Est reading time: 5 min

Morning, let’s begin with today’s political headlines before moving on to markets.

Far-right European parties have made significant advances in France, Germany and Austria in the EU elections that finished yesterday, implying a lean towards anti-immigration and anti-green posture. However, mainstream centre parties are on course to hold a majority.

In a surprise move, Macron dissolved the French parliament and called a snap legislative election within the next 30 days after suffering a deep defeat against the far-right National Rally party of Marine Le Pen. Macron’s candidate for the European parliament is set to get less than half the votes of Le Pen’s candidate.

Germany's far-right AfD party also celebrated last night as Olaf Scholz’s Social Democratic party got less than 15% of the votes. In Italy, Meloni’s ECR party added twice as many seats as the Italian left. Exit polls suggest that far and extreme-right parties were on course to win 22% of the 720 EU parliament seats, behind the centre-right EPP party with 25%.

Belgium, Germany and Ireland also held general or regional elections with Belgium’s leader, Alexander De Croo, resigning following poor results despite the far-right failing to make a landslide win.

The € is falling 0.5% today to 1.0750 as the $ strengthens against all majors. European stock futures are pointing to a weaker open, down 0.4% for the Eurostoxx 50 and 0.7% for the FTSE.

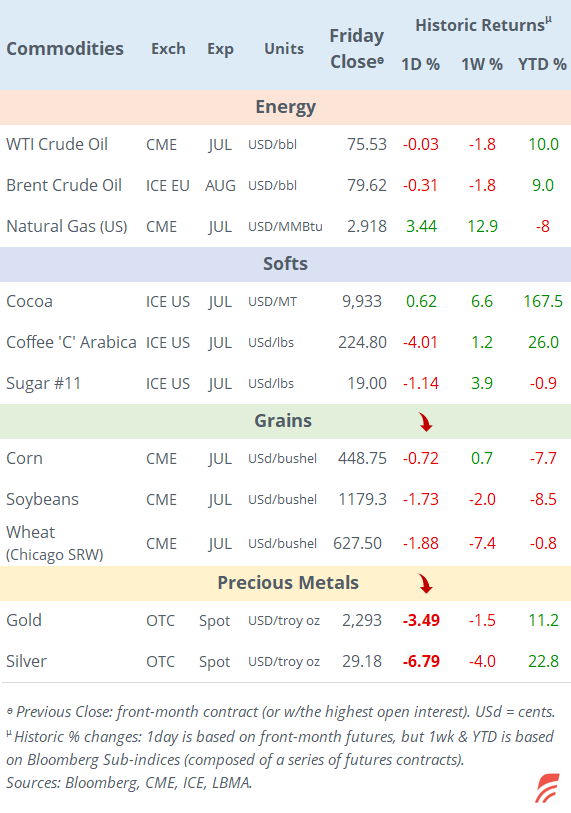

Asian markets are mostly closed today, with China, Hong Kong, Taiwan and Australia on holiday. Stocks in Japan are firmer after a GDP data revision for Q1 showed the economy contracted by less than initially reported (-1.8% annualized). Korean markets are weaker. Crude oil markets are quiet with Brent around $80.

Israeli war cabinet minister Benny Gantz has quit the coalition government, accusing Netanyahu of being responsible for the painful ongoing crisis and called on the Prime Minister to set a date for elections. Gantz’s centrist National Unity party was in opposition until Hamas’s October attack when Israel’s main parties formed an emergency government. Netanyahu still maintains control despite the political tensions. Also, concerns grow over a possible escalation in fighting with Lebanon’s Hezbollah while Washington urges Israel to act differently to lower civilian casualties.

The action on Friday was centred on bond markets with a sharp reversal for US Treasuries as yields jumped higher on stronger-than-expected jobs data. The US economy created far more jobs than analysts anticipated, 272,000 versus 185,000, and well above the reading of a month earlier, which was revised lower. However, the unemployment rate ticked up to 4%, the highest since November 2021.

The robust non-farm payrolls reading reduced the likelihood of multiple interest rate cuts from the Fed which meets on Wednesday and markets almost ruled out any change. But, the probability of a 25bp rate cut at the September meeting, fell to 45% from more than 70% before the jobs report.

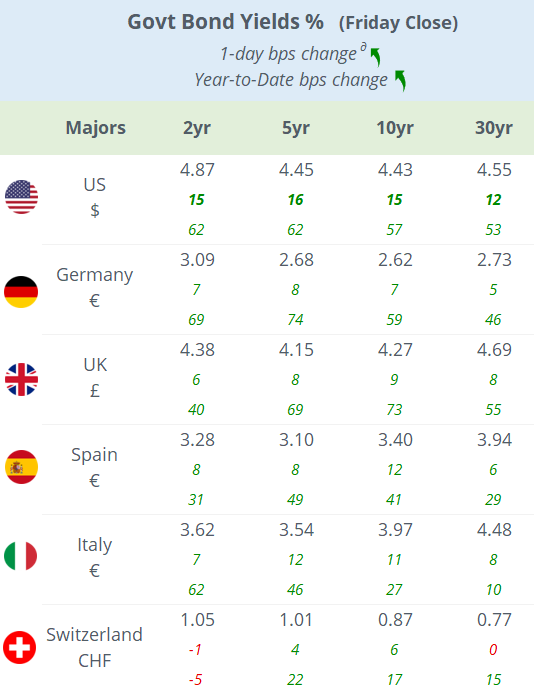

The US yield curve climbed 15bp between the 2 and 10-year tenors with the short end now yielding 4.87%. Other bond markets mirrored the weakness in the US with the Bund and Gilt yield curves also shifting upwards by 7-9bp. The $ rallied on Friday, gaining 0.8% against the €, as policy rate outlooks diverged after the ECB’s rate cut. Gold lost 3.5% on Friday to $2,293 due to the employment update.

Stocks ended somewhat lower on Friday (~0.2%) but managed to finish the week higher by more than 1% on both sides of the Atlantic, with Nasdaq indices as the outperformers (+2.5% WTD). The Stoxx 600, S&P 500 and Nasdaq Composite touched all-time highs on Thursday.

The two best European large-cap names last week were ASML up 10% and SAP up 7%, while GSK (-8%) and BP (5.2%) were the main losers. On a year-to-date basis, two of Europe’s largest companies, Novo Nordisk and ASML have gained 41%.

The latest in corporate deals last week, Bain Capital is taking PowerSchool Holding private (mcap $4.6bn), a US software company, for $5.6bn of enterprise value. Terms: $22.8/share or $4.6bn in total equity value, a 37% premium to the close a day before the announcement.

Meme stock GameStop (US, electronics retailer, mcap $8.5bn), experienced extreme volatility last week after reporting poor earnings before schedule. Quarterly revenues declined 28% YoY (to $882mn) missing expectations but narrowed its losses to $32mn. It also announced a $3.5bn share placement and the stock plunged 40% on Friday to end the week higher by 22%.

Today’s economic data releases include GDP in Sweden, inflation in Norway, Denmark and Greece, €-zone’s Sentix index. But the key events will be the Fed’s meeting and CPI inflation on Wednesday, and the Bank of Japan’s meeting on Friday.

That’s all for today.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. Please share using the button below, as access is free to all.