Good morning and welcome to the second half of the year…

This week will be active on political headlines with yesterday’s French legislative first-round election, the UK general election on Thursday and the aftermath of Biden’s disastrous debate last week.

French President Macron was defeated in the first round of the parliamentary election yesterday gaining only 20.3% of the votes, according to exit polls. His ENS party came third behind the NFP leftwing alliance which got 28.1% and the big winner, the far-right National Rally party of Marine Le Pen with 34%, a historic result. However, Le Pen’s result was slightly below projections. The final round will take place next Sunday and if the National Rally confirms its lead, it will trigger a co-government with Macron’s ruling party, which could lose more than half the 250 seats out of 577 in total in the lower house that it now controls.

On Friday, the French OAT 10-year yield spread to German Bunds closed at 80bp for a 3.29% yield, just 2bp below the all-time high a day earlier.

Today, markets are reacting positively, with the € appreciating 0.4% to 1.0755 in Asian trading hours while €Stoxx 50 futures are rallying more than 1% and Dax is up 0.6%. Bund futures are lower by 0.3%. Most Asian stock markets are also firmer except for Australia and mainland China. The ¥ is marginally weaker at 161, adding pressure on the Bank of Japan to react. Bitcoin is rallying more than 5% at $63,350 and Brent oil is 0.5% higher at $85.40. US stock futures are firmer by 0.25% in overnight trading.

In the UK’s general election on Thursday, 326 out of 650 seats in the House of Commons are needed to win. At the moment, the ruling Conservative party holds 344 while the opposition Labour party, and favourite to win Thursday’s election, controls 205 seats. The latest average of all polls put Labour at ~40%, double what Conservatives are expected to get.

President Biden insists on maintaining his nomination despite a unanimous agreement that his debate performance was poor and revealed signs that he could be unfit for another four years in office at 81 years old. The New York Times editorial board called for Biden to step down and 30% of Democrats agree according to polls.

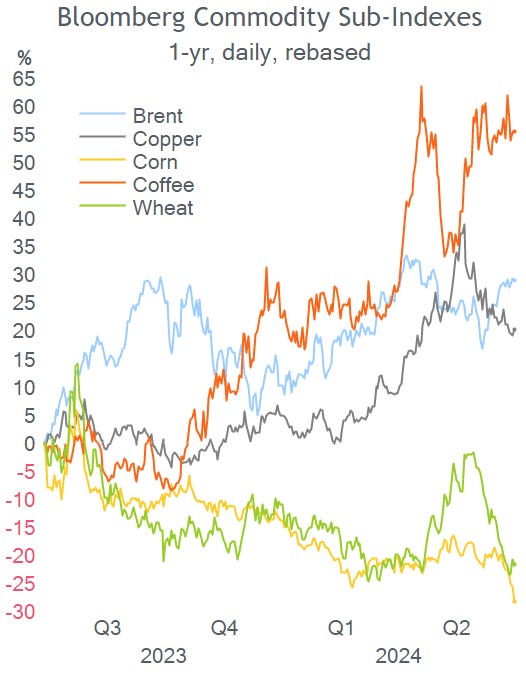

In other headlines, a Caribbean category 4 hurricane Beryl is soon going to hit Barbados with an actual course towards Mexico.

Let’s review the latest data released on Friday. US headline and core PCE inflation cooled in May to 2.6% YoY in line with estimates. The core PCE reading, the Fed’s preferred inflation measure, had its smallest increase since March 2021, raising hopes for a Fed rate cut. Consumer spending rose moderately (+0.2 MoM) and the US economy grew by 1.4% annualised in Q1, slower than the 3.4% the previous quarter.

Equities ended lower on both sides of the Atlantic on Friday with the Nasdaq 100 down by 0.5% to end the week almost flat and the Stoxx 600 lower by 0.2% with French stocks as the underperformers, dragging the overall market to a weekly loss. The CAC40 was the biggest loser of the week with a 2% fall.

A notable mover in US markets was Nike (mcap $114bn) which plunged 20% on Friday, its worst day in 23 years after it provided a worse-than-expected sales forecast as it faces increasing competition from new brands and was downgraded by six brokers. Nike’s stock is down 30% YTD.

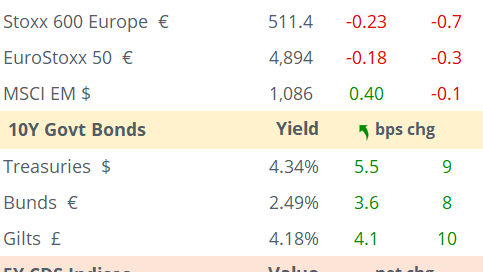

Benchmark interest rates closed ~5bp higher on Friday and for the week with Bunds ending at 2.49%, Gilts at 4.18% and UST at 4.34%. The $ was little changed week-to-date with Nordics depreciating more than 1% against the € and Bitcoin dropping 6%.

In corporate deals, video games company Keyword Studios (Ireland, London-listed, mcap £1.8bn) is ready to agree on a £1.96bn or £24.5/share takeover bid by private equity firm EQT if it becomes firm. Shares gained 6% to a one-year high.

In the IPO market, US biotech Alumis Inc (ALMS) had a poor debut on Nasdaq after raising $210mn and being priced at $16/share. It fell 17% on Friday for a valuation of $760mn.

On data today, we’ll get Germany’s preliminary inflation for June and manufacturing PMIs for most countries. Tomorrow we’ll learn about €-zone’s inflation. The only central bank meeting this week will be Poland’s on Wednesday. The UK goes to the polls on Thursday.

Today is a holiday in Hong Kong and Canada and the trading week will feel shortened by the US holiday on Thursday and the early close of US exchanges on Wednesday.

That’s all for today, see you tomorrow.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.