Morning,

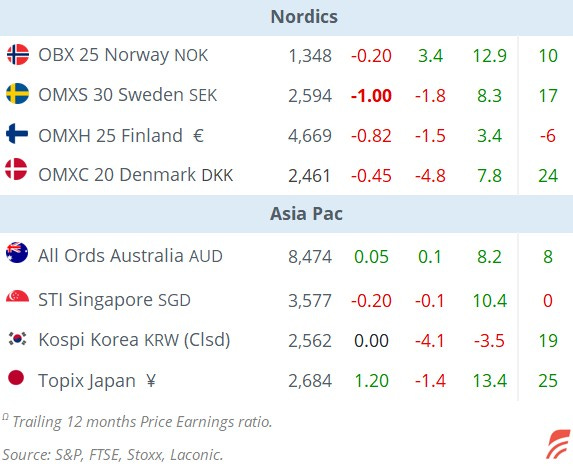

Rising tensions in the Middle East are the main driver of sentiment this week as equity indices in the U.S. and Europe drop from their record highs. Israel renewed its offensive last night against Hizbollah with massive air strikes in Beirut as G7 nations warn of an uncontrolled escalation of the conflict. Biden said the White House was discussing how to advise Israel to respond to Iran’s missile attack and whether oil infrastructure should be a target. Washington and EU officials recognized their limited influence in Tel Aviv’s decisions to act with Biden clarifying that the U.S. has no veto on Israel’s actions.

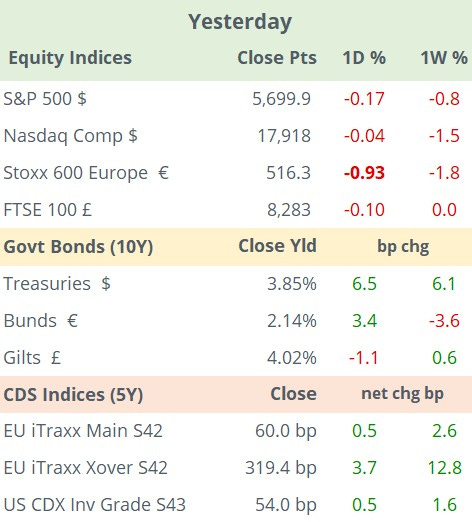

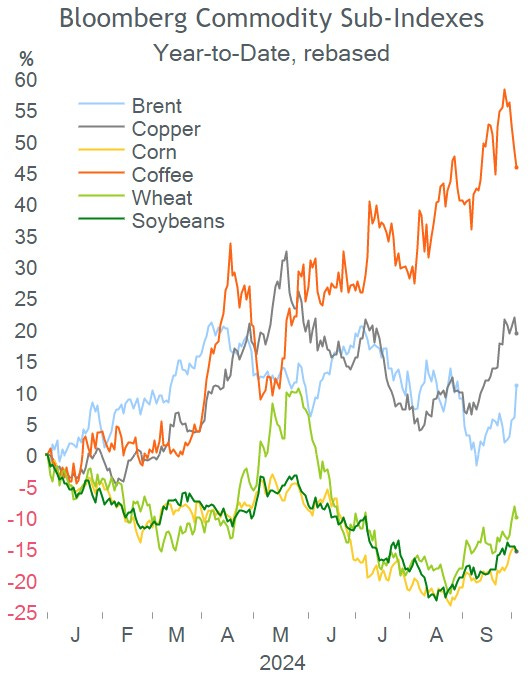

Crude oil jumped more than 5% yesterday, its biggest daily rally in a year, to accumulate a 9% gain in the past week with Brent now dealing at $77.50. Iran exports 1.8mn barrels per day while OPEC’s spare capacity exceeds 5mn which could cushion the impact should Iran stop supplying.

Stocks on Wall Street ended marginally lower last night ahead of today’s non-farm payrolls report. The U.S. Services PMI accelerated to an 18-month high (54.9 pts), significantly better than expected. The East Coast port workers’ strike finished after negotiating a wage increase.

In Europe, equity indices fell 1% on average yesterday with France and Spain as the weakest markest in the past week with declines exceeding 3%. The energy sector outperformed on both sides of the Atlantic driven by higher oil prices.

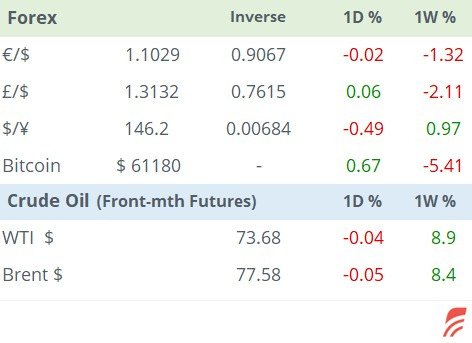

Asian markets are trading mixed today with stocks in Hong Kong gaining ~2%, Japan and Korea adding ~0.5% while Australia and Taiwan are a touch weaker. European and US futures are flat this morning while Bund futures are 0.2% lower.

On the earnings front, Tesco (mcap £25bn, P/E 15x, BBB), Britain's biggest supermarket group, reported solid H1 figures with a pretax profit of £1.4bn, up 10% YoY and raised its full-year profit forecast. Shares advanced 2.5% and accumulated a 25% YTD gain.

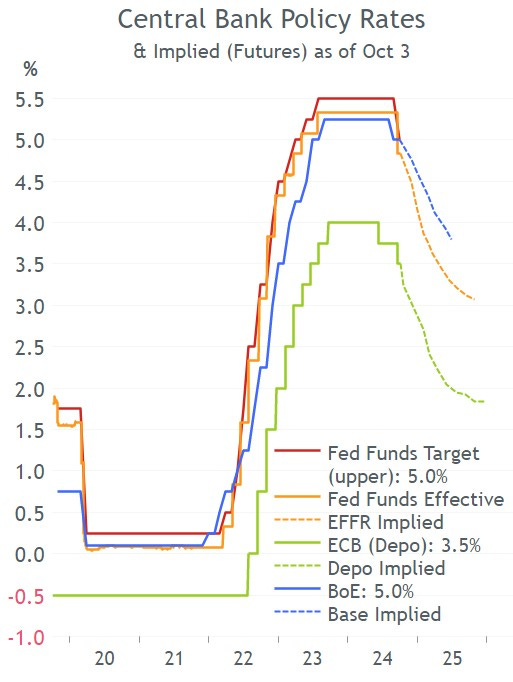

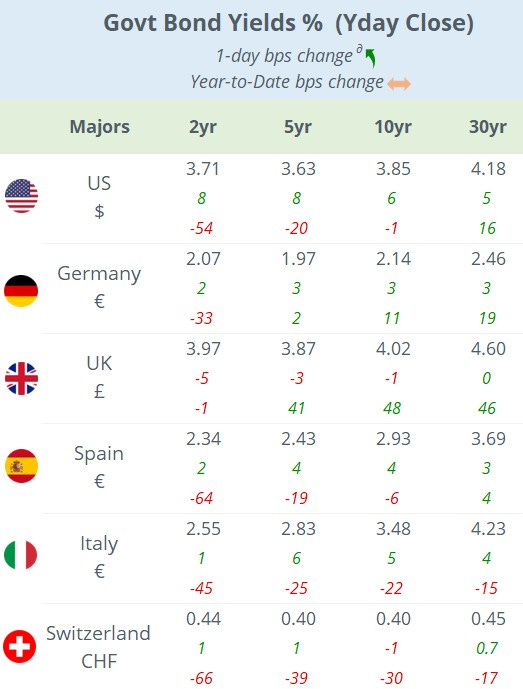

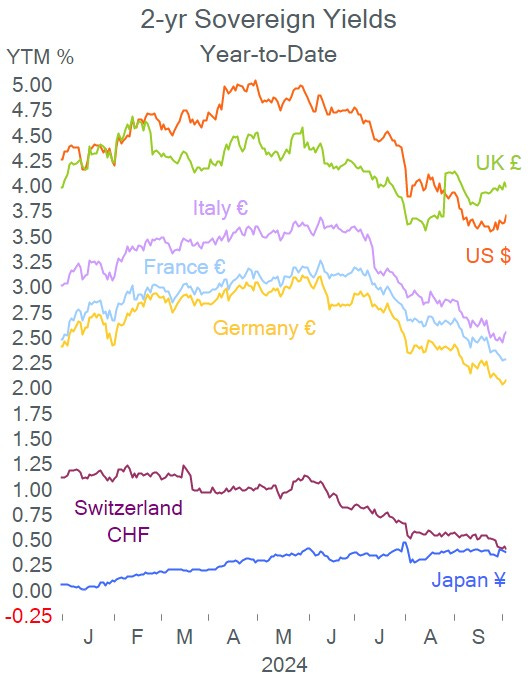

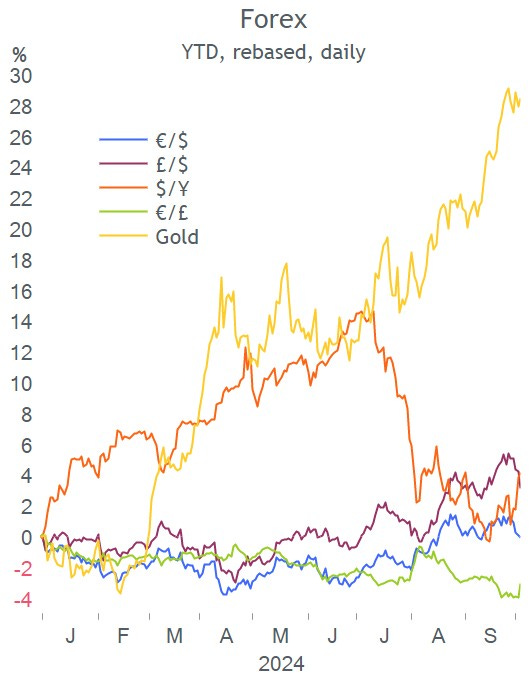

In forex markets, the notable mover was sterling’s 1% fall against the $ and the € on the back of dovish remarks by BoE Governor Bailey who said the central bank could be more aggressive on rate cuts if inflation pressures continue to weaken. Cable is trading at 1.3120, the lowest level in three weeks. Futures are implying a 96% probability of a 25bp rate cut on Nov 7 to 4.75%. The next inflation update will be on Oct 16. The Gilts yield curve was the only developed curve to shift lower on Thursday with 2-yr Gilts now yielding below 4%.

In data, €-zone producer prices fell 2.3% YoY in August versus a 2.2% decrease a month earlier. Swiss retail inflation came in at +0.8% YoY in September, lower than in August.

In corporate deals, Danish logistics group DSV (mcap €39bn) is raising €5bn by issuing new shares to help finance its acquisition of Schenker, the logistics arm of Deutsche Bahn.

Romania’s central bank is the only one holding a policy meeting today with rates expected to remain steady at 6.5%.

Today’s key data release will be the U.S. employment report for September with the analysts’ estimate for non-farm payrolls at +140k (unch vs Aug) and average earnings at 13:30 London time. Also, we’ll get Italian retail sales.

There are no blue-chip companies scheduled to report results today. It’s a holiday in China.

Thanks for your time, enjoy your weekend.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.