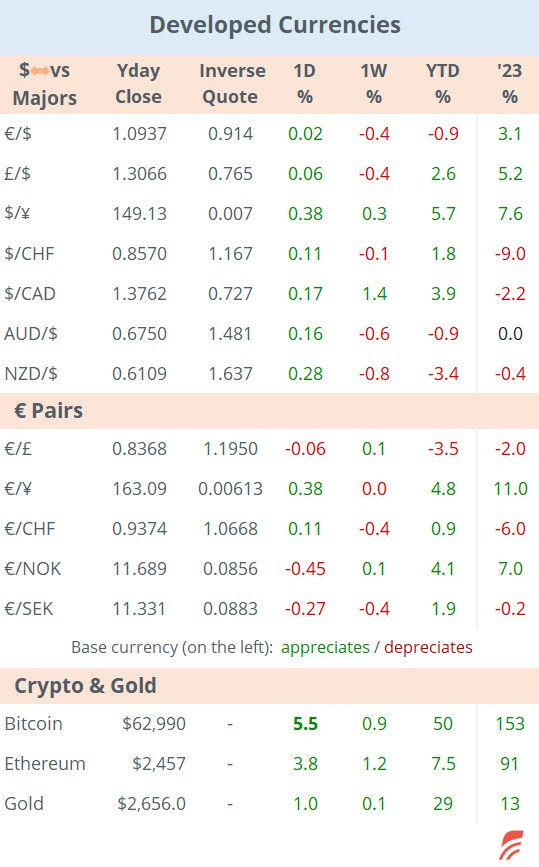

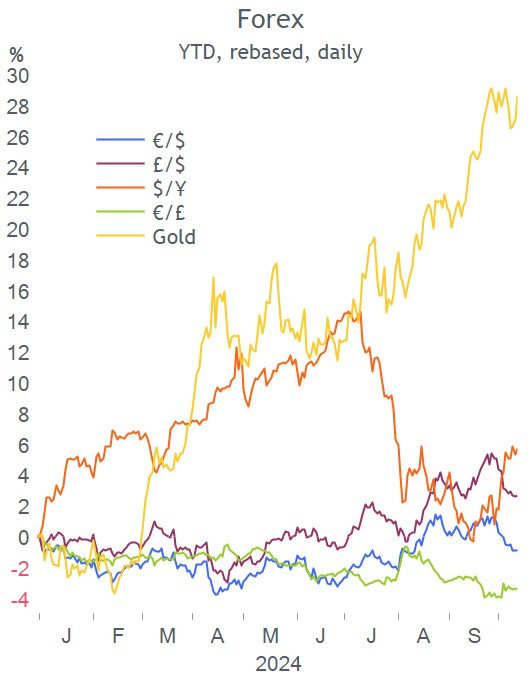

Sovereign bond markets were little changed again on Friday and the trend so far in October has been towards higher yields on the 10-yr space, reversing the rally in September. Treasury (4.07%) and Gilt (4.21%) yields are trading at ~3-month high. The $ and gold finished little changed last week while Bitcoin advanced 5%.

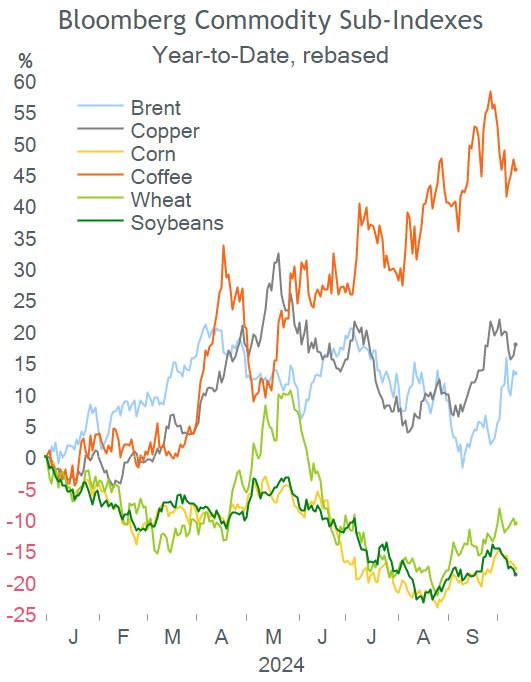

China’s latest consumer and wholesale price figures show that deflation pressures intensified in September with PPI falling 2.8% YoY and CPI advancing only 0.4% YoY, missing expectations. On a widely awaited update on Saturday, the Ministry of Finance committed to more spending but failed to provide details while markets are looking for more concrete announcements. China’s CSI300 stock index dropped more than 3% last week but is up 1.5% today with bank shares leading the recovery. International trade data will be released later today. Brent is dropping more than 1% this morning to $78 driven by these latest updates in China.

Headlines:

-In the Middle East, Hezbollah launched a drone attack in northern Israel from Lebanon on Sunday that killed four soldiers and injured more than 60 people, further escalating the conflict. (BBC)

-A man carrying a loaded handgun was arrested outside a Donald Trump rally in California. This is the third incident involving Trump’s security.

-China is holding military exercises around the island of Taiwan which are interpreted as a response to comments by the Taiwanese president to resist Beijing’s pressure. (Reuters)

-Elon Musk’s SpaceX (unlisted) has completed its first successful landing of a Starship rocket after a launch into space and a safe return to the launchpad. Musk said the achievement was a big step towards making life multi-planetary. SpaceX was recently valued at $180bn. (FT)

In credit ratings, the outlooks for France (AA-) and Belgium (Aa3) were d/g to negative by Moody’s and Fitch.

The earnings season continues with other large banks reporting tomorrow (GS, Citi) as well as several European blue chips (LVMH, Rio).

The ECB meets on Thursday with markets fully pricing in a 25bp rate cut to 3.25%.

It’s Columbus Day in the U.S. today and equity markets will be open but bond markets will be closed. It’s also a holiday in Japan and Canada.

Thanks for your time, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.