Script: Estimated reading time ⏲ ~5 mins

Good Friday,

European equities ended mixed yesterday with the FTSE advancing and €-zone indices declining on an active day for earnings reports. US benchmarks reversed their recent falls and finished more than 1% firmer, ahead of Apple’s earnings after the close and today’s employment report.

Apple moderately beat quarterly revenue ($90.8bn, -4% YoY) and earnings ($23.6bn, -2%) estimates as it suffered its worst iPhone sales drop in three years (-10.5%). Shares added 2% during market hours and extended the gain by 2% after the close, following the announcement of a $110bn stock buyback plan, the largest in US history and a 4% cash dividend increase.

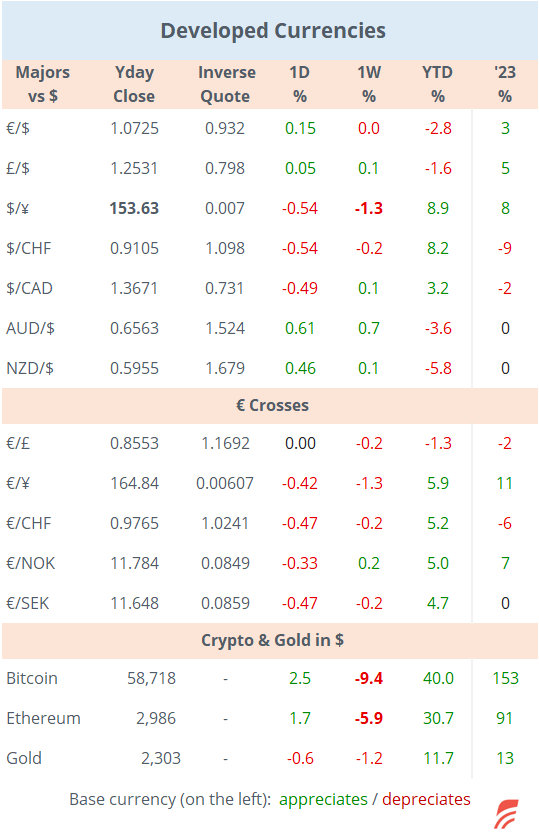

In Asia this morning, stocks are trading firmer with Japan and mainland China closed for holidays. The Japanese yen accelerated its recovery on speculation of another intervention by the Bank of Japan, to stop the currency from breaching the 160 resistance against the dollar. It is now trading below 153.

Headlines today,

-Gazprom of Russia posted its first loss in 24 years, as natural gas and shipments to Europe plunged. Shares had their worst day in a year, down 3.5% to a market value of $40bn.

-Turkey has stopped all trade with Israel over the war in Gaza.

It was an active day for European earnings releases with Shell sharply beating estimates with a $7.7bn profit in Q1 on strong oil trading and after announcing a $3.5bn share buyback. Shares added 2%. Giant Pharma Novo Nordisk A/S ended 3% lower despite raising its full-year outlook (Q1 profits: $3.4bn) as it had to reduce prices of its weight drugs. ING Group gained more than 6% on a strong quarter (€1.6bn profit) and a buyback announcement (€2.5bn) while Standard Chartered rallied 9% to a six-month high, on another earnings ($1.9bn) beat.

On data updates yesterday, inflation in Switzerland accelerated faster than expected, up 1.4% YoY in April, still within the Swiss National Bank’s target range.

Regarding corporate deals, Swiss pharma giant Novartis is acquiring Mariana Oncology, a US private radiology drug specialist for $1bn.

In the US, entertainment company Paramount Global saw shares rally 13% after Sony and Apollo tabled an $11bn bid in cash, plus assuming $14bn in debt, to take it private.

Also, media reports suggested last night that commodities group Glencore is considering a rival bid for Anglo-American after Anglo rejected BHP’s approach.

Remember that beauty group Puig Brands will begin trading on the Madrid exchange today. The IPO was priced at €24.5 per share for a total value of €14bn in Spain’s largest equity offering in a decade.

In credit ratings, the notable update was Danske Bank’s two-notch upgrade by Moody’s to A1. Also, Israeli banks Leumi and Hapoalim were downgraded one notch by S&P to A-.

On the data front, we’ll get the monthly labour update in the US with analysts expecting April’s non-farm payrolls to rise by 243,000 compared to 303,000 in March. Norway’s central bank will hold its policy meeting with rates expected to remain at 4.5%.

That’s all for today, have a nice weekend.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. It is prohibited to copy and paste, forward, or set up auto email forwarding rules to give access to others. Please share the publication using the button below, as access is free to all.