Morning,

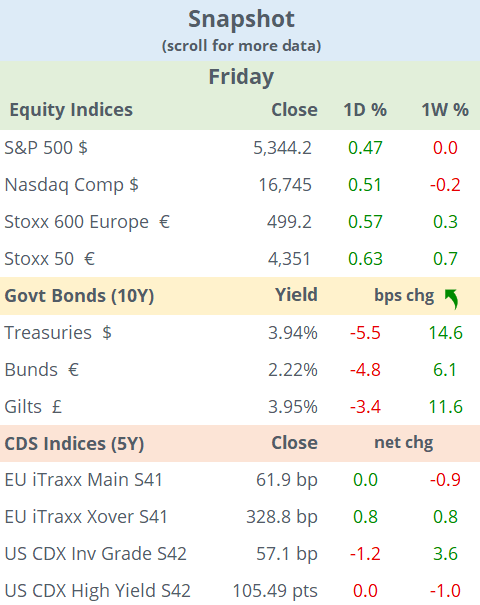

Risk assets managed to recover from last Monday’s selloff and equity indices in Europe and the US finished almost unchanged week-to-date while Asian benchmarks rebounded partially to end ~3% lower.

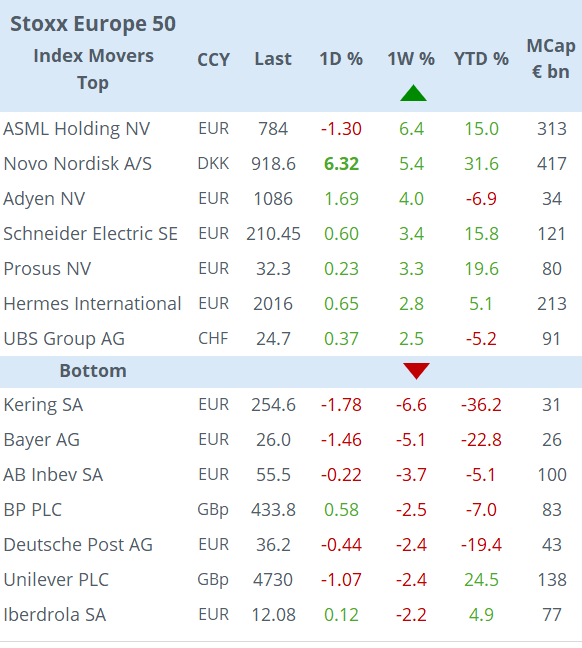

Technology was the week’s best-performing sector in Europe with ASML as the biggest mover among large-caps, with a 6% gain while the Autos sector was the weakest. Also, Europe’s largest co Novo Nordisk (mcap €417bn) rallied 6.3% on Friday on the back of Eli Lilly’s (+11% WTD) solid earnings report, to accumulate a 32% gain this year.

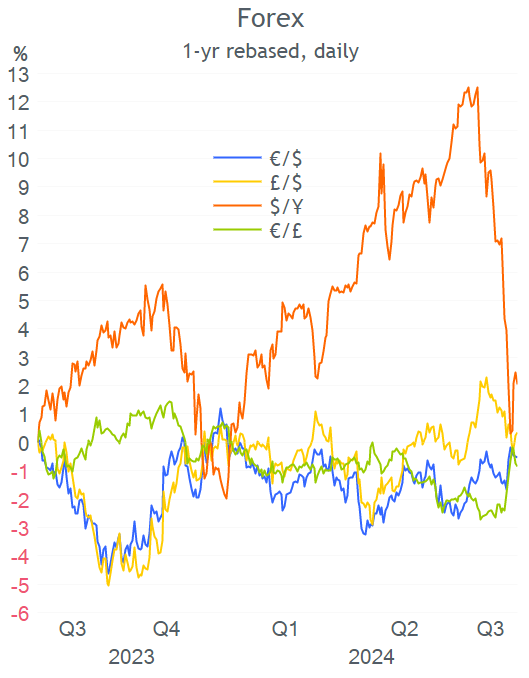

Bond prices finished a touch firmer on Friday but yields ended the week higher with 10-yr Treasuries adding 15bp to 3.94% and Gilts adding 11bp to 3.95% ahead of the US CPI update this Wednesday. There were no significant weekly moves in forex markets with the DXY $ index finishing flat and stabilized near the 103 pts level. In the crypto space, Ethereum lost 14% WTD to reduce this year’s performance to +14%.

It was a positive week for commodities with crude oil advancing 4%, US and European natural gas rallying 10% and cocoa futures climbing 21% on supply tightness in Ghana.

APAC region markets are mostly higher today with stock indices in Korea and Taiwan up 1% while Singapore is lower following a holiday on Friday. Japanese markets are closed today but the ¥ is weakening to 147. Futures in Europe are pointing to a positive open and Bitcoin is dropping 4% to $58,500 this morning.

In data on Friday, Germany’s final inflation reading for July was confirmed at 2.6% YoY, marginally above June’s while Italy’s inflation was revised lower to 1.6% after prices fell almost 1% in July.

Headlines:

-The University of Michigan and the FT conducted a survey that shows that more US voters are trusting candidate Kamala Harris over Trump in economics, in a sharp reversal for Democrats since Biden stepped down.

-Ukraine troops are advancing into Russian territory and have taken control of small towns near the border as Kyiv increases its defence. Countries have accused each other of starting a fire at Europe’s largest nuclear plant in Ukraine but under Moscow’s control, on Sunday evening.

-Japan issued its first-ever megaquake alert following Thursday's 7.1 quake.

In M&A deals, Britain’s largest investment platform Hargreaves Lansdown Plc (mcap £5.2bn) agreed to a £5.4bn takeover, this year’s second-largest deal for an LSE-listed co, by an investment consortium led by CVC and Nordic Capital.

In IPOs, Chinese autonomous driving start-up WeRide (WRD) plans to raise $120mn at a $5bn valuation on Nasdaq.

In credit ratings, Finland’s outlook was d/g to negative by Fitch (AA+).

It will be a light day for economic data with inflation in Portugal & Denmark and Germany’s wholesale prices in an otherwise busy week. From tomorrow, we’ll get inflation updates in the US and the UK; GDP in the €-zone, UK and Japan; and retail sales in the US, UK and China.

In monetary policy meetings, New Zealand's (Wed) & Norway’s (Thu) central banks hold meetings this week. Apple goes ex-dividend today.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.