Morning,

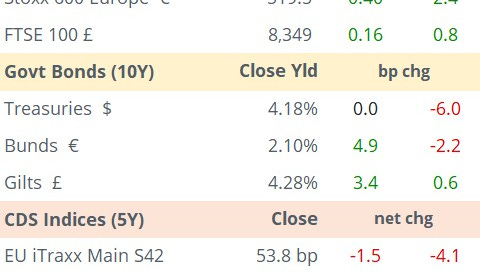

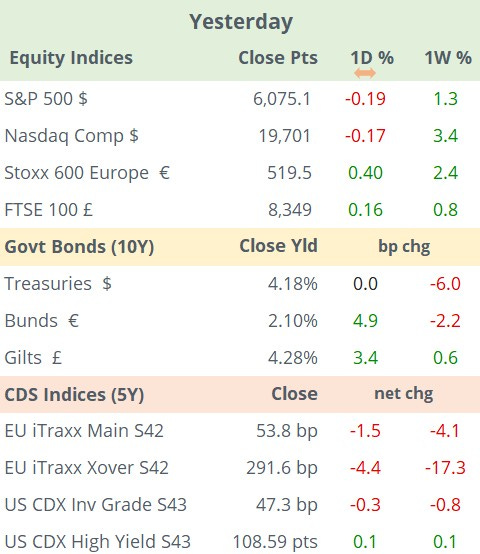

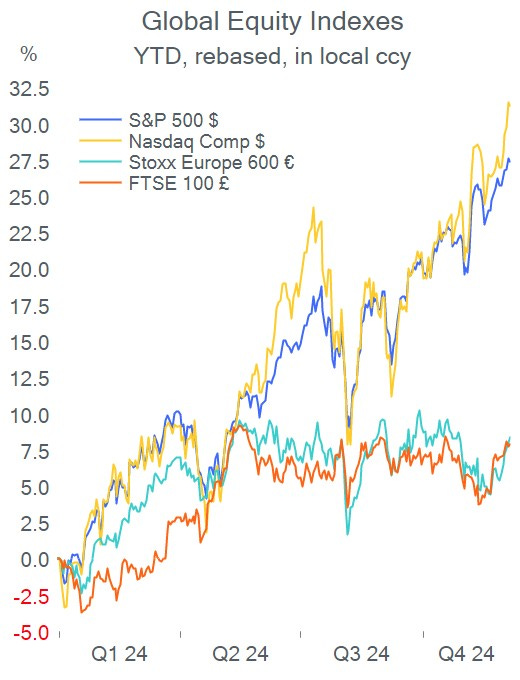

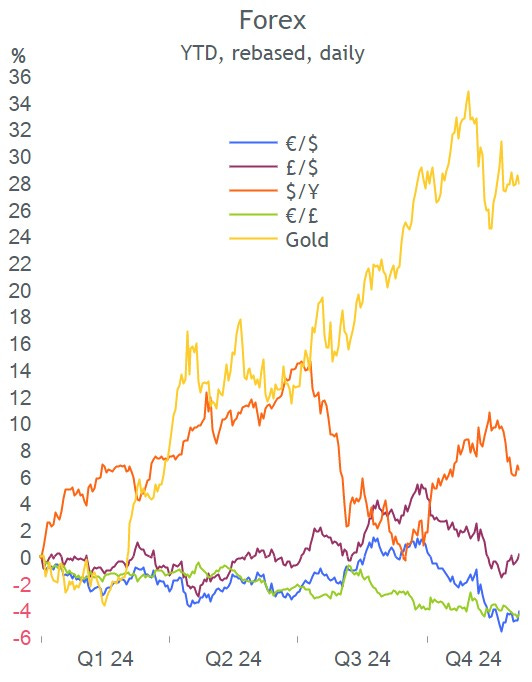

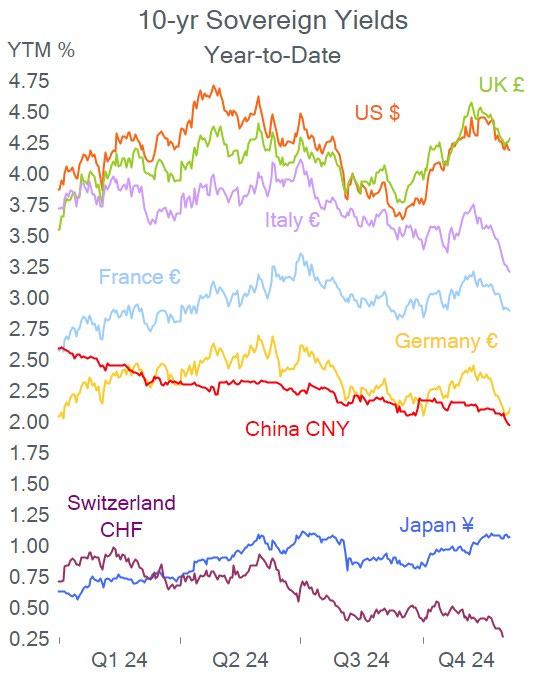

European equities finished at a five-week high on Thursday, helped by bank stocks as investors bet a new budget could be approved in France after the PM was toppled. Indices have rallied >4% in the past week with the Dax at a record high ahead of today’s US non-farm payrolls report. The $ fell on Thursday and European bond yields shifted a touch higher with 10-yr OATs closing at 79bp over Bunds for a 2.89% yield.

In French politics, Macron announced he will name a new PM in the coming days after Michel Barnier resigned following a no-confidence vote in parliament on Wednesday and said he plans to remain in power until the end of his mandate in 2027. (F24)

Canadian banks disappointed analysts with their earnings reports and outlooks for next year. TD Bank (mcap $91bn) missed profit estimates and suspended its earnings forecast following a large penalty in a US money-laundering case. Shares plunged 7% to a six-month low. CIBC (mcap $62bn) was the only bank to beat estimates and shares rose 4%.

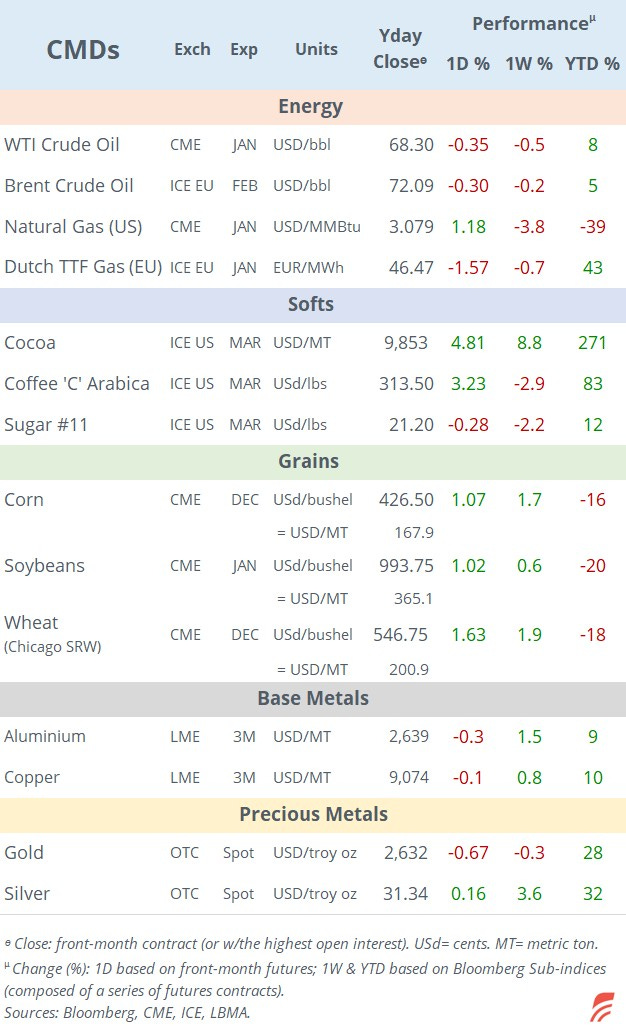

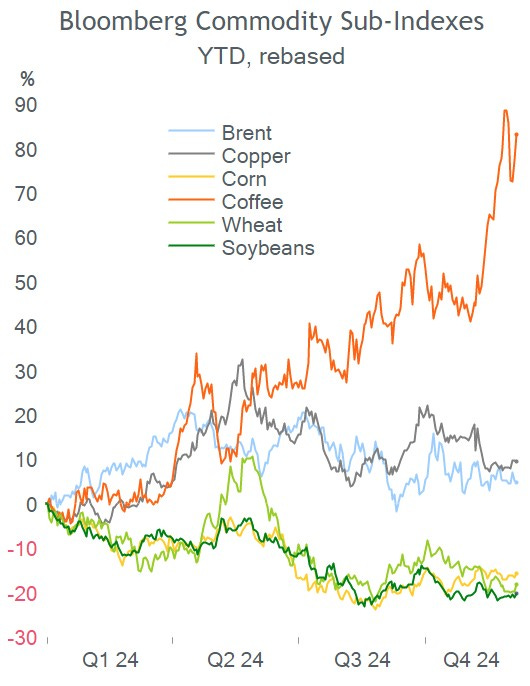

OPEC+ decided to extend oil production cuts until 2026 to support prices and plans to wait until April to slowly begin reintroducing 2.2mbpd of crude supply. Brent finished little changed on Thursday and is trading steady this morning at $72.00. (EI)

Trump appointed a former PayPal executive as his “White House A.I. & Crypto Czar” to reshape Washington’s policy on digital currencies. Bitcoin is trading at $98k this morning. (FT)

In monetary policy decisions, India’s central bank kept its repo rate unch today at 6.5% as expected, citing still high inflation (6.2% YoY, above the RBI’s tolerance band) despite the sharp activity slowdown in the last quarter. In a surprise move, the RBI cut its ‘cash reserve ratio rate’ by 50bp to 4%.

In corporate deals, struggling British utility group Thames Water (debt £19bn) has received a bid proposal from Covalis Capital for full ownership to restructure the company. France’s Suez would run operations while Covalis would divest underperforming assets and plan a listing of the remaining business. (Reuters)

Day ahead:

Data: US non-farm payrolls at 13:30 Ldn time (+200k exp vs +12k prior); €-zone Q3 GDP (revised); Germany industrial orders and production. Corporate earnings: no blue chips scheduled to report today.

** ‘Markets Dawn Europe’ will take a few days off **

Thanks for your time and enjoy your weekend.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.