Morning,

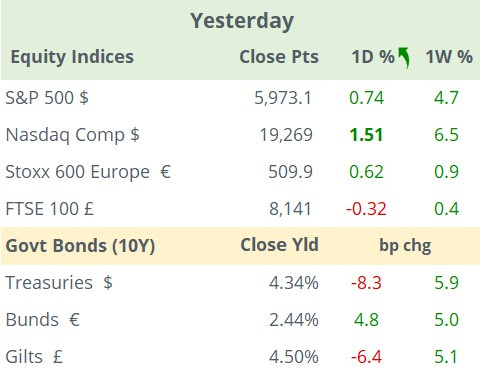

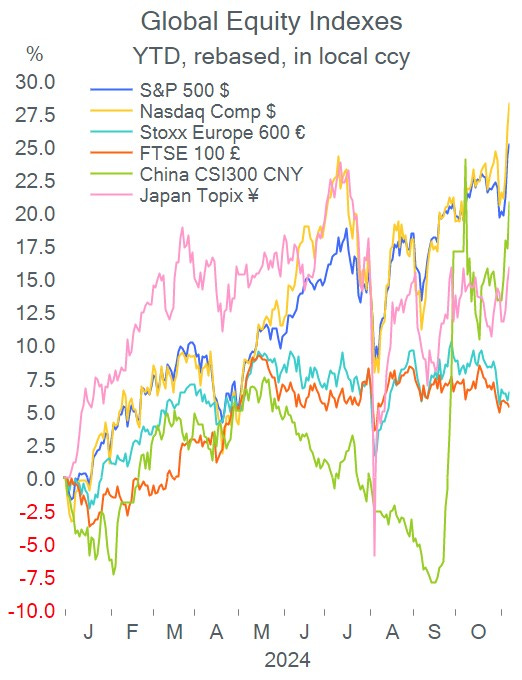

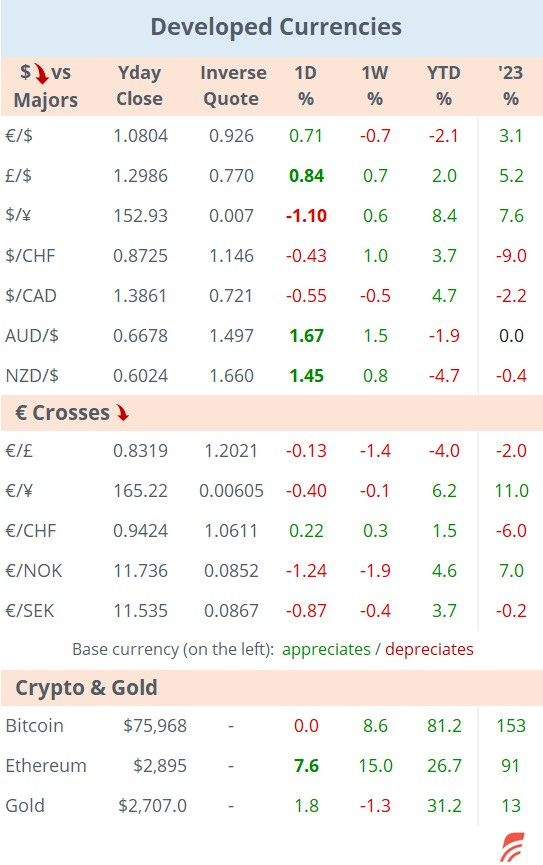

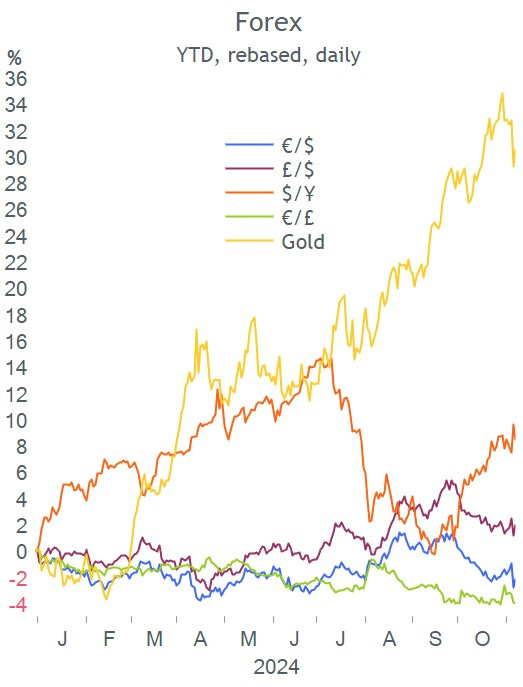

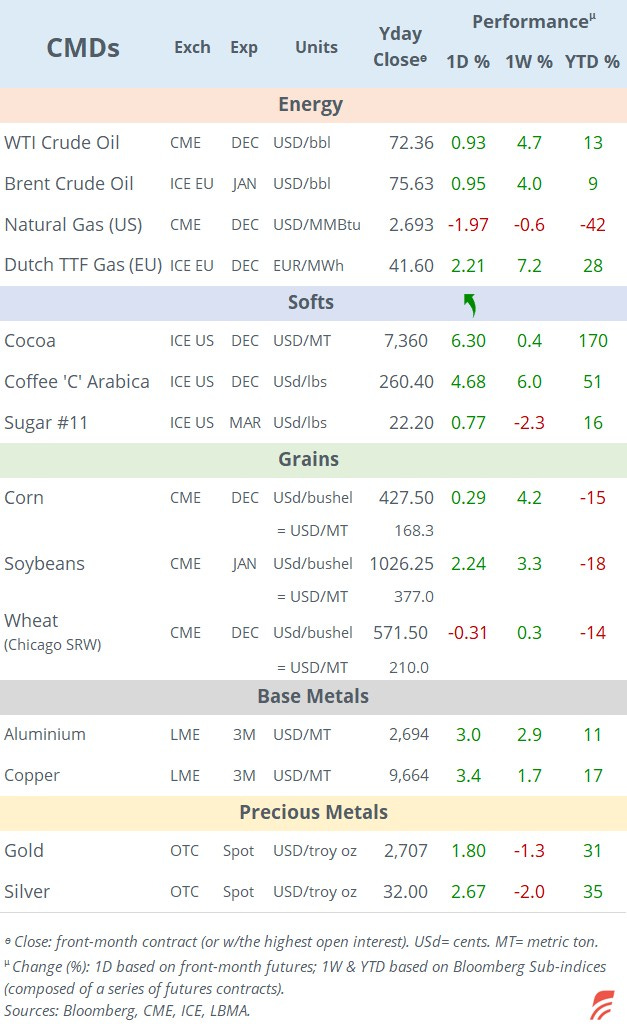

Thursday was a risk-on day across global markets with equities rallying in Europe, the US and Asia as investors digest the result of the election and the Fed and Bank of England’s outlook after their respective meetings. Britain’s FTSE 100 was the only benchmark index to end marginally down after the Bank of England raised its inflation outlook. The $ index fell below 105 pts again, giving up the steep gains of the post-election day.

On the political front, Germany’s ruling coalition collapsed after Chancellor Scholz fired his finance minister (Lindner of the FDP party), sparking chaos as the country heads towards a snap election in January.

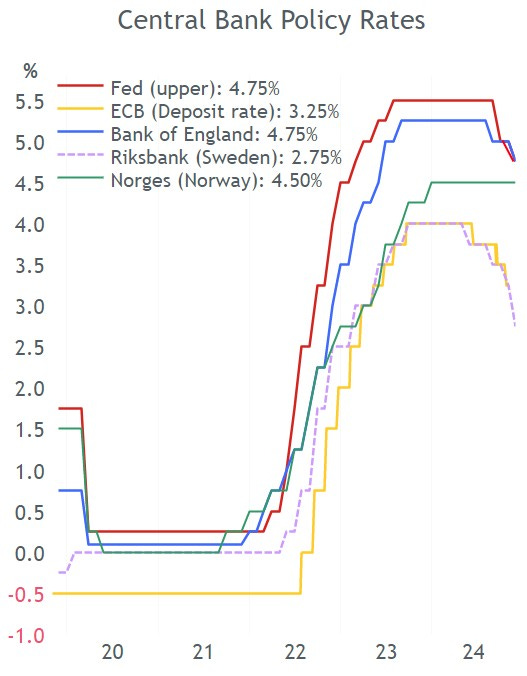

It was an active day for monetary policy action, with no surprises from central banks’ decisions.

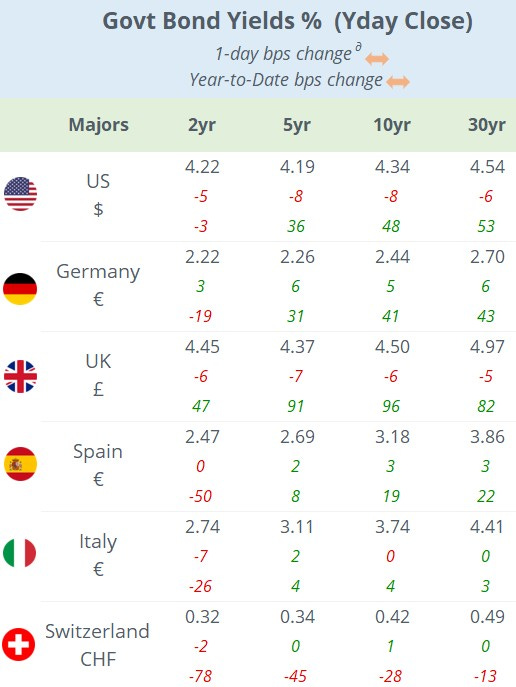

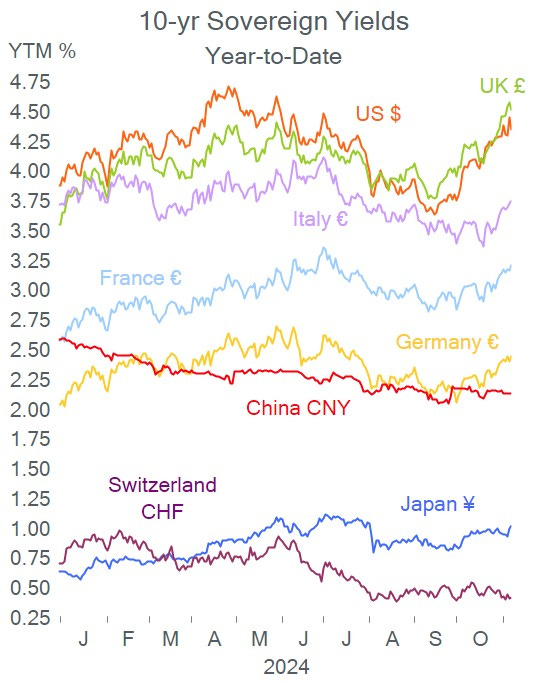

The Fed eased rates by 25bp to a 4.5-4.75% range in a unanimous FOMC decision as it recognised that economic activity is solid, job conditions have eased and inflation made progress towards the central bank’s 2% target. Governor Powell did not rule out nor signalled another cut next month and said that as the level of interest rates approaches a neutral level, the pace of cuts will slow. Futures are now pricing in a 71% probability of a 25bp cut on December 18.

The Bank of England also cut its base policy rate by 25bp to 4.75% the second easing decision this year and raised its inflation forecast after the Labour Budget announcement. The BoE signalled gradual rate reductions ahead. It said inflation was likely to increase to ~2.5% by yr-end, much higher than the 1.7% YoY recorded last month, and by 2.7% by December of next year, mainly as services inflation remains too high. Governor Bailey stated that the budget will not significantly impact the central bank’s decisions. Sterling partially recovered from Wednesday's decline with cable appreciating 0.7%. Gilts rallied with 10-yr yields falling 6bp to 4.50%.

Sweden’s Riksbank eased policy by 50bp to 2.75% and signalled multiple cuts ahead as inflation (+1.1% YoY) has dropped below its 2% target. The Swedish krona advanced 0.8% against the €.

Norges Bank of Norway maintained rates steady at 4.5%, the highest level since 2008 and signalled no changes in the near term as core inflation (+3.1% YoY) remains above its official target (2%). The Norwegian krone gained >1% against the €.

Data released yesterday include a much stronger than expected retail sales update in the €-zone, up 2.9% Yoy and an upward revision for the previous month reflecting an improvement in consumer spending, particularly in non-food items and were stronger in Spain and Germany.

Also, China’s trade figures showed exports rose well above estimates and at the fastest pace in >2 yrs or +12.7% YoY as manufacturers anticipated Trump’s potential tariffs by increasing production. Imports fell for the first time in four months, down 2.3% YoY.

Finally, house prices in Britain rose almost 4% in the past twelve months to a record high as new buyers face increased taxes announced on last week’s budget.

In economic data today, we’ll get retail sales and industrial production in Italy, industrial production in Sweden, Univ of Michigan Sentiment in the US and tomorrow, China’s inflation (CPI and PPI) updates.

The central banks of Peru (-25bp to 5% exp) and Romania (unch at 6.5% exp) hold policy meetings today.

Blue-chip companies reporting include Richemont, Sony and Softbank.

That’s all for this week, thanks for your time and enjoy your weekend.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.