Morning,

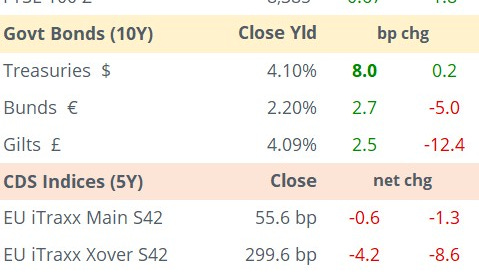

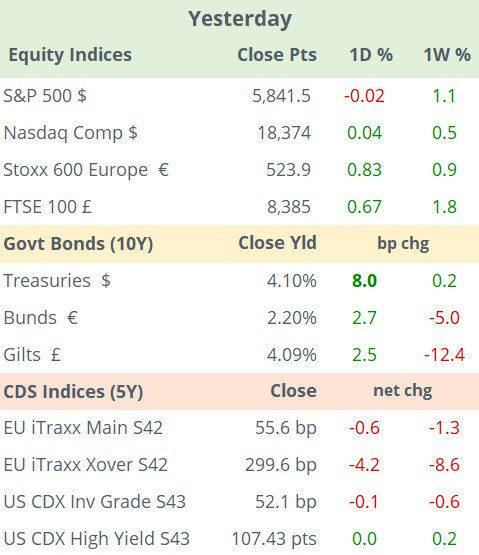

Stocks on Wall Street ended little changed last night with the Dow Jones Industrials hitting a fresh record to accumulate a 15% YTD gain. Investors’ focus on Thursday was on the ECB’s policy meeting and signals and today’s focus is on the latest economic data in China.

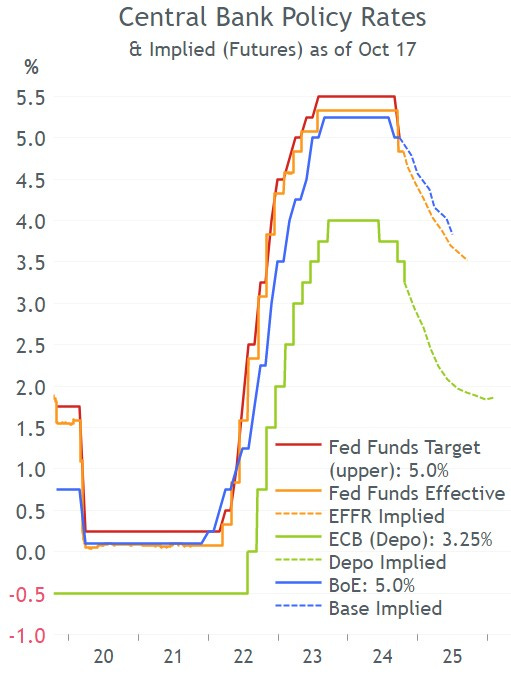

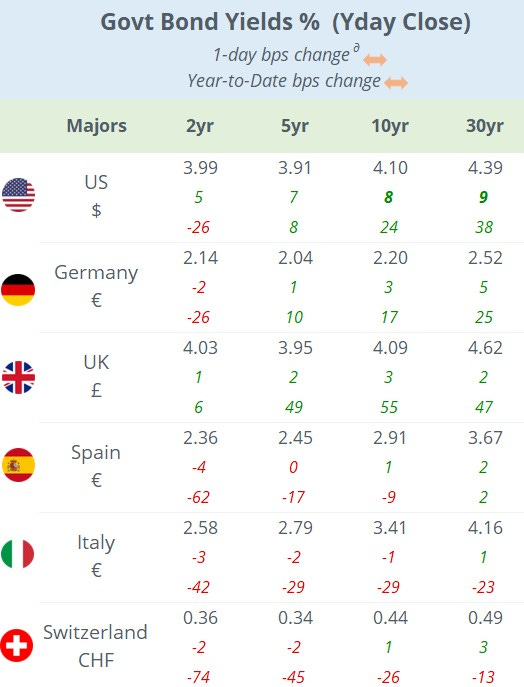

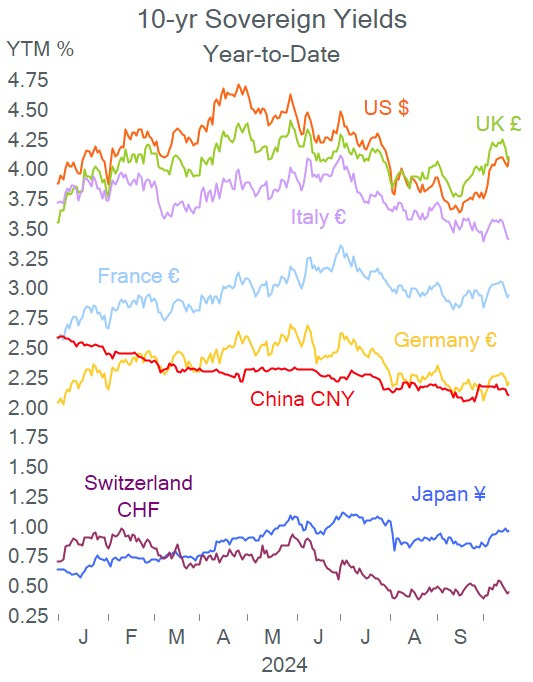

As widely anticipated, the ECB eased its benchmark interest rates by 25bp for the third time this year bringing the deposit rate to 3.25% and the refinancing rate to 3.40%. The central bank signalled further rate cuts on the back of controlled inflation. President Lagarde expects a soft landing scenario for the worsening growth prospect of the block’s economy but with chances to avoid a recession.

"We believe the disinflationary process is well on track and all the information we received in the last five weeks were heading in the same direction - lower," Christine Lagarde said.

The €-zone’s final headline inflation reading for September came in at 1.7% YoY, below the ECB’s 2% target and well below the new deposit rate. Core HICP inflation was unchanged at 2.7%.

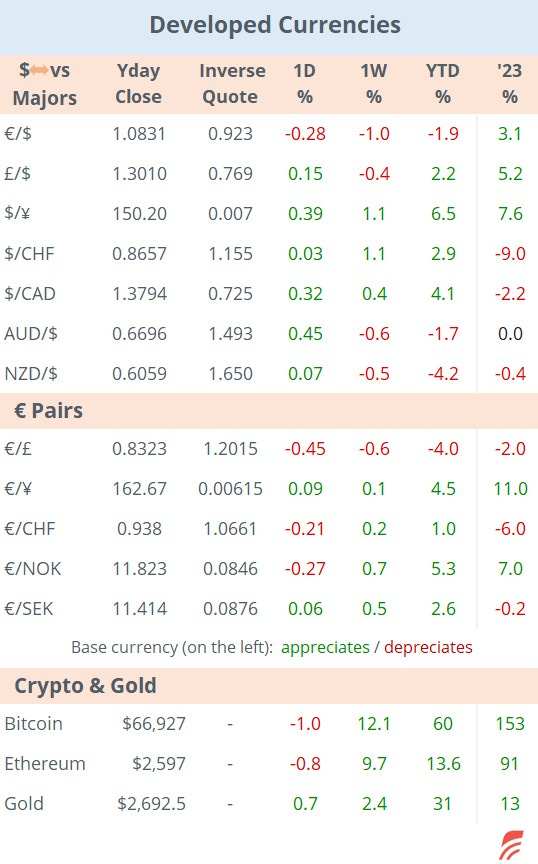

Markets reacted positively with stocks trading 0.8% higher on average including a new all-time high for the Dax index, the € fell marginally (-0.3%) and the Bund yield curve steepened modestly.

The latest economic data in China released today shows a deceleration of growth with GDP advancing 4.6% YoY in Q3 (+0.9% QoQ), better than forecasts but the slowest pace since Q1 of 2023. It represents a modest slowdown from the 4.7% recorded a quarter ago. Retail sales (+3.2% YoY), industrial output (5.4%) and urban investment (3.4%) all came in better than consensus in September and higher than a month ago. Markets continue to focus on the weakness of the property sector and expect more announcements on the fiscal front. Chinese and Hong Kong equities are trading firmer today (+2.8%) and the yuan (CNY) is little changed (7.12).

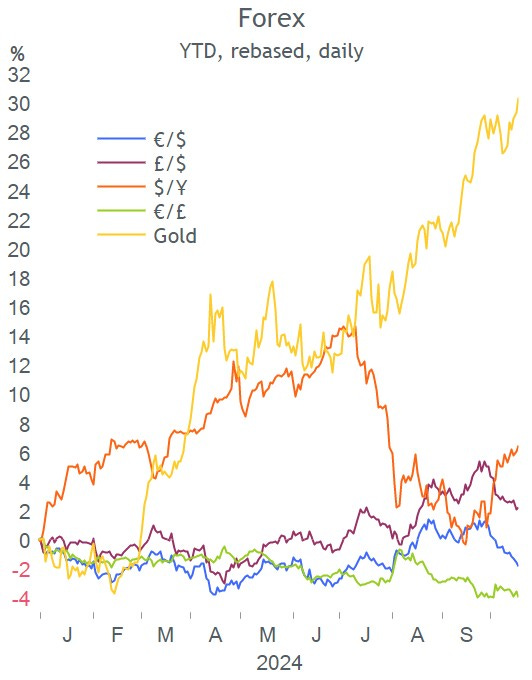

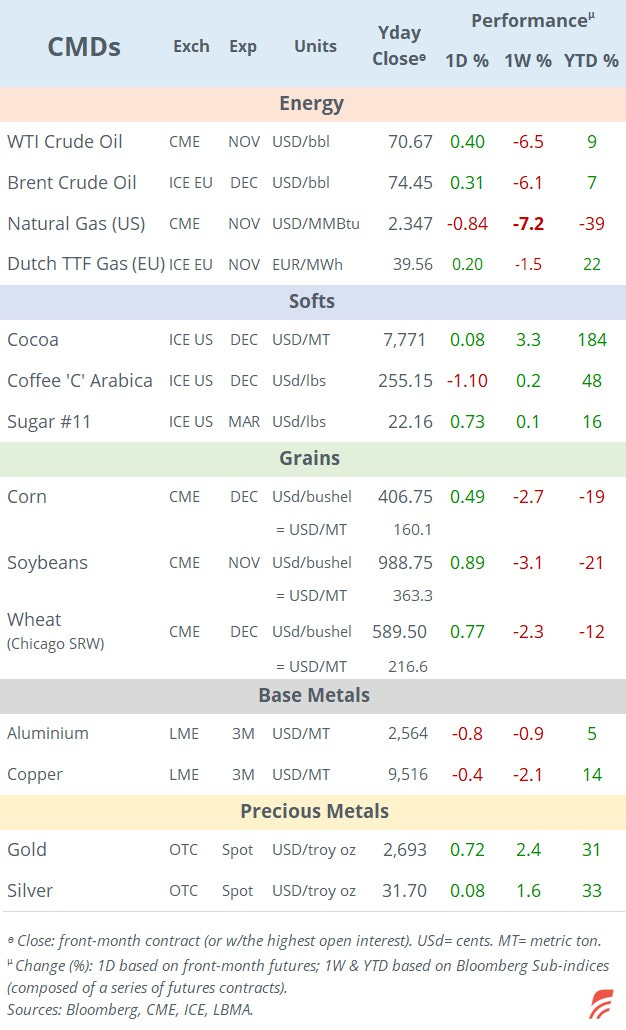

Gold traded shy of $2,700 yesterday, a historic nominal record, driven by a lower interest rates scenario, an escalating Middle East conflict and the US election next month. The safe-haven metal is 31% higher YTD.

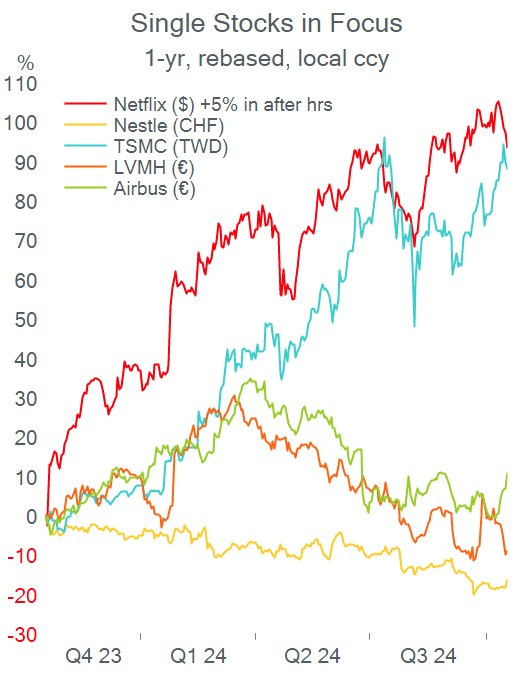

On the earnings front on Thursday, Netflix (mcap $295bn) beat estimates with a net income of $2.3bn for the quarter and shares gained 5% in after-hours trading. The company added more than 5mn new subscribers in Q3, well above estimates.

Swiss food giant Nestle (mcap $260bn) marginally missed revenue estimates and cut its full-year sales outlook to just +2%. Shares added 2.5% but remain 12% lower YTD.

Headlines:

-Israel confirmed the killing in Gaza of Hamas leader Sinwar, the mastermind behind the October 7 attacks. The incident is seen as a big victory for Netanyahu who said the war against terrorism wasn’t over. Hamas said it will retaliate and Hezbollah plans to escalate its war with Israel.

In other central bank meetings, Turkey left rates unch at 50% while Chile cut rates by 25bp to 5.25%, as expected.

In corporate deals, French drugmaker Sanofi SA (mcap €128bn) said it received an improved bid for 50% of Opella, its consumer division from a consortium led by PAI Partners as the company faces opposition from union workers. Sanofi shares are +12% YTD.

In Spain’s industrial sector, steelmaker Sidenor is interested in acquiring parts or all of train manufacturer Talgo SA (mcap €475mn). Talgo shares jumped 15% in three days.

Data today: UK retail sales; US housing market figures. Earnings reports today: Volvo, P&G, Amex, Schlumberger.

European stock futures are 0.3% lower in early morning trading.

That’s all for this week, thanks for your time and enjoy your weekend.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.