Podcast script: Estimated reading time ⏲ ~6 mins

Good Friday,

It’s a busy morning, we’ll summarize the key issues with a few bullet points before covering some in more detail. Thursday was a risk-off day on both sides of the Atlantic, driven by a weak GDP reading and higher inflation in the US.

Meta Platform’s shares plunged 10%, their worst day in 18 months after announcing higher AI-related expenses and lower expected revenue.

However, sentiment reversed sharply after the market closed when mega-caps Microsoft and Alphabet released earnings. Both beat analysts’ estimates on strong demand for cloud services to host AI engines. Alphabet announced its first-ever dividend and a $70bn stock buyback plan. Alphabet shares gained 16% and Microsoft added 4% in extended hours trading.

These positive earnings reports are driving Asian markets higher by more than 1% today, except for Australian stocks, which are back from a holiday and impacted by BHP’s weakness.

The Eurostoxx 50 lost 1% yesterday hit by mixed earnings reports, with Deutsche Bank gaining 8%, Barclays 7%, Astra Zeneca and Unilever 6% while Adyen plunged 18%.

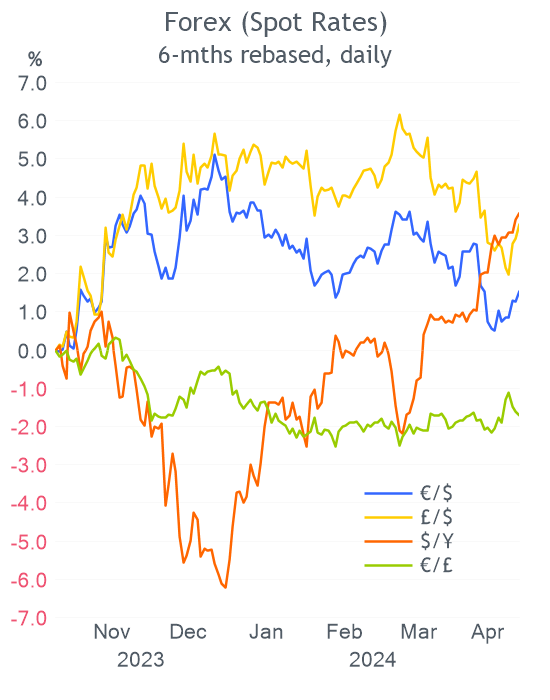

The Bank of Japan left its policy rate unchanged as expected at a range of 0 to 0.1% and forecast inflation to stay around 2% in the next three years while signalling another rate hike later this year. Today’s inflation update for Tokyo showed price pressures eased as it dropped significantly.

French President Macron warned European leaders about the future of Europe in a long speech in Paris. He warned of the mortal dangers that the EU is facing as the rules of the game have changed. He urged the block to invest in artificial intelligence, nuclear power, biotech, space and renewable energies.

Back to yesterday’s main story on the state of the US economy. Q1 GDP expanded by an annualized basis of 1.6%, half the pace of Q4 and well below estimates. The Q1 core PCE price index, a proxy to today’s inflation update, reflected a spike in price pressures of 3.7% well above the 2% for the previous quarter.

These poor updates fueled the recent sell-off in bonds and the US Treasury curve shifted 5 basis points across tenors, taking the 2-year Note yield to 5%, the highest in 5 months as traders delay their timing expectation for a Fed rate cut.

Corporate deals: as we mentioned yesterday, Australian miner BHP confirmed its takeover bid for smaller rival Anglo American, which saw shares rally 16% to £25.60. BHP’s bid is £25.08 per share, a 14% premium to Anglo’s close on Wednesday and values Anglo’s total equity at $42bn.

US-listed shares of BHP fell 3% and in Sydney, which reopened today after a holiday, they are dropping by more than 4%. Media reports suggest that Anglo considers the approach as unattractive and opportunistic.

In the US software sector, IBM agreed to acquire HashiCorp for $6.4bn to expand in cloud computing. IBM’s bid is 43% higher than HashiCorp’s close on Monday when the rumours of an approach first surfaced. IBM shares fell 7% as it also reported results that marginally missed sales estimates on weakness in its consulting unit. IBM’s market value stands at $169bn.

IPOs: Microsoft-backed cybersecurity start-up Rubrik posted a solid debut on the NYSE. It raised $752mn and shares, which were priced at $32, ended 16% higher for a valuation of $6.4bn. Microsoft invested at a $4bn valuation in 2021.

British commodity broker Marex Group had a lukewarm debut on Nasdaq with shares advancing just 1.5% from their $19 IPO price. It raised $292mn and was valued at $1.4bn.

British private equity firm CVC Capital Partners will list today in Euronext Amsterdam after the deal was upsized to €2.3bn on the back of strong demand.

Today’s key data release will be the highly awaited US PCE inflation at 13:30 London time which will provide more light on yesterday's PCE price increases during Q1. Also in the US, we’ll get the latest in personal consumption. Finally, retail sales in Spain and Norway.

Today’s earnings releases include Total Energies, NatWest, Exxon, Chevron and AON among others.

Have a nice weekend.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. It is prohibited to copy and paste, forward, or set up auto email forwarding rules to give access to others. Please share the publication using the button below, as access is free to all.