Morning,

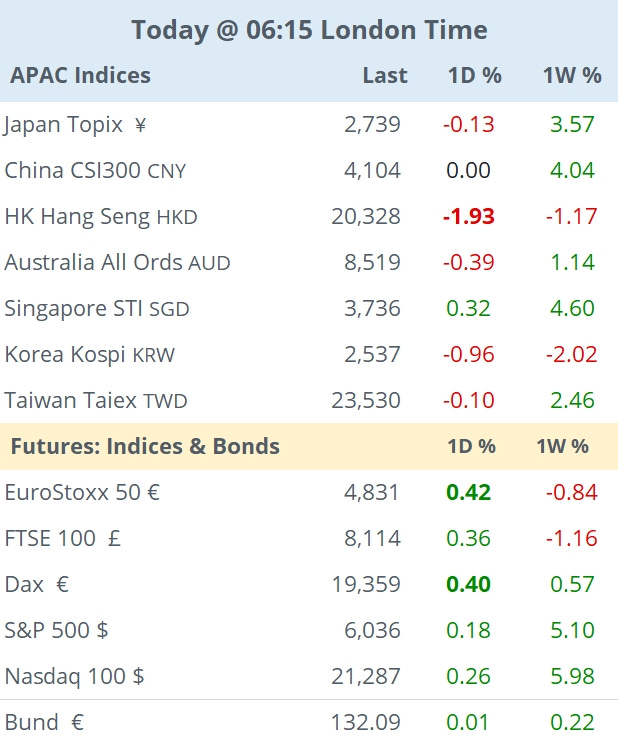

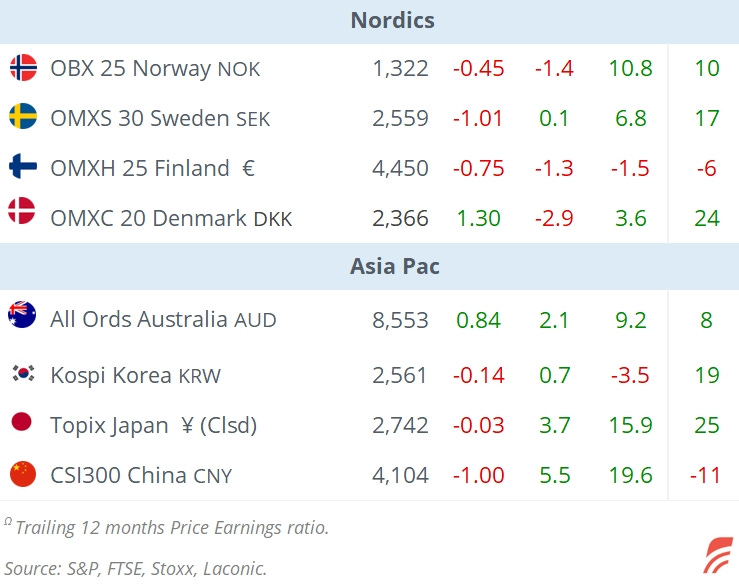

Today´s global market focus is on China following Friday´s fiscal stimulus announcements and Saturday´s inflation update. Asian equities are marginally lower but Hong Kong is losing 2%. Beijing´s highly awaited fiscal stimulus failed to convince markets as the $1.4tn package was intended to help local governments but lacked direct stimulus. It concentrated on stabilizing the provinces' finances ahead of the Trump administration's expected tariffs but was not designed to boost growth.

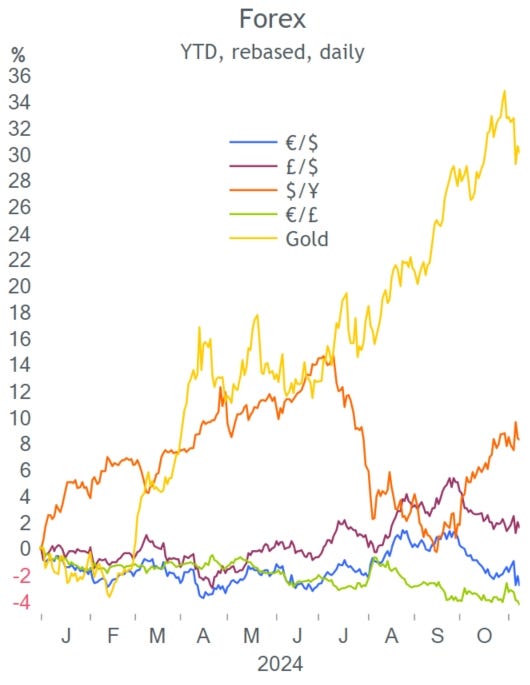

The latest inflation data shows that China continues to struggle with deflation as headline CPI fell 0.3% MoM, much more than forecast and prices advanced 0.3% YoY, the slowest pace in four months. Producer prices fell 2.9% on an annual basis, deepening the deflationary scenario. The yuan has depreciated sharply (2.3%) since the beginning of October to 7.18, the weakest since early August.

In the US, the ´reflationary´theme is gaining momentum as measures by Trump are expected to slow down the disinflation trend or even lead to a rise in prices.

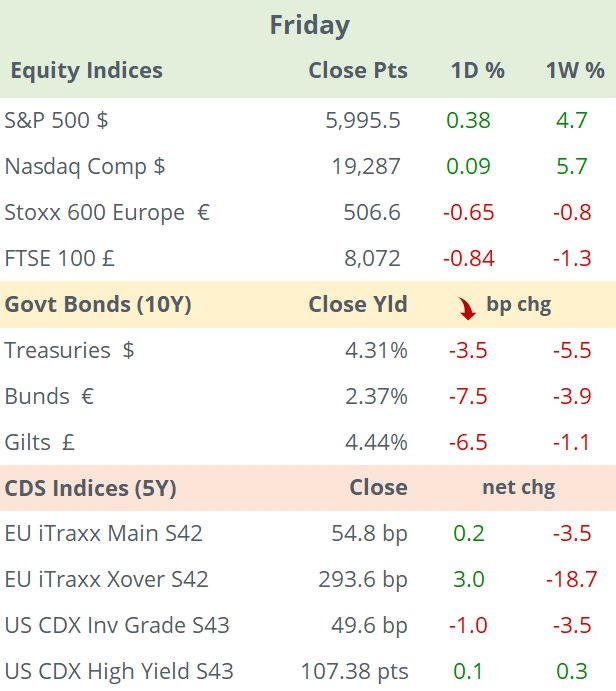

This is how the main indicators performed last week, after the US election, the Fed and BoE policy meetings. The $ index appreciated 0.7% WTD to 105 pts, accumulating six straight weeks of gains. Bitcoin rallied 15% and is this morning trading at a new all-time high of $81k. The S&P 500 advanced 4.7% it´s best week this year, briefly traded above 6,000 points, also a fresh record high, driven by a 30% rally for Tesla. The Renewables sector on both sides of the Atlantic is the main loser of Trump´s victory. The VIX volatility index fell sharply to sub 15%, the lowest level in 12 weeks.

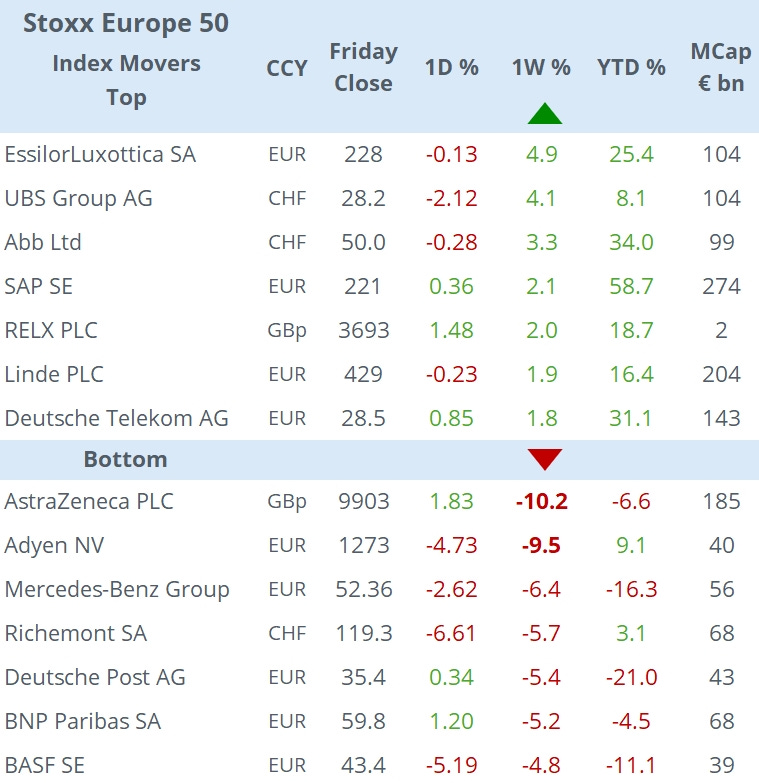

European indices fell between 1.5 and 2.5% last week mainly on weaker Auto and Luxury goods stocks, accumulated three weeks of declines and are now significantly underperforming the US market this year. The Eurostoxx 50 is up by 6% in 2024 while the S&P 500 rallied 26% and the € is 3% weaker in the same period.

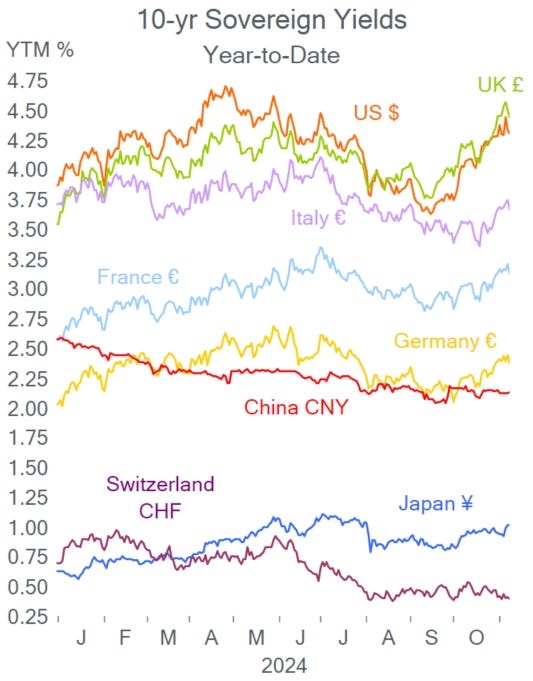

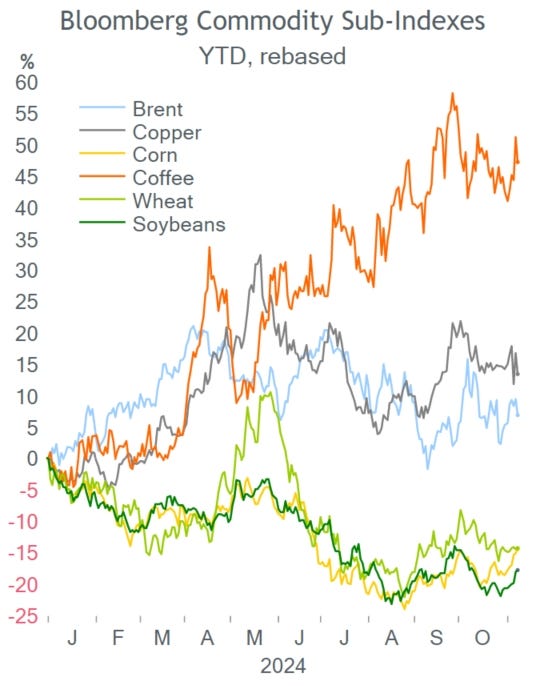

Benchmark bond yields had a volatile week but finished little changed. 10-yr Treasury yields fell 5bp to 4.21%, Bunds dropped 7.5bp to 2.37% and Gilts ended the week flat at 4.44%. Crude oil fell >2% on Friday to close the week just 1% higher and is trading around $73.60 this morning.

In deals, Blackrock and privately held hedge fund Millennium Mgt are said to be exploring partnership opportunities.

In IPOs, India´s food and grocery delivery app Swiggy plans to list this week and raise $1.4bn with orders books oversubscribed by 3x in the country´s second-largest equity offering this year.

In credit ratings, Spain´s outlook was u/g to Positive (A-) by Fitch and Croatia was u/g two notches by Moody´s to A3. 10-yr Croatian bonds yield 3.26% or 90bp over Bunds.

In data today: inflation in Norway and Denmark. Later in the week: US CPI and PPI inflation, Eurozone and UK GDP, and industrial output and retail sales in China.

There are no Western large-caps scheduled to report earnings today.

Thanks for your time, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.