Morning,

A quick reminder that Markets Dawn Europe will take a summer break and will return on Monday, September 2nd. We will keep our updates subject to market activity, so if markets remain calm, we will not publish until then. In the meantime, plse send us your feedback, suggestions, ideas, anything you’d like to share at laconic@succinct.info.

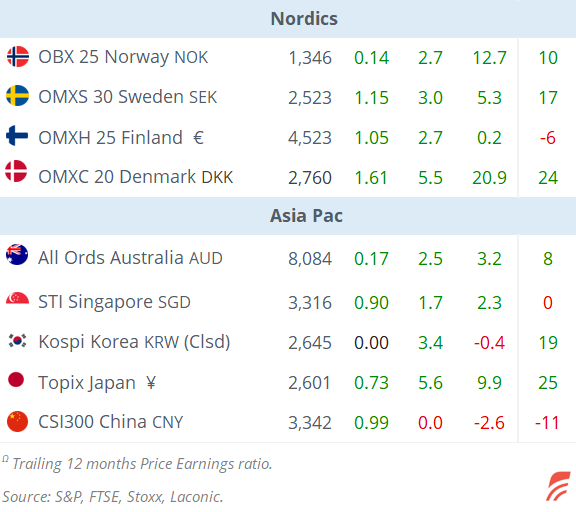

Thursday was a risk-on day for global markets driven by easing fears of a U.S. slowdown. Strong retail sales, low weekly jobless claims and a solid report from Walmart reflect healthy consumer spending and increase the chances of a soft landing for the U.S. economy. Every U.S. leading equity index advanced sharply with the Nasdaq 100 and Russell 2000 adding 2.5%. Europe also rallied with the technology sector as the outperformer and the Eurostoxx 50 finished 1.7% higher. The S&P 500 is now 16% higher YTD compared to a 6.4% gain for Europe’s Stoxx 600.

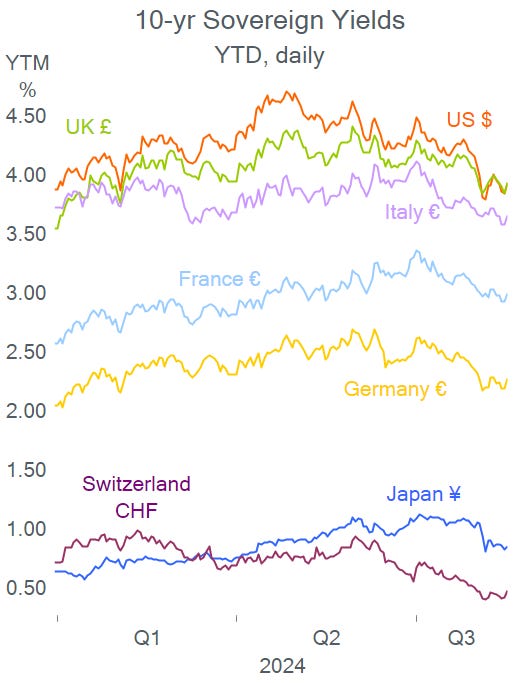

Retail sales in the U.S. grew at the fastest pace in 18 months in July, +1% MoM and was significantly above estimates. Weekly jobless claims came in below consensus (+227k). However, industrial production fell more than anticipated, -0.6% MoM, the worst reading since October. Overall, data shows a good state of the U.S. economy. The $ appreciated while interest rates rose and traders reduced their bets for a 50bp Fed rate cut in September.

In forex markets, the notable mover was once again the ¥ which resumed its depreciation trend towards the 150 threshold.

The positive data updates in the U.S. and the U.K. led to a reversal in bond prices from the past few days with benchmark yields surging between 10 and 15bp across tenors for Treasuries, Gilts, Bunds and €-zone sovereigns.

In earnings reports, America’s largest retailer Walmart (mcap $588bn), beat quarterly earnings ($4.5bn, -43% YoY) and revenue ($169bn, +5% YoY) expectations and raised its forecast for the year as it sees stable consumer health. Shares rallied nearly 7% to a record high. Other mega-caps posting significant gains on Thursday were Amazon, Nvidia, Broadcom and Tesla with improvements between 4 and 6%.

Dutch fintech Adyen (mcap €40bn) beat half-year core profit estimates and reported an EBITDA growth of 32% sending shares up 12%.

On other data released yesterday, Britain’s economy expanded at a solid pace in Q2, with GDP growing by 0.6% QoQ following a +0.7% expansion in Q1, and leaving behind two years of lacklustre performance.

Norway’s central bank left its policy rate steady as anticipated at 4.5%, a 16-year high and signalled it they would remain at restrictive levels for some time ahead as inflation (core at 3.3%) remains above target (2%). The economy is weakening and the krone (NOK) is among the worst major currencies this year with a ~5% depreciation against the €.

Asian stocks are rallying sharply today following the positive sentiment on Wall Street. Japanese equities are gaining 2.5% to post their best week in four years following the steep selloff ten sessions ago. Korea, Taiwan and Hong Kong are also up by 2%. European and U.S. stock futures are modestly firmer overnight.

In credit ratings: Fitch d/g to A- several Israeli banks including Leumi, IDB and Hapoalim.

Data to be released today: retail sales in the UK & housing market statistics and the University of Michigan sentiment indicator in the U.S.

Next week’s monetary policy meetings: China (LPR) and Sweden on Tuesday; Korea on Thursday. Inflation updates next week include the €-zone (final July), Canada, Japan, Austria and Germany (PPI).

That’s all for today and for this month. See you after the break.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.