Morning.

Stocks on Wall Street finished a touch lower yesterday despite a slightly better-than-expected non-manufacturing PMI (ISM 51.5 pts) reading and a weak labour update that supports the interest rate cut scenario. The U.S. private sector hired the fewest workers in a year (99k ADP Employment) ahead of today’s non-farm payrolls report. Initial jobless claims came in line with estimates (227k). The S&P 500 joins Europe’s Stoxx 600 index in posting three straight negative sessions in a historically poor month for equity performance.

In other economic data, Germany’s industrial orders for July surprised with a notable improvement, up nearly 3%, well above expectations and June’s figure was revised upwards. However, €-zone retail sales slipped marginally on an annual basis.

French luxury stocks Hermes, LVMH and Kering fell between 1.5 and 6% on Thursday on the back of increasing concerns about a Chinese slowdown. Tiffany and Sephora, owned by LVMH, are downsizing flagship stores in Shanghai. LVMH (mcap €309bn) shares are down 15% in 2024.

Bond markets were little changed yesterday but Treasury, Bund and Gilt yields maintained their downward trend as traders gained confidence that central banks (Fed and ECB) will deliver the widely expected rate cuts this month.

In earnings reports, Broadcom (U.S., semiconductors, mcap $711bn) beat revenues and profit estimates on the back of strong figures on its A.I. unit but the company’s sales guidance disappointed analysts. Shares ended a touch lower but remain 37% higher YTD.

In M&A, U.S. telecom giant Verizon (mcap $174bn) is acquiring fibre-optic internet provider Frontier Communications (mcap $9bn) in an all-cash deal worth $20bn of enterprise value. Also, private equity firms Vista and Blackstone are considering a bid for Smartsheet, the U.S. workplace software maker that is valued at $7bn. Finally, Japanese retail leader Seven & i Holdings rejected the $40bn bid from Canada’s Alimentation Couche-Tard.

In IPO news, Barcelona-based frozen bakery maker Europastry is planning to list in Madrid during October while Samsonite International (mcap $3.4bn), the Hong Kong-listed luggage manufacturer, plans a dual listing in the U.S.

In corporate bonds issues, the notable issuers yesterday were Danone (7-yr) and SES (wireless telco, 30-yr) with €-den bonds.

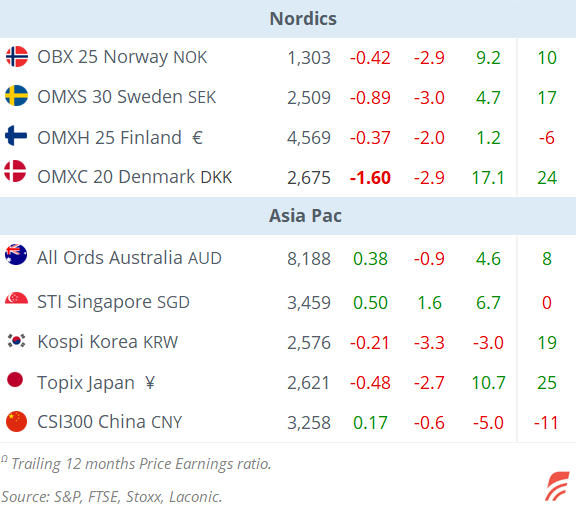

Asian markets are mixed this morning, with Tokyo and Seoul falling nearly 1%. Japan’s household spending for July surprised with a steep drop (-1.7%), much worse than anticipated. Indices in Australia and Taiwan are trading firmer. The ¥ continues to appreciate and trades below 143 against the $ for the first time since early January. Nasdaq futures are 0.4% lower overnight while European futures are flat.

Today’s key data will be the U.S. labour report for August including non-farm payrolls (+160k exp), the unemployment rate and average earnings; Germany’s industrial output; €-zone’s revised GDP (Q2); and UK home prices. The September Bund futures contract expires today.

Enjoy your weekend.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.