Morning,

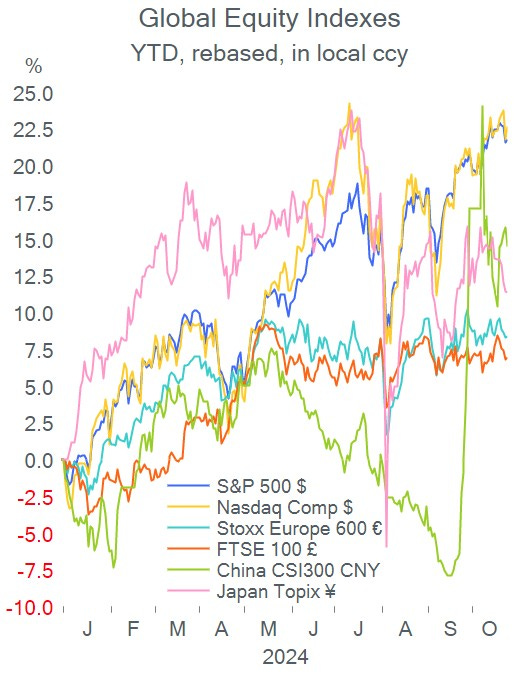

Wall Street finished firmer last night driven by Tesla’s 22% rally following its late Wednesday earnings announcement which included a strong revenue outlook of up to 30% growth for next year and some short covering. Shares are 5% higher this year to a total market value of $832bn compared to an S&P 500 return of 22% YTD. Tesla’s forward price-earnings ratio is double that of Nvidia at 73 times.

On data released on Thursday, prelim PMIs for October were little changed in developed countries with Manufacturing readings still on the weak side while Services continue to expand. Of note, were a solid US Services PMI at 55.3 points and a somewhat deteriorating mfg reading in the UK (50.3).

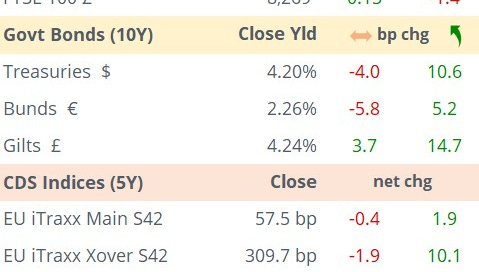

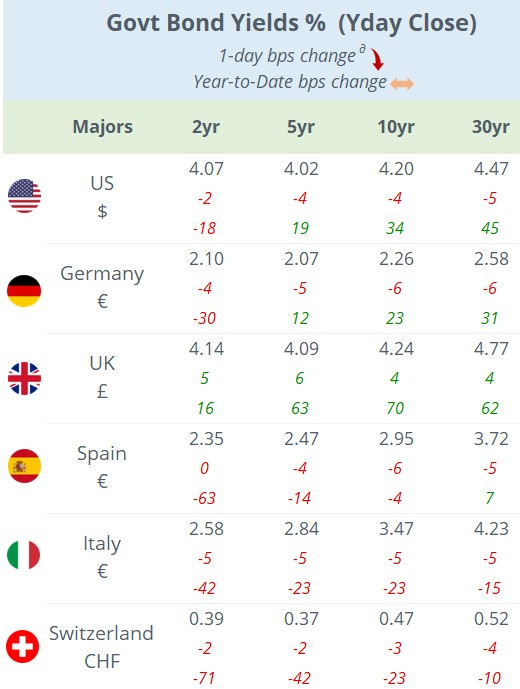

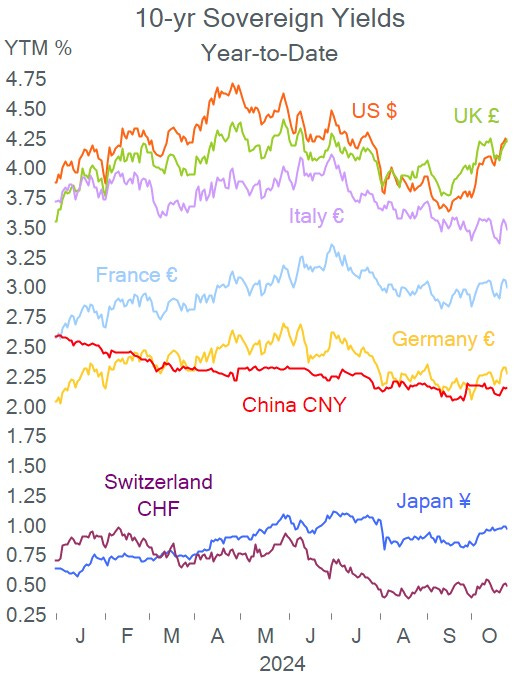

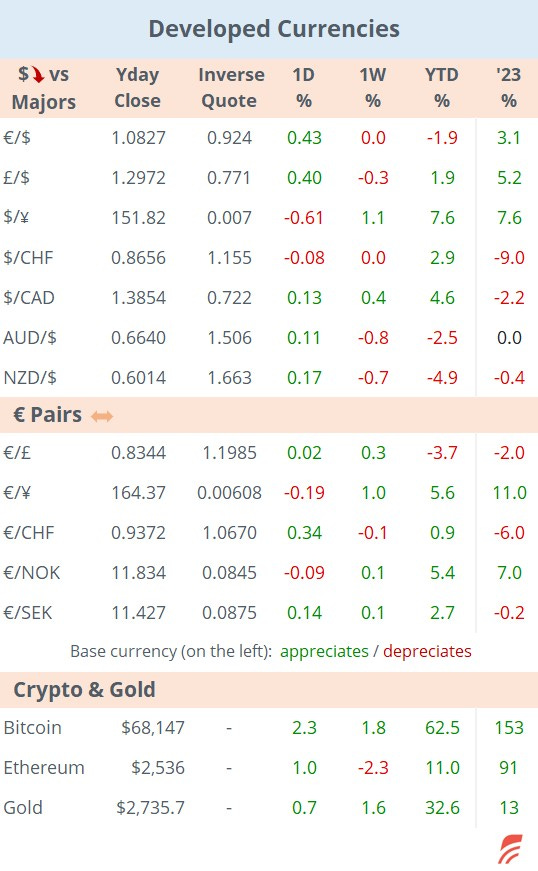

Bonds and currencies reversed this week’s trend with benchmark yields dropping by around 5bp (ex-Gilts) across the curve and the $ partially reversing its recent recovery.

In Asian markets today, most equity indices are trading firmer except for Japan which is ~1% softer ahead of this weekend's election and after the inflation update this morning (Core CPI 1.8% YoY vs 1.7% exp). €Stoxx 50 futures are pointing to a weaker opening in early trading while US futures are flat.

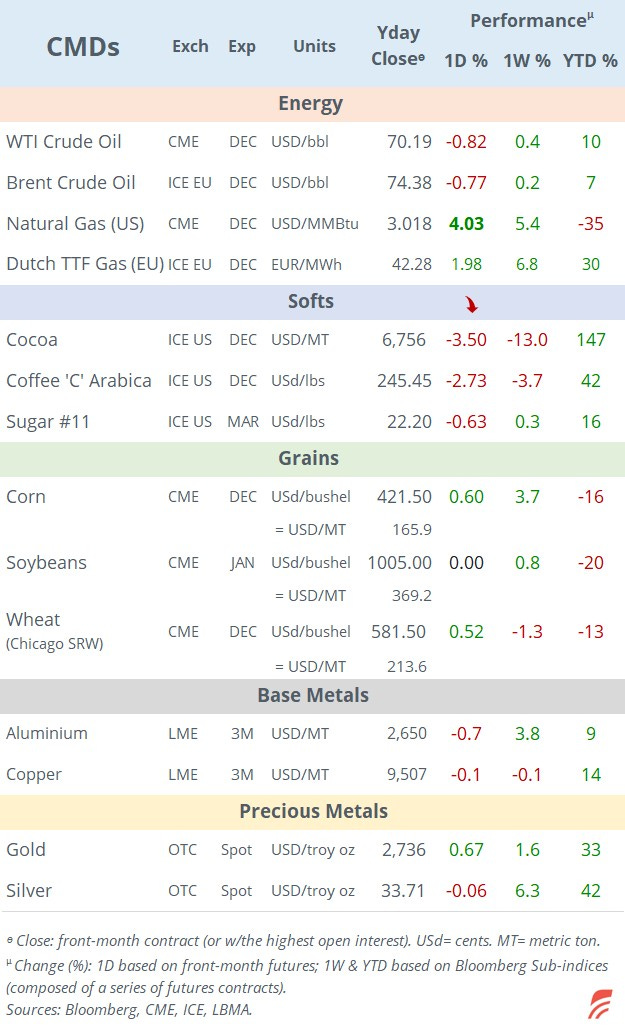

In M&A, KKR is acquiring a 25% stake in ENI’s biofuel unit Enilive for nearly €3bn as the Italian energy company (mcap €44bn) continues to partner with investors to decarbonise its product line. ENI shares are -7% YTD and it reports earnings today. (BW)

In debt capital markets, Iberdrola placed 12-yr £ denominated senior bonds rated Baa1/A- at Gilts +95bp. Italian machinery maker, Omnia Della Toffola issued 7-yr senior high-yield bonds in €.

Ratings: Italy’s Banco BPM (mcap €9bn) was upgraded one notch by S&P to BBB. (AN)

Day ahead:

Data: US durable goods and Michigan’s sentiment; Germany Ifo indicators; Sweden PPI. Credit ratings of France, Italy, Belgium and Sweden will be reviewed by several agencies.

Monetary policy: Russia is expected to hike rates by 100bp to 20%.

Earnings announcements: Sanofi, Mercedes Benz and NatWest.

On Sunday: Japan and Uruguay hold general elections while Bulgaria holds a parliamentary election. (Reuters / Wiki)

Thanks for your time and enjoy your weekend.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.