Morning,

Thursday was a solid day for European stocks with France’s CAC 40 posting its best day since late January, up 1.34%, partially recovering from the recent sell-off. BNP Paribas and Kering were the best performers among Stoxx 50 members with gains of around 2.5%. Overall, the Stoxx 600 ended 1% higher while Wall Street closed weaker last night with the IT sector making a small pullback from its record high.

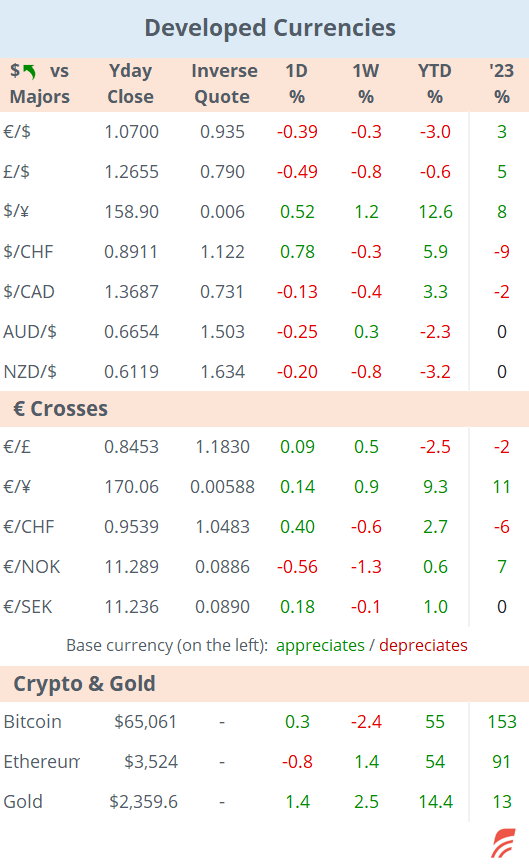

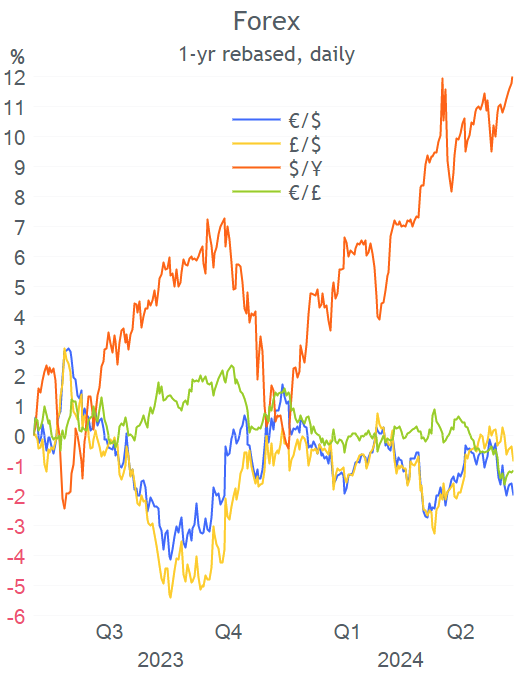

There were no surprises at the three monetary policy meetings held by central banks in Europe. The Bank of England kept rates steady at 5.25%, a 16-year high, with 2 out of the 9 MPC voters opting for a rate cut. Markets are pricing in a 50% chance for a rate cut at the August meeting after Governor Bailey said that hitting the 2% inflation target was good but not enough to justify easing policy. Short-end Gilt yields added a few basis points (2-yr @ 4.15%). £ fell 0.5% yesterday against the $ and was flat versus the €.

The Swiss National Bank became the front-runner in cutting interest rates after delivering another 25bp cut to 1.25% as anticipated on the back of lower inflationary pressures. The SNB signalled more easing measures in the near term. The Swiss franc depreciated against majors.

Norway’s Norges Bank kept rates unchanged at 4.5% and signalled no intentions to ease policy this year, a hawkish signal compared to previous indications. Norges forecasts a total of 75 basis points of rate cuts for next year and sees inflation at 4% in 2024, double its target.

Indonesia also maintained rates steady at 6.25% as expected as it uses other monetary tools to stabilise the currency.

Most Asian markets are significantly weaker today with the Hang Seng down by 1.9% (at one point), and Korea losing 0.8%. Stocks in Australia, Singapore, India and Japan are showing modest gains.

Japan released its latest inflation data today showing a mixed reading with core nationwide accelerating to 2.5% YoY, still lower than expected while the so-called core-core reading, which excludes energy and food items, eased to 2.1% from 2.4% a month earlier, marking the 9th straight month of cooling inflation. Stocks in Tokyo are a touch firmer, the yen has fallen for six consecutive days and is nearing 159 and 10-year JGBs are yielding 0.97%, a few basis points higher on the day.

European and US equity futures are almost flat this morning and Brent is little changed at $85.65.

-Accenture Plc (IT consulting, mcap $205bn) gained 7% on the back of stronger-than-expected guidance for sales growth after reporting a quarterly net income of nearly $2bn on $16.5bn of revenues. Shares are 13% lower YTD.

-MSCI confirmed South Korea’s classification as an emerging market mainly due to Seoul’s restrictions on stock short-selling. Indices constructed by Dow Jones, S&P, FTSE and JP Morgan classify the country as developed.

In private markets, British fintech Revolut is seeking to raise $500mn at a record $40bn valuation, which would make it Europe’s largest start-up.

It was an active day for corporate deals with British Tate & Lyle (food processing, mcap £2.5bn) acquiring privately-owned CP Kelco of the US (plant-based ingredients) for $1.8bn in a stock and cash deal. Tate shares fell 9%.

BP is expanding its presence in Brazil with the purchase of 50% of its joint venture with Bunge and taking full control of BP Bunge Bioenergia for $1.4bn. BP Bunge Bioenergia is one of the largest sugar and ethanol businesses in the country.

Vodafone completed the block sale of 18% of India’s Indus Towers (telco towers, mcap $10.8bn) for $1.82bn which it will use to reduce debt levels.

Today’s key data release will be manufacturing and services preliminary PMIs for the US, €-zone, UK and Germany but we also get retail sales in Britain. Finally, Finland’s exchanges are closed for a holiday.

That’s all for today, have a nice weekend.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.