Morning,

Thursday was an active trading day in global markets, with risk assets continuing to rally driven by Beijing’s stimulus efforts and a sharp recovery for the Chinese equity market. The CSI300 stock index rallied 4.2% yesterday and is now in positive territory in 2024 following a steep recovery of 16% in just eight days. Ahead of next week-long holiday, Beijing announced more measures today to revive its economy including a reduction of the reserve requirement ratio by 50 bp and the issuance of $280bn worth of sovereign debt. Stocks are gaining another ~4% in mainland and Hong Kong.

In Europe, yesterday’s notable winners were luxury goods companies with the top four stocks in the sector LVMH, Hermes, Kering and Richemont jumping ~10% to become the best-performing large caps of the day and propelling the broad Stoxx 600 to an all-time high. Paris’ CAC 40 index was the main mover among €-zone benchmarks with a 2.3% gain, helping the blue-chip €-Stoxx50 index post its best day since November 2022, also advancing 2.3%.

Stocks on Wall Street also shifted higher by a more modest amount but enough for the S&P 500 and Dow Jones Industrials to finish at fresh record highs. In local currency terms, the S&P 500 is 20% higher YTD, double the Stoxx 600 return. The best-performing €-zone index is Madrid’s Ibex with an 18% gain this year.

In earnings reports, the notable mover was Accenture Plc (mcap $223bn) which added 5.5% to a six-month high after beating sales and profit estimates and delivering an upbeat outlook for the next quarter driven by a strong A.I. unit.

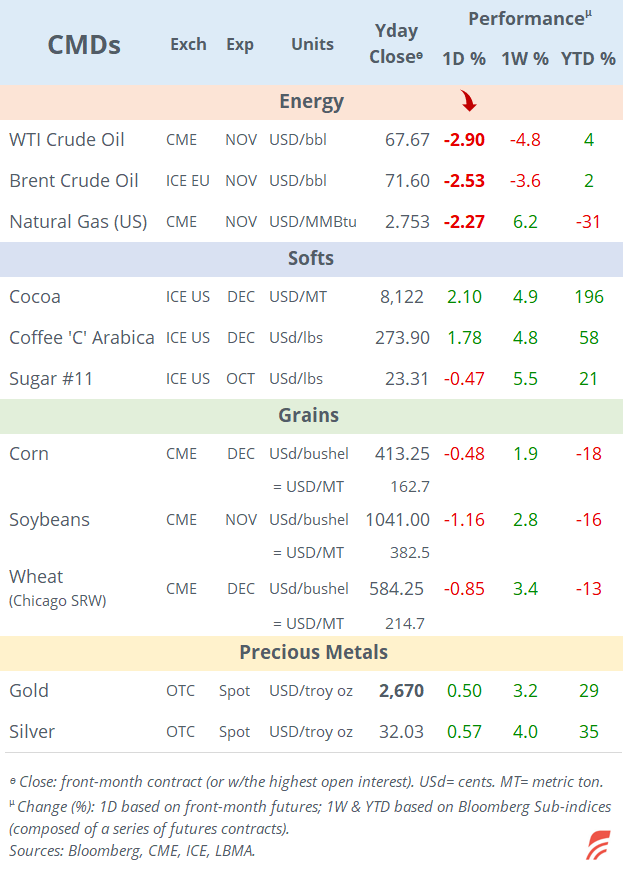

In commodities, Saudi Arabia plans to increase crude oil production to recover market share after failing to lift prices to its $100 target. Brent fell 2.5% for a second consecutive day and is at $71.40 this morning.

There were no significant moves in other asset classes with bond yields ending mixed and little changed with 10-yr Bunds at 2.17%, Treasuries at 3.79% and Gilts at 4.01%. Britain’s fixed income market is the main mover this month as yields reversed their initial rally in September and have risen during the last eight trading days.

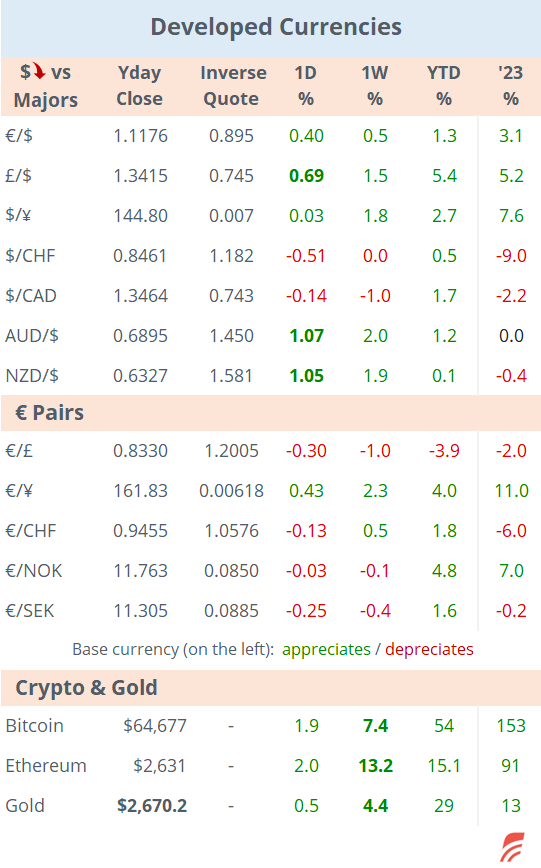

In monetary policy decisions, the Swiss National Bank cut rates by 25bp, the third time this year, to 1.0%, in line with analysts' estimates, and sent a dovish signal. The Swiss Franc appreciated 0.5% against the $ and is almost flat YTD. Mexico also eased policy by 25bp to 10.5%, as anticipated.

In economics, the final U.S. GDP update for Q2 was confirmed at a healthy 3% annualized rate on the back of strong consumer spending. The Q1 reading was revised upwards to 1.6%.

In corporate deals, it’s worth noting a pick up in IPO activity with India’s food delivery start-up Swiggy filing to list with a $15bn valuation target as it aims to raise $1.25bn.

In U.S. markets yesterday, three relevant listings: biotech BioAge Labs raised $200mn (mcap $760mn), healthcare Guardian Pharmacy Services raised $112mn (mcap $880mn) and natural gas producer BKV Corp sold shares for $270mn (mcap $1.5bn). Companies raised $30bn in U.S. exchanges so far this year, more than doubling last year's figure.

In debt capital markets, the notable corporate issuer yesterday was Broadcom (mcap $820bn) placing senior unsecured bonds rated BBB in 5, 7 and 9-yr maturities.

In sovereign issues, Turkey placed its single largest $ bond, raising $3.5bn with a 10-yr bond rated B1/B+, priced at 298bp over Treasuries for a 6.75% yield.

Data today: U.S. PCE inflation (a deceleration to 2.3% YoY expected) and personal consumption; consumer inflation in Japan, France and Belgium; GDP and CPI in Spain; producer inflation in Italy; €-zone sentiment indicators.

That’s all for this week, enjoy your weekend.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.

Just want to thank you for these. I find them to be fantastic. Let me know how I can help you to promote this etc."nice to haves": Maybe just the inclusion of base rates for main economies and expected path priced in. Usually it is discussed in the brief but would be nice to see it written. Again thank you and excellent work!