Morning,

Thursday was a highly volatile day for global markets with wild moves in equities, rates and currencies on the back of economic data, earnings releases and monetary policy updates, ahead of today’s non-farm payrolls report. We’ll focus on the big picture and look at what triggered the risk-off sentiment that continues today with a significant sell-off in Asia.

The catalyst was a weak ISM Mfg PMI reading in the US, showing a contraction (46.8 pts) in factory activity which raised concerns about a deceleration of growth. It is the lowest print since November.

Apple beat sales and earnings estimates while Amazon missed on revenues and disappointed in guidance but these mega-caps ended only marginally lower as they reported after the close. In after-hours trading, Amazon lost 7% and Intel plummeted 20% after missing all estimates and announcing cuts in spending, headcount and dividends.

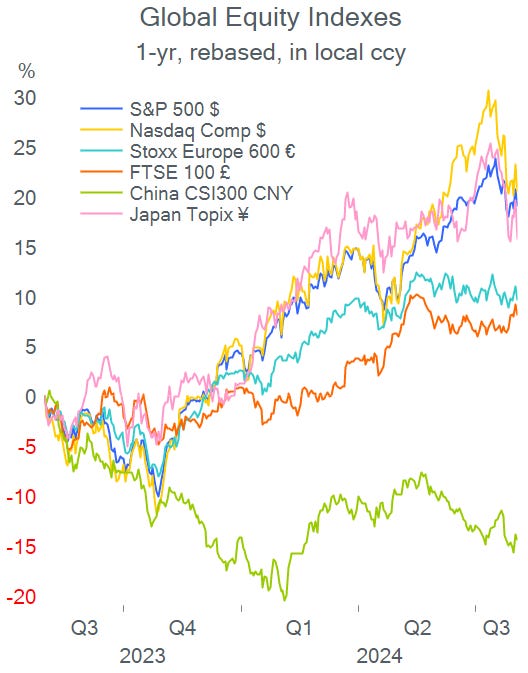

What drove stock indices sharply down yesterday were semiconductor stocks with Nvidia, Broadcom, AMD, Qualcomm and Arm losing between 7 and 15%. The equity sell-off was broad-based with the Dow Jones, S&P 500, Nasdaq and Russell indices down 1.2 to 3% and only the defensive sectors managed to post gains (Utilities, Healthcare, Real Estate). The equal-weighted S&P 500 lost 1% and the VIX volatility index jumped to 18.60%, its highest level since mid-April.

European blue chips fell 2.2% with the Dax, Cac, Ibex and Mibtel as the biggest losers driven by a weak banking sector which posted its worst day (-4.5%) in 17 months. Societe Generale plunged 9%, NatWest 8% and HSBC 6%.

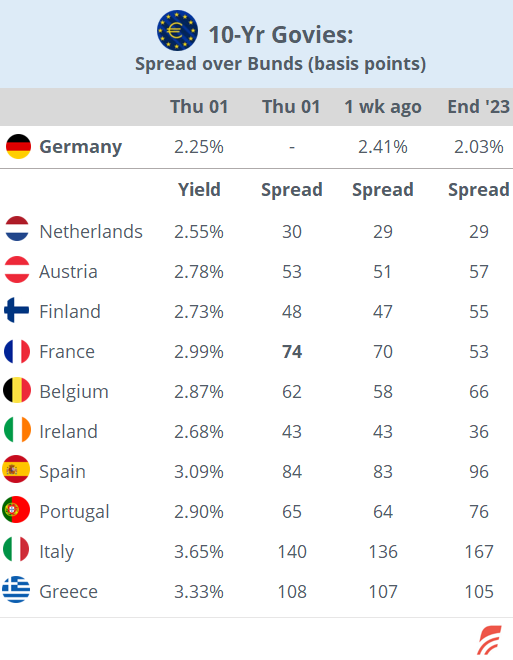

In rate markets, all developed countries' curves shifted lower with US Treasury yields falling sharply. The 2-yr yields fell 17bp to 4.17% and the 10-yr dropped 13bp, to below 4% for the first time in six months.

The Bank of England cut its policy rate by 25bp to 5% from a 16-year high and signalled it will move with caution going forward. It was the central bank’s first rate cut in more than four years after consumer inflation reached its goal of 2%. Traders are pricing in a 74% chance for no change at the next meeting. The BoE projects economic growth of 1.25% for this year, a notable improvement from the previous estimate (+0.5%).

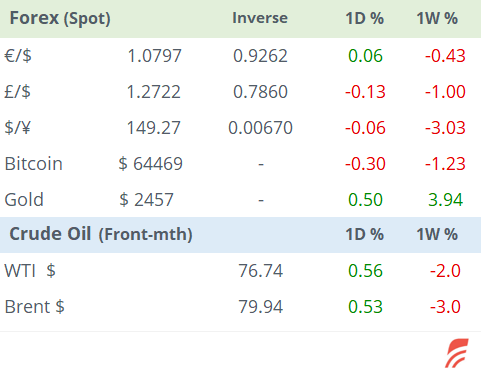

BoE’s impact in markets: a steep depreciation of Cable, down almost 1% to 1.2739, a 4-wk low and a 0.6% fall of £ against the €. The Gilts curve shifted lower again by ~10bp with the short-end yielding 3.71%. The FTSE 100 dropped 1%, half the decline of its European peers measured in local currency.

Asian stocks are having their worst day this year with Japan’s broad Topix index down 5%, its worst day in four years as the ¥ maintains its appreciation trend. Korea and Taiwan are losing more than 3.5% while Australia and Hong Kong are 2% lower. €-Stoxx 50 and Dax futures are pointing to a weaker open and the Nasdaq 100 futures are losing 1.4% overnight. Treasury futures continue to move higher and are now at the same level as at the start of the year. Brent oil is above $80 again and Bitcoin is little changed at $64,400.

In deals, BNP Paribas (mcap €70bn) is in talks to acquire Axa Investment Managers for around €5.1bn.

In the US tech healthcare sector, R1 RCM (mcap $6bn) is being taken over by private equity firms (TowerBrook Capital Partners and Clayton, Dubilier & Rice) for $9bn of enterprise value. R1 shares rallied 10%.

In data today: July’s employment report (NFP +175k exp vs +206k in June) and factory orders in the US; inflation in Switzerland; retail sales and industrial production in Italy.

Large-caps reporting today: Exxon, Chevron and Linde.

Enjoy your weekend.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.