Good morning,

Last night’s first US Presidential debate in Atlanta between Biden and Trump generated nearly unanimous agreement in mainstream media that Biden struggled as he confronted a barrage of controversial statements from Trump, who still holds a slim lead in the battleground states according to polls. S&P 500 Futures and the $ reacted positively to the debate and are both higher in overnight trading.

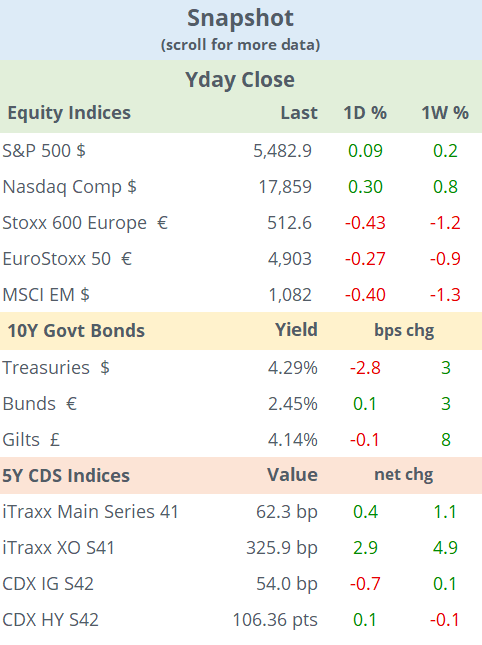

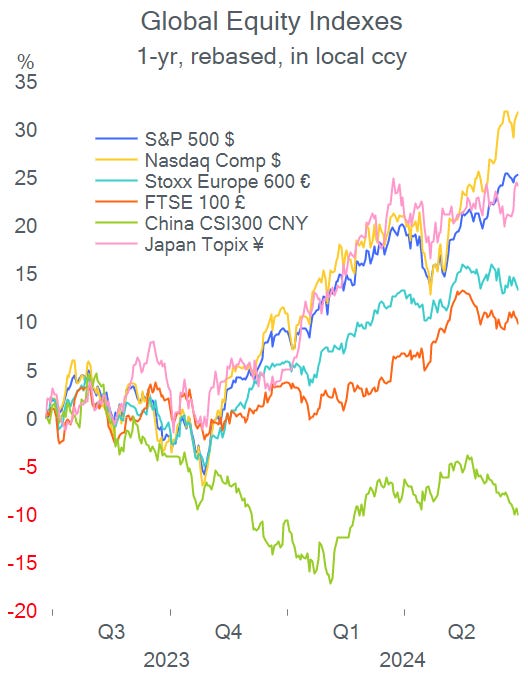

Stocks in Wall Street ended marginally firmer yday with drug retailer Walgreens Boots (mcap $13.5bn) as the notable mover with a 22% plunge, after missing quarterly earnings estimates, cutting profit forecast and announcing store closures in the US. Shares are down 53% YTD.

European equities fell for a third consecutive session with Paris and Milan benchmarks leading the drop with a 1% fall ahead of Sunday’s legislative election in France. The retail sector was the key underperformer with Swedish fast-fashion giant H&M (mcap $22bn) losing 13% after missing profit estimates and providing a weaker sales outlook.

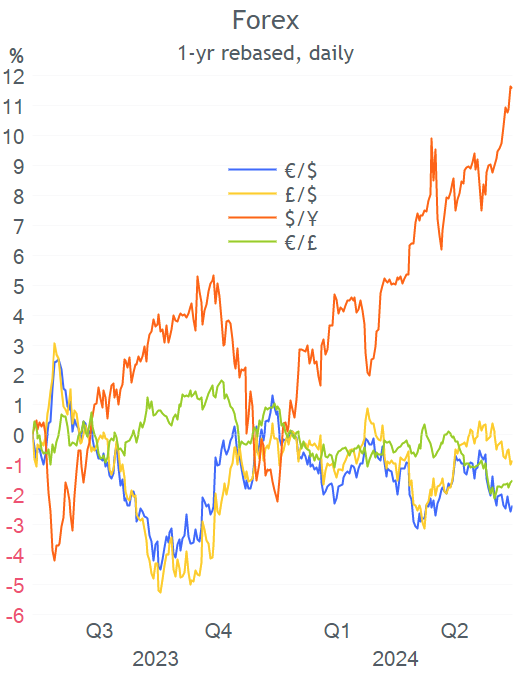

Markets in Asia today are firmer across the region with stocks in mainland China gaining 0.6%, Taiwan +0.8% and Japan +0.5%. The ¥ is at 161 but still no intervention by the Bank of Japan. European futures are pointing to a higher open by around 0.3%. Brent oil shifted upwards and is dealing near $87.

In monetary policy updates, Sweden’s Riksbank kept its rate unchanged as expected at 3.75% as inflation prospects remain the same but signalled two or three cuts this year. The Swedish krone fell almost 0.8% against the € to a 3-week low and 2-year bond yields eased 6bp to 2.44%.

The Czech central bank cut its benchmark rate by 50bp more than analysts expected to 4.75% but signalled a slowdown in the pace of easing.

In economic data, the final reading for US GDP in Q1 was 1.4% annualized, better than the preliminary reading. Also, inflation in Belgium accelerated to 3.74% YoY in June.

Other headlines,

-The head of Bolivia’s army was arrested following a failed “coup d’etat” on Wednesday. President Luis Arce, a protégé of leftist former President Evo Morales, retains power. The $Bolivia ‘28 govt bond (Caa3/CCC+) trades at 2,440bp over UST, 29% yield. The country barely qualifies as a Frontier Market.

In corporate deals, French materials company Saint Gobain (mcap €37bn) is acquiring Fosroc, a UAE-based construction chemical company, for almost €1bn in cash to drive its international expansion.

Haleon Plc, Britain’s pharma (mcap £30bn) will sell its nicotine alternatives division outside of the US for £500mn to India’s Dr Reddy’s Labs (pharma, mcap $12bn).

In IPOs, the Korean online comic platform Webtoon Entertainment (WBTN) saw shares rise 10% on its Nasdaq debut for a $2.9bn valuation. The co is controlled by Naver Corp (Korea, online services, mcap $18bn).

The total value of global mergers and acquisitions has risen 22% YoY to $1.5tn according to the LSE, following a weak 2023, with deals worth more than $10bn up by 70%. Goldman was the top deals financial adviser this year.

Today’s key data will come at 1:30 London time with the release of US PCE inflation, consumption and personal income. Also, inflation updates in France, Spain and Italy as well as UK’s and Denmark’s Q1 GDP. Colombia’s central bank meets today (25bp cut to 11.50% exp).

On Sunday, France holds the first round of parliamentary elections which will determine next week’s sentiment until Britain’s general election on Thursday.

Have a nice weekend.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.