Today’s geopolitics headlines highlight the escalating tension between Russia and Ukraine after Moscow fired an experimental hypersonic missile at a Ukrainian city and Putin stated that the war was taking global character. (Reuters)

Also, the Dutch International Criminal Court issued an arrest warrant for Netanyahu and his former defence minister for war crimes in Gaza. Washington described the decision as ‘not credible’ and ‘outrageous’. (FT)

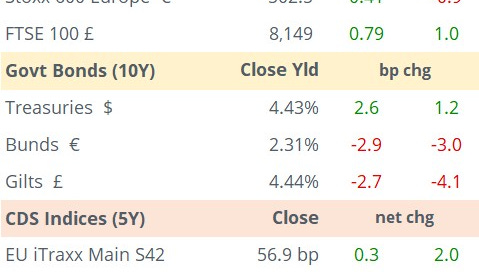

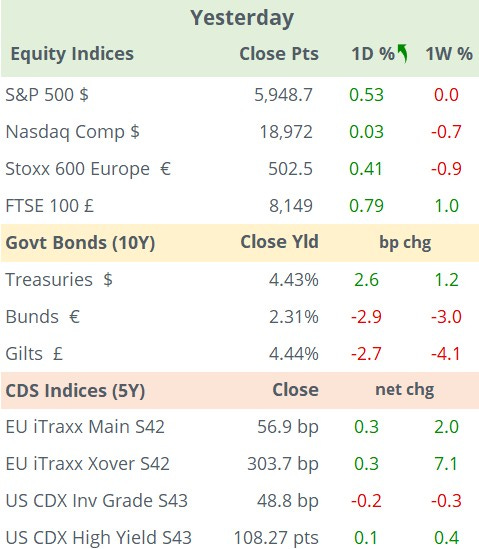

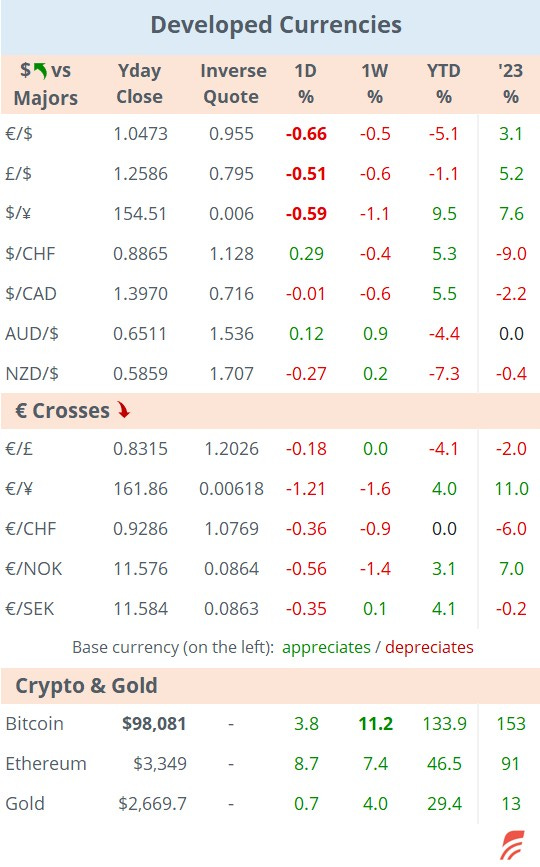

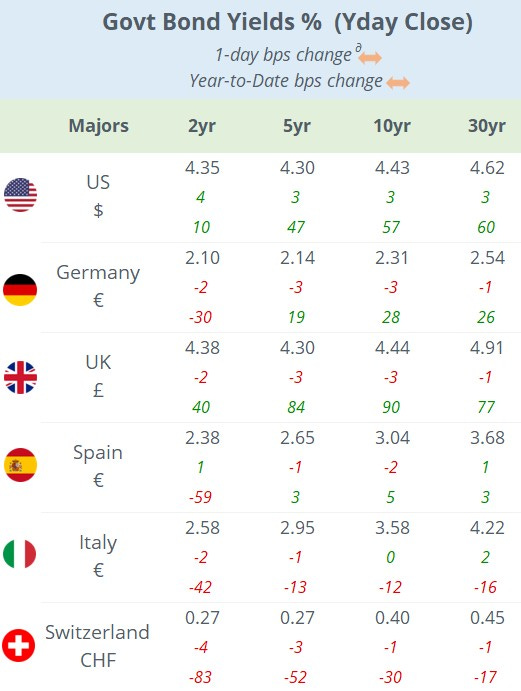

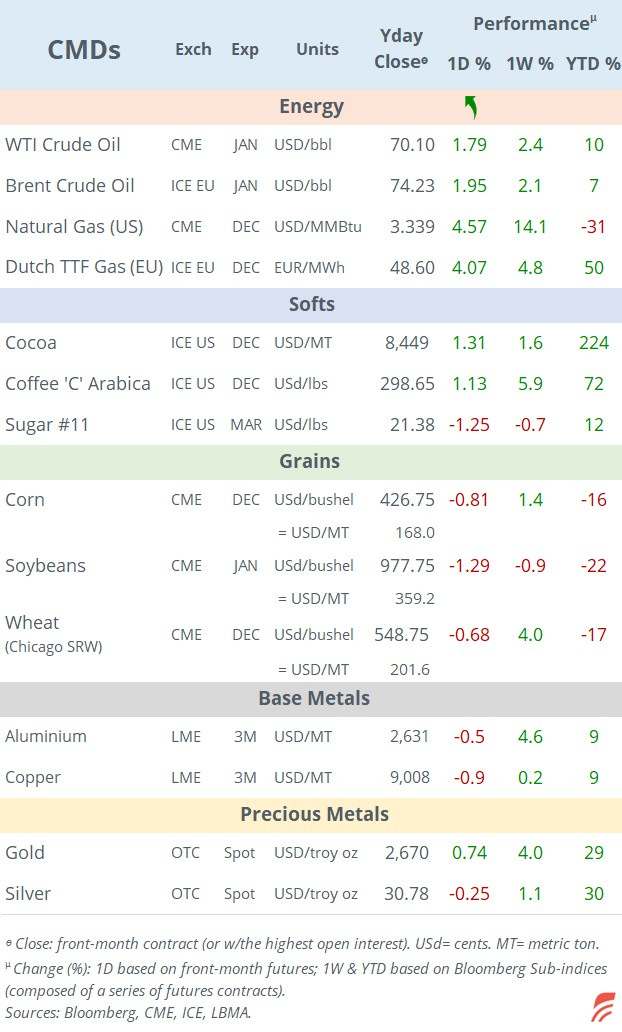

The $ continues to appreciate as the DXY index reaches a 12-month high above 107 pts and the € trades below 1.05 as expectations for policy rates diverge after Trump’s victory. US existing home sales rebounded 3.4% in October and weekly jobless claims fell to a seven-month low in data released yday. Traders are pricing in a 73% probability for another 25bp ECB rate cut to 3% versus a 58% for a Fed cut to 4.375% (mid-range) at their respective meetings in December. Also, traders see a low chance for a Bank of England rate cut next month following Wednesday’s inflation update.

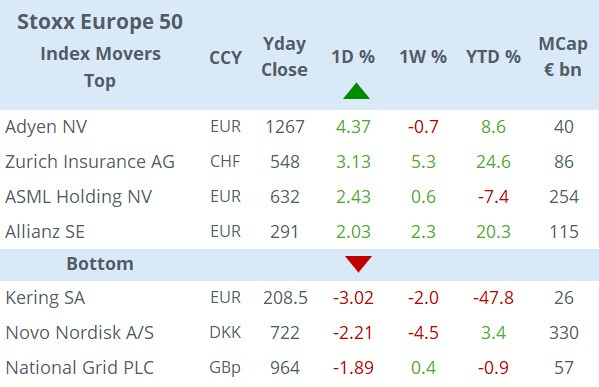

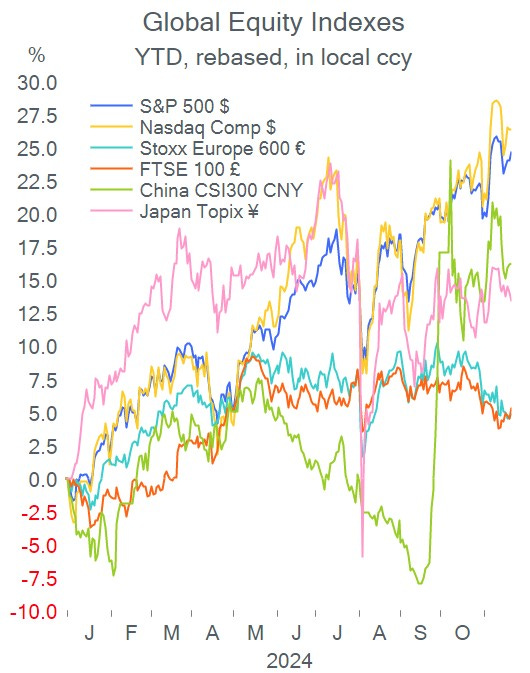

Equity indices traded firmer on both sides of the Atlantic on Thursday with Alphabet (mcap $2tn) as the notable mover with a ~5% drop after the Department of Justice confirmed its push for Google’s parent to divest its Chrome browser to settle its antitrust case. Alphabet shares are 20% higher YTD.

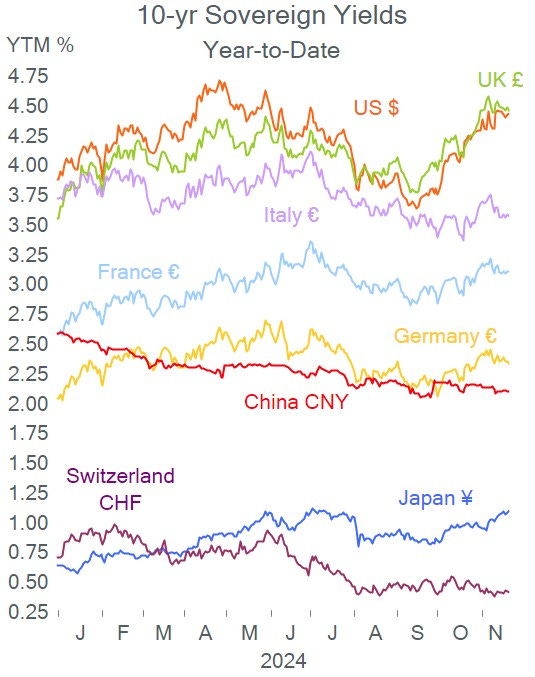

Japan’s core nationwide inflation in October came in at 2.3% YoY, modestly above estimates but slightly lower than a month earlier and still higher than the BoJ’s target. The ¥ is little changed today and 10-yr JGBs are trading firmer at a 1.075% yield.

Asian stocks are mixed today with Chinese indices falling 1.5% while all other markets are moving higher, including Taiwan’s ~2% rally. European futures are pointing to a higher open.

In business news, Swedish electric vehicle battery supplier Northvolt AB (privately owned) filed for bankruptcy protection in the US after failing to secure rescue funding and cash fell below $30mn, enough to cover one week of operational costs and nearly $6bn in debt. (FT)

In monetary policy action in EM yday, Turkey kept rates steady at 50% as anticipated and the central bank projected inflation to drop from the actual 49% to 21% at the end of next year. South Africa’s Reserve Bank cut its benchmark rate by 25bp to 7.75% in a unanimous decision and estimated inflation to remain <4% in the short term.

Credit rating changes: Lloyds Banking Group was u/g to A+ and HBOS Plc was u/g to AA-. The ratings of Italy and Greece will be reviewed today by Moody’s and Fitch.

In the DCM space, two BBB- rated European companies sold 5-yr senior bonds. Italian electrical components co Prysmian Spa (mcap €18bn) at 3.97% (Bunds +184bp) and French fintech Worldline SA (mcap €1.8bn) ar 5.375% (+323bp).

In data today, we’ll get November’s flash PMI updates in the €-zone, UK and US; Germany GDP and UK retail sales. There are no scheduled monetary policy meetings.

On Sunday, Romania holds the first round of presidential elections.

That’s all for this week, thanks for your time. Enjoy your weekend.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.