Script: Estimated reading time ⏲ ~4 mins

Good morning,

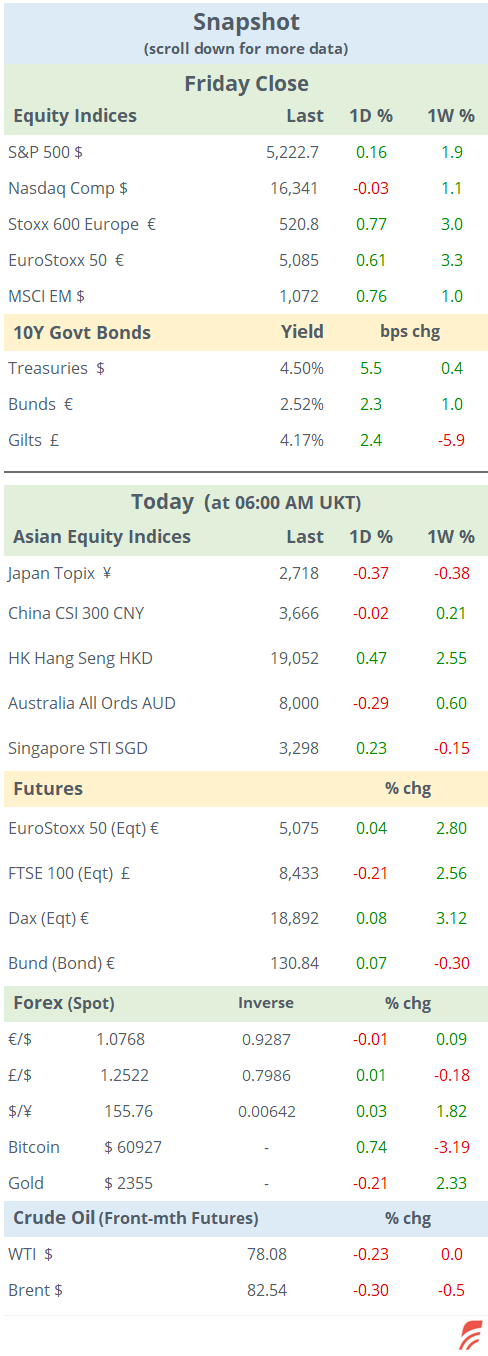

European and US equities ended last week on a positive note ahead of this week’s US inflation update. The Stoxx 600 added 3% WTD and the S&P 500 advanced nearly 2% and accumulated three weeks of gains. Some country benchmarks in Europe did even better with Germany, Switzerland and Portugal gaining 4% last week. There were no significant moves among sector indices worth highlighting. The notable large-cap movers last week include UBS up 10%, Shopify down 21%, Palantir down 12%, Tesla, Disney and Airbnb down 7%.

Interest rate markets finished the week mostly unchanged with 10-yr Treasuries at 4.50%, Bunds at 2.52% and Gilts at 4.17%. Currency markets were also calm with the ¥ as the only mover, dropping 2% against the $ and €. Bitcoin lost 4% last week and is now dealing at $61,000. Crude oil futures ended the week flat after a weaker Friday (-1.3%), and Brent is now trading slightly lower at $82.50.

Asian markets are mixed and little changed today with Japan, Korea and Australia around 0.4% lower while Hong Kong and Taiwan are firmer. European equity futures are also mixed with the FTSE pointing to a marginally weaker open.

Headlines,

-Russian forces continued to gain territory in the north-eastern region of Ukraine during the weekend as they get closer to Kharkiv, the country’s second-largest city. Also, Putin removed his defence minister Shoigu, a long-standing ally after 12 years in the role and replaced him with an economist. Shoigu will become secretary of Russia’s Security Council.

-Israel asks Palestinians to abandon the city of Rafah as it plans for more strikes to eliminate Hamas, while Netanyahu receives warnings from London and Washington.

-In Spain politics, the Catalan Socialist Party, part of Prime Minister Sanchez’s PSOE, won regional elections with 28% of the votes this weekend in a blow to the independence movement of Carles Puidgemont which came second with 21%.

- On Saturday, China reported inflation showing consumer prices rose for a third month, implying a recovery in demand and lower risks of deflation. CPI was up 0.3% YoY and core CPI rose by 0.7% while producer prices fell by 2.5% in the past 12 months. Beijing began preparations for selling $140bn worth of long-date domestic bonds to boost the economy and support investment.

The UK reported GDP figures as well as industrial activity on Friday, showing a 0.6% QoQ expansion, its fastest growth in almost three years and March GDP rising by 0.4%, well above expectations. The update means that the UK exited a mild recession and according to Prime Minister Sunak, it has turned a corner. Manufacturing (+2.3% YoY) and industrial (+0.5% YoY) output also printed above estimates although they came in below the previous month.

In IPOs on Friday, the highlight in US markets was Chinese electric vehicle company, Zeekr Intelligent Technology (ZK), the premium brand of Geely which also owns Lotus and Volvo. Zeekr raised $440mn on the NYSE, the first major Chinese listing in the US in 3 years, and was priced at $21. Shares had a solid debut, rallying 35% to reach a $7bn market cap.

Today will be a slow day of an active week regarding data releases, with inflation in Portugal. Tomorrow we’ll get inflation updates in Germany, Spain and Greece, PPI in the US and employment figures in the UK. It turns heavier by mid-week, with US CPI inflation, retail sales, and GDP and final inflation in the €-zone as well as China’s investment and retail sales.

There are no significant monetary policy meetings scheduled for the week. In terms of market holidays, China and Korea will be closed on Wednesday while Sweden and Norway will be shut on Friday.

That’s all for today, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. Please share the publication using the button below, as access is free to all.