Audio correction: ECB officials also made dovish comments stating that, although monetary policy will likely be eased in June, the following meeting could well be a pause as it is unclear whether an easing cycle will gain pace.

Script: Estimated reading time ⏲ 3 mins

Good Friday,

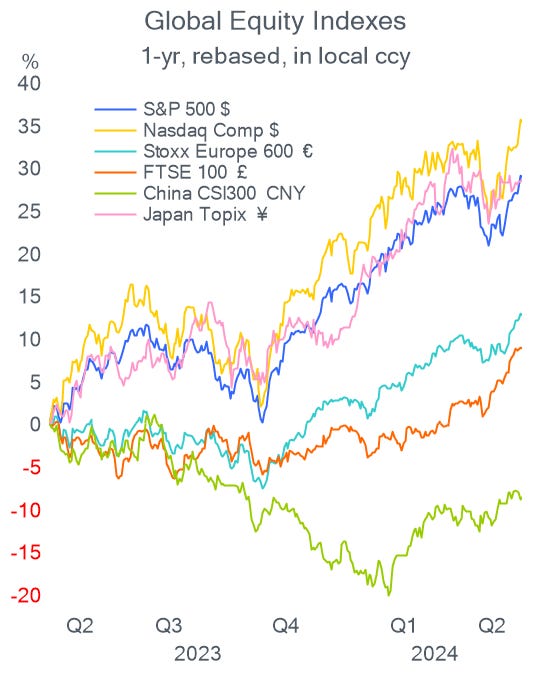

Stocks on Wall Street retreated from their all-time highs to end marginally lower last night as the multi-day rally takes a pause. The S&P 500, Nasdaq 100 and Europe’s Stoxx 600 all finished the day lower by 0.21%. The notable mover was the Dow Jones Industrials reaching an intraday record above 40,000 points. In European markets, the Dax, Cac and Belgium’s Bel 20 indices were the underperformers of the day.

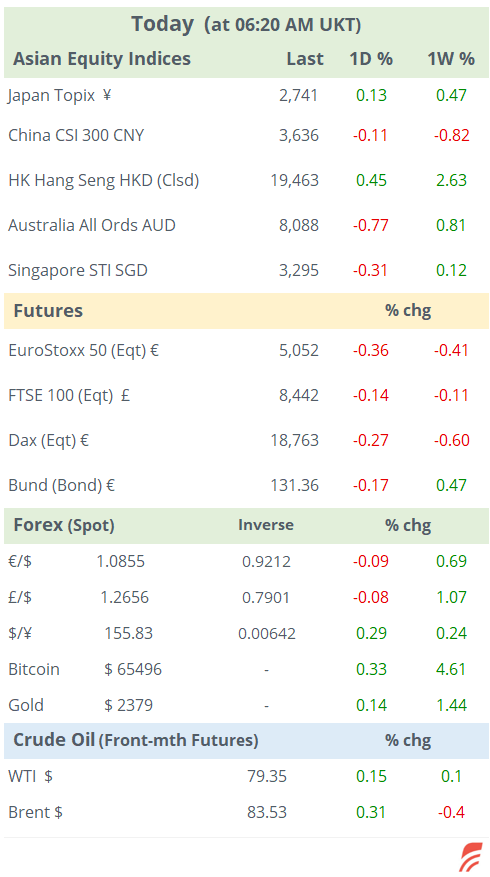

Asian equities are trading lower this morning with Australia and Korea down almost 1% while Japan and Hong Kong are a touch firmer. European stock futures are pointing to a weaker open. Brent is slightly higher at $83.50, the $ is marginally stronger and Bitcoin is now at $65,500.

Today’s headlines highlight the friendly meeting of Putin and Xi Jinping in China where they both expressed positive remarks regarding the two country’s diplomatic relations and described the US as a ‘hostile’ nation.

Also, Brussels will investigate whether Meta Platforms is taking the right measures to protect children’s mental health on all its apps and complies with the Digital Services Act.

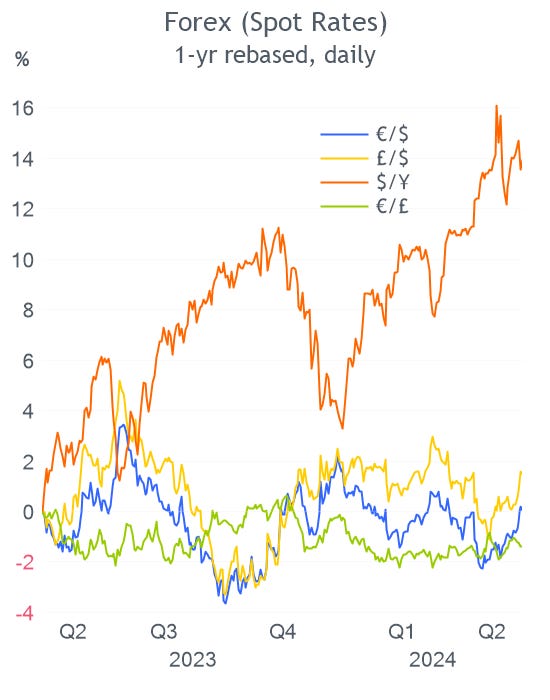

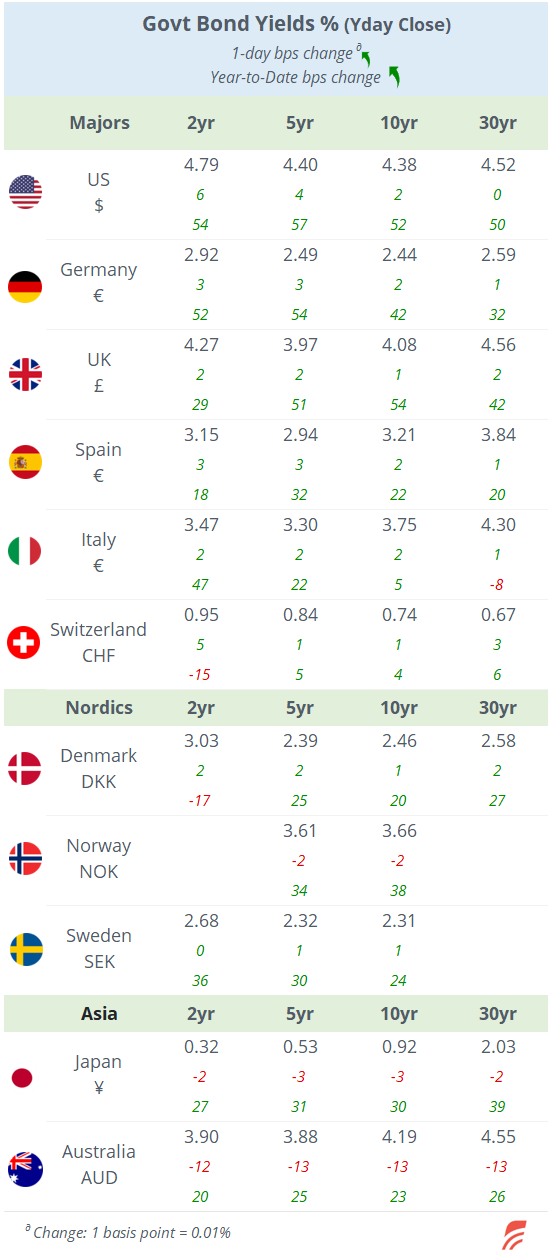

We heard some cautious remarks by Fed policymakers with Mester, Barking and Williams saying that more data is required to be confident that inflation is dropping to the central bank’s 2% target, as it is taking longer to cool prices, and the Fed should be in no rush to cut rates. 2-year Treasury yields gained 6bp to 4.79%.

ECB officials also made dovish comments stating that, although monetary policy will likely be eased in June, the following meeting could well be a pause as it is unclear whether an easing cycle will gain pace.

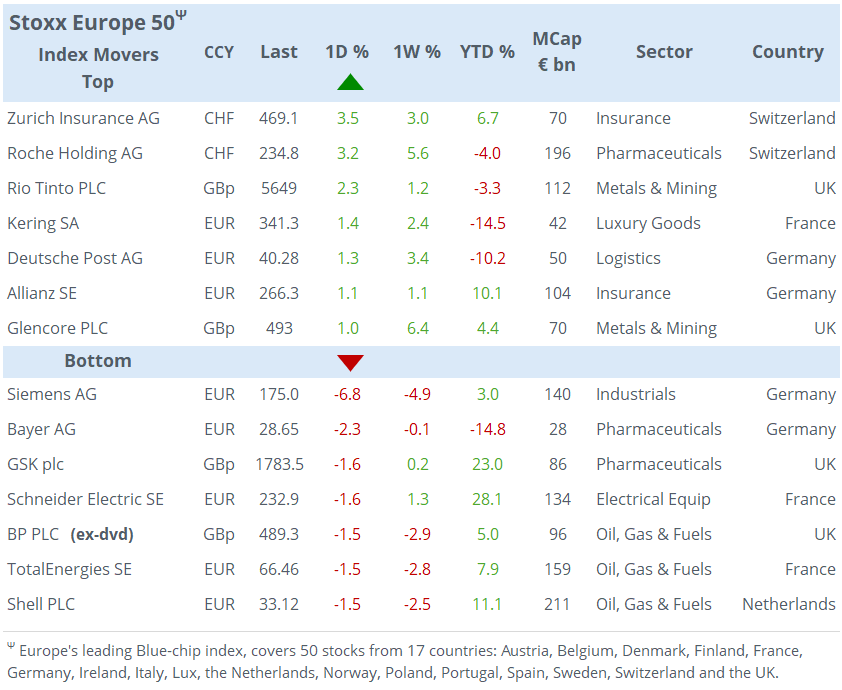

The two blue-chip stocks that reported results and are worth highlighting, are Siemens and Walmart. The German industrial company disappointed after missing sales ($19.1bn) and profits in its industrial business (falling to $2.51bn) sending shares down by 6.8%. Net income declined 38% YoY to €2.2bn as demand in China slowed down significantly due to a destocking trend of Chinese massive inventories.

Walmart beat quarterly revenue ($161.5bn, +6% YoY) and earnings ($5.1bn, +205% YoY) estimates and shares rallied 7%, their best day in four years, to an all-time high. Its e-commerce sales, a unit that competes with Amazon, increased 22% YoY. It also lifted full-year sales and profit forecast. Walmart’s total market cap stands at $482bn. Walmart's strength meant that the Consumer Staples sector was the only rising sector in the US yesterday.

In economic data this morning, China reported a drop in retail sales (+2.3% YoY) and urban investment (+4.2%), both readings came below expectations while industrial output rose (+6.7%) in April. The takeaway is that factory activity improved on strong external demand but domestic consumption and property prices cooled down. New home prices fell at the fastest pace in nine years (-3.1% YoY).

It was a calm day for corporate deals, Swiss insurer Chubb shares in the US gained nearly 5% after Berkshire Hathaway announced it built a 6% stake worth $6.7bn.

It will be a quiet Friday on the data and earnings front, with the final reading for €-zone inflation for April and Swiss luxury company Richemont reporting results. Today is a holiday in Norway.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. Please share using the button below, as access is free to all.