Est reading time: 5 min

Morning,

Let’s begin with the headline that is making every cover today. In a unanimous verdict, Trump was found guilty of all 34 counts in the hush money case, becoming the first US former or serving President, to be convicted of a crime. Trump can appeal but the final sentence is due on July 11, and he can still legally run for President in November.

The US economy grew slower than previously estimated in Q1, at 1.3% annualized, and a proxy for inflation ticked down ahead of today’s PCE inflation update. Bond yields partially reversed their recent sell-off and the US Treasury yield curve shifted lower by 7bp. European yields also fell with the short-end of the Gilts curve as the notable mover, down 20bp to 4.36% yesterday. The $ depreciated against all majors with the Swiss Franc as the biggest winner, posting its best day of the year with a 1% rally.

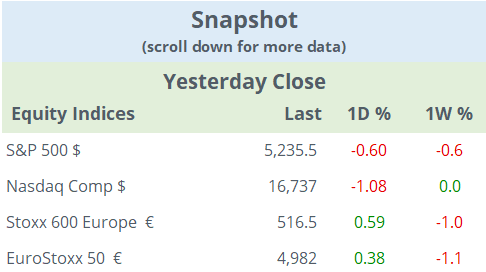

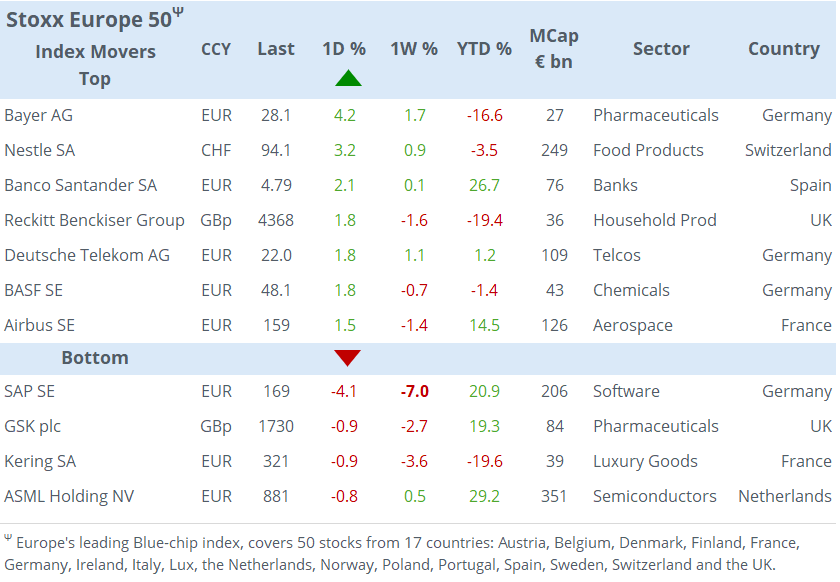

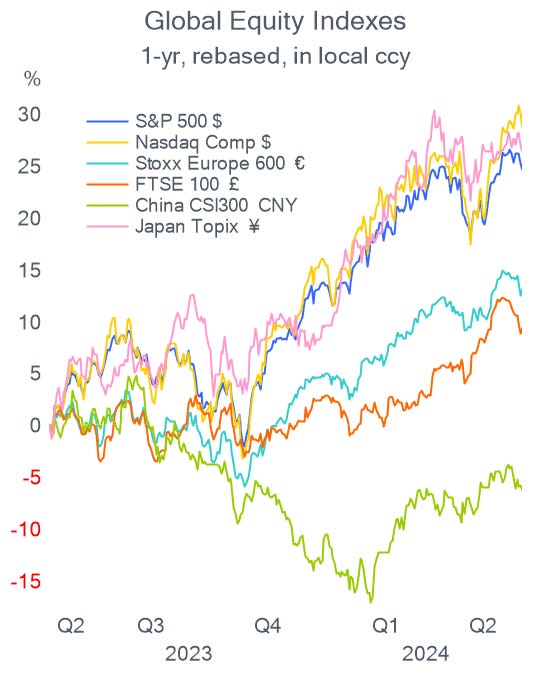

Equity markets ended mixed yesterday with European equities trading firmer while Wall Street closed significantly weaker. The Stoxx 600 added 0.6%, the S&P 500 fell by 0.6% and Nasdaq lost 1%. Information technology was the notable underperforming sector in the US with a 2.5% decline driven by Salesforce’s 20% plunge after disappointing sales guidance on weak cloud services demand. Microsoft, Nvidia and Oracle fell more than 3%.

Asian markets are trading firmer today with stocks in Tokyo rallying 1.6% while European futures are marginally lower this morning and US stock futures are down by 0.3%. Brent oil fell 2% yesterday and is little changed today at $81.75.

Following the uptick in German inflation on Wednesday, Spanish HICP inflation rose by 3.8% YoY, also above estimates (3.7%), higher than a month earlier (3.4%), and the highest in one year. The driver of higher consumer prices was the increase in the value-added tax for energy to 21%. Core inflation printed at 3.0% versus 2.9% the previous month.

Core inflation in Japan accelerated in May to 1.9% YoY, in line with expectations while factory output unexpectedly declined, raising uncertainty on the Bank of Japan’s next move.

A potential corporate deal worth highlighting is the advanced talks between French renewable power producer Neoen (mcap €4.8bn, P/E 30x) and Canada’s Brookfield and Singapore’s Temasek regarding a buyout transaction that values Neoen at €6bn. Terms: €39.85/share in cash, representing a 27% premium to the target’s undisturbed price. The stock was suspended for trading yesterday.

In the music sector, Sony is in talks to acquire the catalogue of British rock band Queen for around $1bn.

Permira-owned Italian luxury trainers company, Golden Goose, plans to float at least 25% of its shares in Milan next month. It reported revenues of €587mn last year.

South Africa’s central bank maintained its benchmark repo rate steady at 8.25%, as expected, in a unanimous decision. In politics, with more than 30% of the election votes counted, the ANC party leads with 42% but is set to lose its majority for the first time since its creation 30 years ago. The centrist Democratic Alliance got 25% so far followed by the radical Freedom Fighters party with 9%. The rand (ZAR) had its worst day since July, down 2% to 18.76.

Today’s economic data will be the week’s most relevant with €-zone (flash) inflation for May; PCE inflation and Consumption in the US for April. But we’ll also get retail sales in Germany; inflation in France, Italy and Austria; GDP in France, Italy, Portugal and Canada; and house prices in the UK.

On Sunday, Mexico holds a general election with incumbent President Lopez Obrador’s candidate, Claudia Sheinbaum, as the front-runner.

Have a nice weekend. See you on Monday.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. Please share using the button below, as access is free to all.