Global markets are currently focused on the state of the US economy. Yesterday’s lower-than-forecast weekly jobless claims were the trigger for a strong rally in Wall Street as it calms recession concerns. The weekly unemployment aid figure fell to 233k from 250k a week earlier and was below the 240k estimate, a sign that the labour market remains somewhat strong. However, it's worth highlighting that the figure is still above the two-year average of 218k.

In any case, investors considered this print as positive and the S&P 500 posted its best day since Nov 2022, surging 2.3% to close near its pre-Monday sell-off level. All US sectors finished higher. The Nasdaq 100 jumped 3% with the volatile semiconductors sector as the notable winner. Nvidia, Broadcom, AMD and Qualcomm added 5-7% while other mega-caps such as Eli Lilly gained almost 10%.

Pharma giant Eli Lilly (mcap $803bn) beat quarterly revenue ($11.3bn) and net income ($3bn) estimates and raised its full-year revenue outlook on the back of strong demand for its weight-loss drug Zepbound. Shares are 45% higher YTD and trade at a trailing P/E ratio of 124x.

Remarks by Fed officials Barkin of Richmond and Schmid of Kansas City were optimistic regarding the labour market, the disinflationary path, and are confident that the Fed will reach its 2% inflation goal in the near term.

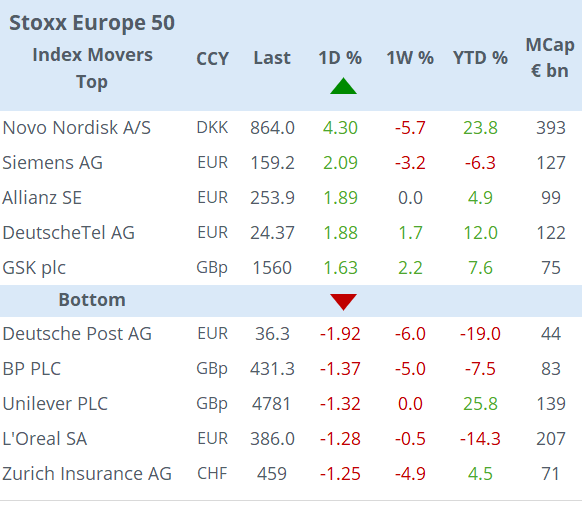

European markets had a mixed day with the Dax a touch firmer while all others fell modestly. Novo Nordisk was Thursday’s best performer among large caps with a 4.3% gain helped by Eli Lilly, after a steep drop on Wednesday following its earnings release.

It was a calm day in forex and interest rate markets with £ appreciating ~0.5%, cryptos rallying nearly 10% and Treasury yields edging higher again by a few basis points.

Chinese inflation accelerated in July with consumer prices advancing 0.5% MoM compared to a price drop a month earlier and +0.5% YoY while producer prices (PPI) fell -0.8% YoY.

Irish HICP inflation decelerated to +0.2% on a monthly basis and remained steady on an annual basis at +1.5%, the lowest reading in three years.

Equities in Asia opened significantly higher today following Wall Street’s strong performance but later reversed. Japan is now trading marginally firmer, Taiwan is recovering 3%, Hong Kong is +2%, and Korea and Australia are gaining 1%. The ¥ is strengthening 0.3% to 146.90. European index futures are marginally higher.

Headlines:

-A magnitude 7.1 earthquake hit southwestern Japan yesterday afternoon local time, without major damages reported.

-Trump and Kamala Harris will hold their first TV debate in a month from now on ABC. Trump requested two more debates on other networks, one for an earlier date and another after Sep 10.

In monetary policy action, Mexico surprised with a 25bp rate cut to 10.75% but signalled it still sees inflation increasing as it revised upwards this year’s CPI forecast to 4.4%. Headline inflation in July was 5.57% YoY, higher than in June. The Mexican peso appreciated 2.2% to 18.86 vs $, but remains 10% weaker YTD. India’s Reserve Bank kept rates unchanged at 6.5% as anticipated.

Corporate deals: KKR will launch a tender offer to acquire Fuji Soft, a Japanese software company valued at $3.8bn. Shares rallied 20%.

Debt issues: Coca-Cola placed two tranches (€500mn) of €-den senior bonds, 13-yr and 29-yr, rated A+, at 108bp (3.48% yield) and 135 (3.84%) over Bunds.

Data today: CPI inflation in Norway and Greece; July’s final inflation reading in Germany and Italy; Canada employment.

Peru’s central bank meets today with rates expected to remain steady at 5.75%. Rating agencies will review the ratings of Germany, Netherlands, Denmark, and Switzerland. Holidays: Singapore and South Africa.

Enjoy your weekend.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.