Morning,

Risk assets fell again yesterday with technology and luxury as the main drivers of weakness. The Nasdaq Composite and €-Stoxx 50 indices fell 1% following Wednesday's sell-off. The US technology benchmark cut its year-to-date gains to 12% and Europe’s blue-chip index is just 6.5% higher YTD.

In Europe, benchmarks in Lisbon, Paris and Frankfurt were the notable underperformers yesterday with Gucci-parent Kering (mcap €34bn) declining 7.5% to a 7-year low, the biggest loser among Stoxx 50 members after reporting a poor outlook for the rest of the year.

Nestle (mcap €242bn) missed revenue estimates and also lowered its sales outlook sending shares down 5%. Unilever (€138bn) gained 6% after a solid operating earnings (€6.1bn) update and a dividend increase announcement (+3%).

Asian markets are firmer today except for Taiwanese stocks which are catching up after two days of holidays and are falling 3.3%. The ¥ is little changed at 153.90 and Brent oil is higher at $82.50. FTSE (+0.5%) and US index (+0.4%) futures are the only notable gainers in overnight trading.

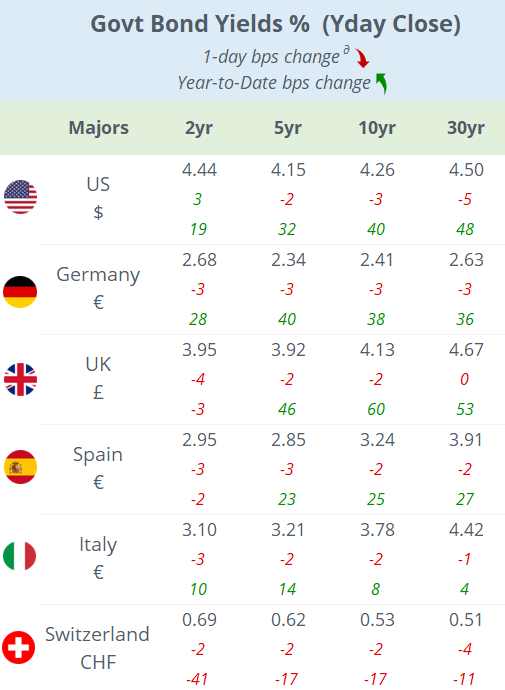

There is little to report on the interest rate market besides the range-bound trading for benchmark yields in the past few days. Leading yield curves shifted 3 to 4bp lower across tenors yesterday following the US GDP update.

The US economy expanded at a solid pace in Q2 with GDP increasing at 2.8% annualised, well over the 2% expected and faster than the 1.4% in Q1, driven by stronger consumer spending. Durable goods orders for June fell sharply (-6.6% MoM), significantly missing estimates and much weaker than a month earlier, driven by lower demand for aircraft and parts.

Germany’s Ifo sentiment indicators (Business Climate, Current Conditions and Expectations) were broadly negative, below estimates and lower than a month ago, a day after a weak PMI reading.

In IPOs, this year's largest listing in US markets was cold storage REIT Lineage (LINE), which raised $4.4bn and gained 5% on its debut at a $19bn valuation. Shares were priced at $78.

In business news, OpenAI, the parent of ChatGPT, launched a web search tool called SearchGPT, to challenge Google’s leadership.

Today’s key economic data release will be PCE inflation and consumption in the US and retail sales in Spain, Norway and Denmark. Russia’s central bank meets today.

Companies reporting: Mercedes Benz, BASF, ENI, Colgate and Bristol-Myers Squibb.

Venezuela holds general elections on Sunday with incumbent president Maduro losing popularity.

Have a nice weekend.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.