Est reading time: 5 min

Morning,

Yesterday’s main event was the widely anticipated ECB 25bp policy rate cut from its all-time high, the first easing of monetary policy in nearly five years. The deposit rate was reduced to 3.75% and the refinancing rate to 4.25%, despite an uncertain inflationary outlook. Although price pressures have eased in recent months, the most recent data shows that the disinflationary trend has paused.

President Lagarde was clear in stating they are not committing to any particular rate path, meaning that yesterday’s decision is not necessarily the start of an easing cycle and the ECB remains data dependent. Only one ECB member voted against the decision, the Austrian central bank governor, who believes that the bank signalled markets of the rate cut before having the latest data.

€-zone headline inflation has dropped from a 10.6% peak in October 2022 to 2.6% last month. The ECB forecasts inflation to remain above its 2% target until Q4 of next year, with an average inflation this year of 2.5%. The focus is now on wage growth and domestic prices and another rate cut for July has been mostly ruled out (12% prob) while markets have reduced their bets for a September cut to around 48%.

Denmark’s central bank, which mirrors the ECB’s decisions, also cut rates by 25bp to 3.35%. The Fed (5.25-5.50%) and the Bank of England (5.25%) are expected to maintain policy rates unchanged in the coming weeks.

Equities reacted positively to the decision and most European indices rose between 0.5% and 1%. The short-end of the Bund yield curve saw yields rise by 4bp to 3.01% and the 10-yr bond finished at 2.54%. Bund futures for June expired yday. The € closed a touch firmer against the $ (1.0888) and £ (0.8512).

In stocks, the lagging sectors were the rate-sensitive ones such as utilities and real estate while technology, banks and healthcare outperformed. In single names, Europe’s largest company, Novo Nordisk, was the best performer among large-caps, adding 4% to a fresh record high and market cap of €480bn. Also, SAP added 3.6% on positive guidance remarks by its CEO.

Wall Street finished flat last night ahead of today’s employment report. Weekly jobless claims came in above estimates (+229k) and higher than a week earlier (+221k).

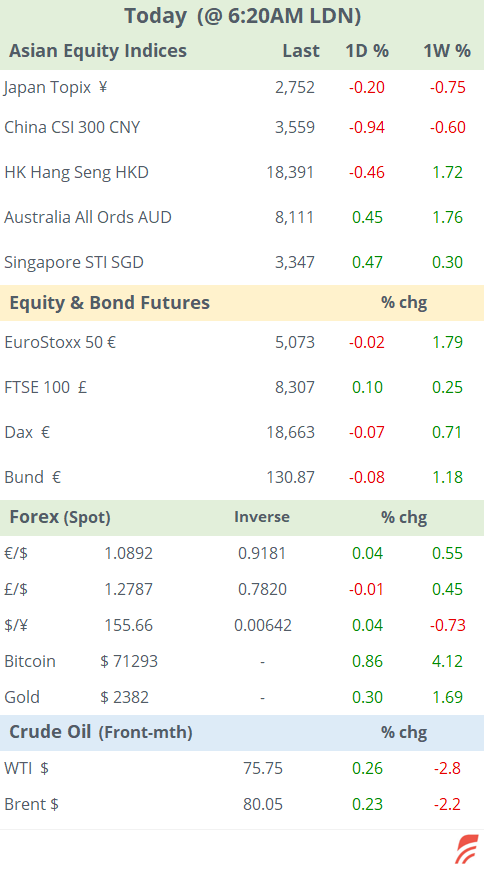

Onto today’s markets, Asian stocks are trading mixed, with Japan, China, Hong Kong and Taiwan lower between 0.2 and 0.7% while Korea (+1%) , Australia (+0.4%) and Singapore (+0.4%) are firmer. India’s Nifty 50 index is also higher (+0.7%) as traders digest the political news and the central bank’s decision. The Reserve Bank of India left its repo rate unch at 6.5% as expected today, for the eighth straight meeting, as the economy remains strong.

European stock futures are little changed this morning, Brent oil is again above $80 and Bitcoin is firmer at $71,200.

-Bondholders of Credit Suisse’s AT1 (additional tier one bonds) are suing Switzerland’s government for the write-down of their $17bn holdings when UBS rescued the bank.

-The Saudi government is set to complete the sale of Aramco shares to raise $11bn priced (0.6% of the co) at SAR 27.25/share, a 3.7% discount to yday’s close.

-China reported a strong improvement in exports today, +7.6% YoY in May, exceeding forecasts and the fastest pace in four months, while imports cooled to +1.8% YoY, much lower than anticipated, leading to a steep jump in its trade balance ($82.6bn).

At 13:30 London time, we’ll get US non-farm payrolls and related employment data for May. Expectations are for 185k new job posts compared to 175k in April and a monthly average of 244k in the past year. Finally, Russia’s central bank also meets today.

That’s all for today, have a nice weekend.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. Please share using the button below, as access is free to all.