Morning,

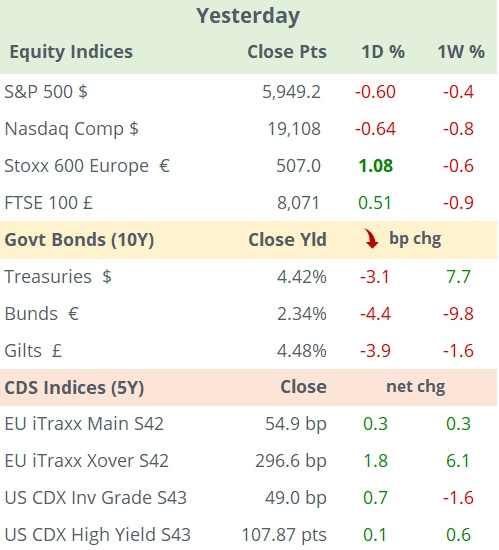

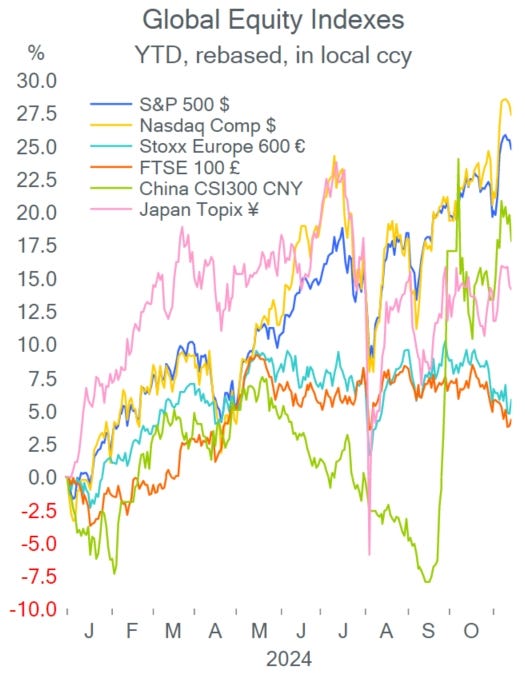

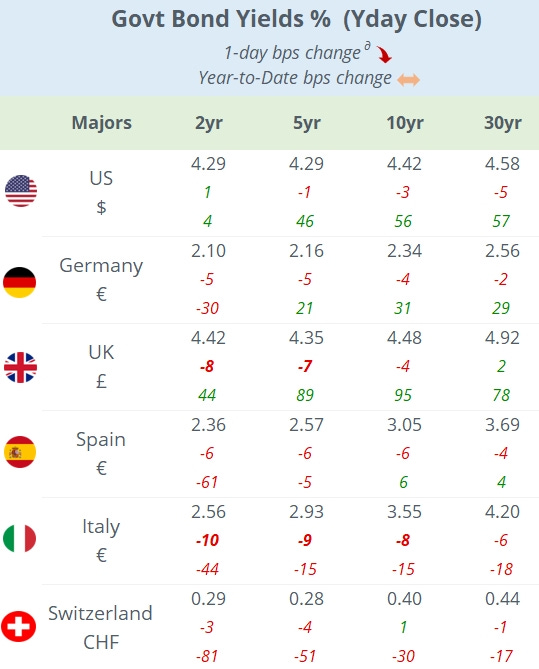

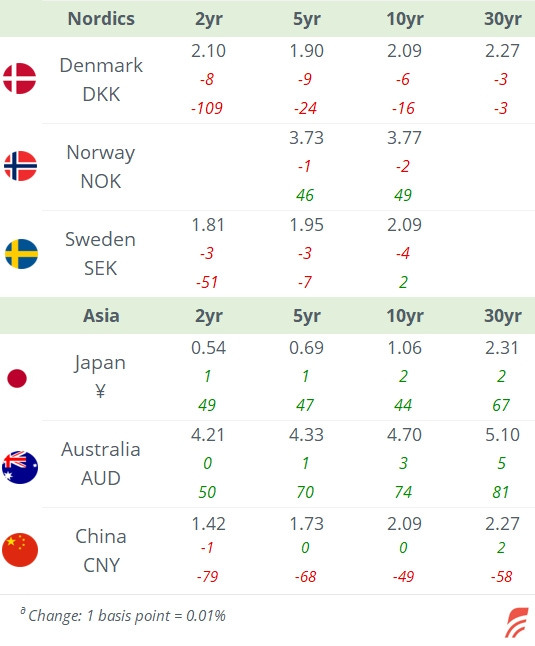

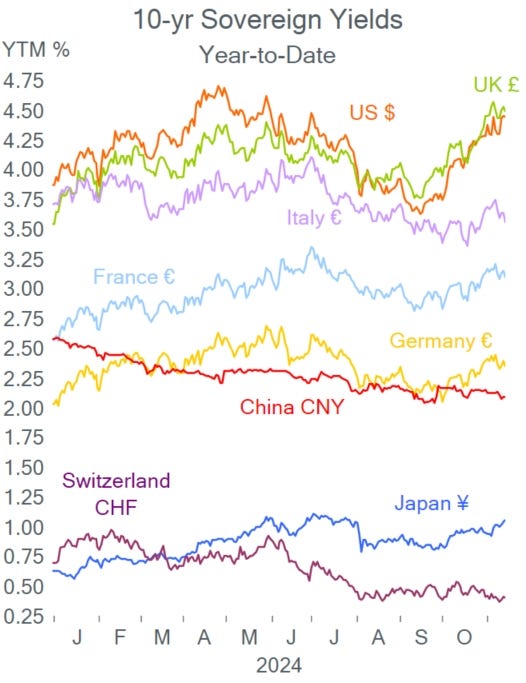

European equities had a strong day on the back of solid earnings by Siemens and a positive outlook update by ASML. Also, data showed that the €-zone´s GDP expanded by 0.9% YoY in Q3, accumulating four straight quarters of growth. Benchmark bond yields in the €-block dropped across tenors with Italian BTPs as the main movers with 2 and 5-yr yields easing by 10bp. Italy´s 10-yr bond yields 3.55% or 120bp over Bunds.

US stocks ended lower by ~0.7% driven mainly by Jerome Powell´s hawkish remarks stating that there is no need for the Fed to rush rate cuts given the ongoing economic growth and robust job market which he described as ´remarkably good´.

Fed officials maintain that inflation will continue to decelerate to their 2% target allowing them to cut interest rates to a neutral setting. The timing of this process remains unclear with Trump´s victory and markets are pricing in fewer rate cuts for next year. The probability of a 25bp rate cut in December dropped to 61% as of Thursday´s close. Yesterday´s wholesale inflation (PPI) update showed an acceleration to 2.4% YoY in October driven by higher services costs.

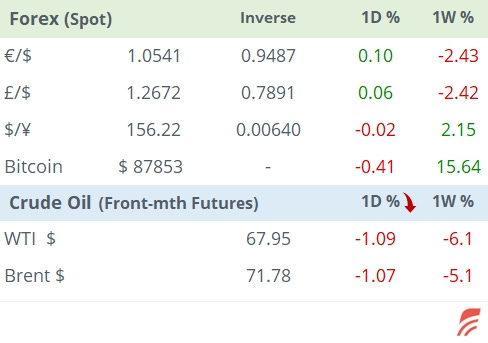

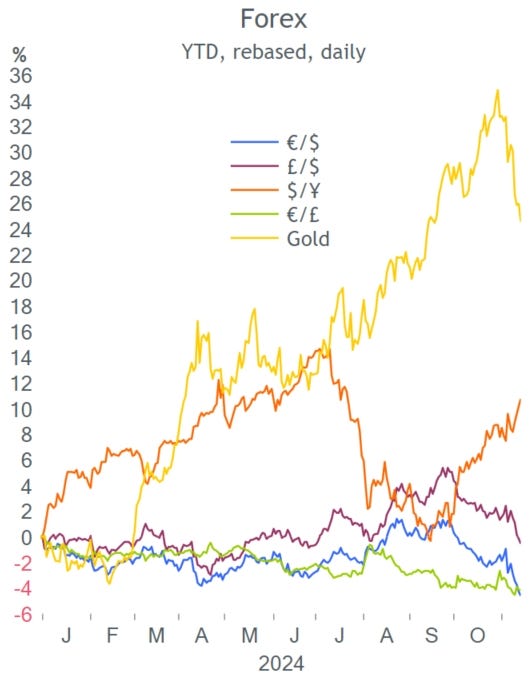

The $ continues to strengthen and is 2 to 3% firmer against majors in the past seven days with the € accumulating a 5% depreciation YTD.

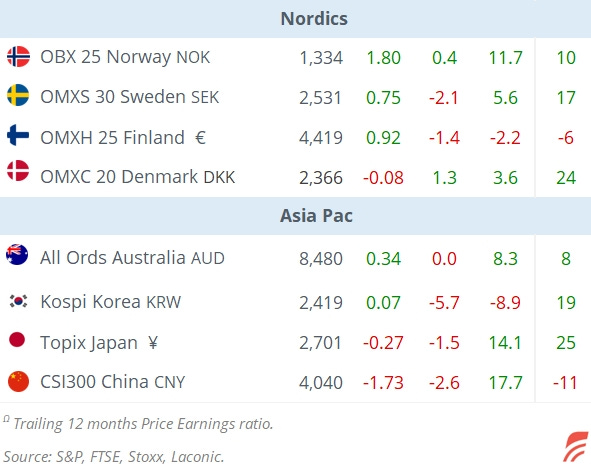

China released mixed to marginally softer data this morning with industrial output slowing (+5.3% YoY), missing estimates and property investment dropping 10% YoY while retail sales (+4.8%) and the unemployment rate (5%) showed modest improvements.

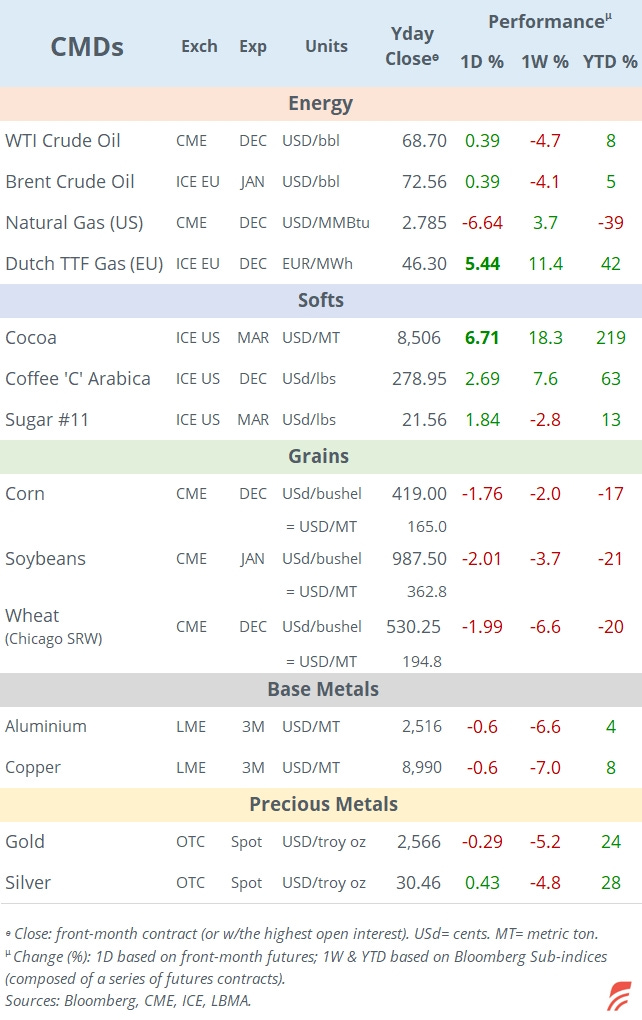

In commodity markets, EU gas prices rose >5% yesterday to a one-year record high of €46 per megawatt hour and accumulated an 11% rally in the last 7 days on concerns that Russian gas supplies into Austria may be halted due to a court order against energy company OMV AG.

Mexico´s central bank cut its benchmark rate by 25bp to 10.25% as expected, its third straight easing decision and signaled future reductions as inflation continues to decelerate. Core CPI slowed to 3.8% YoY and headline inflation stands at 4.7%, still above the 2-4% official target. The Mexican peso (MXN) has depreciated 17% this year, in line with the Brazilian real. Moody´s cut Mexico´s (Baa2) outlook to negative citing institutional and policy weakening, impacting the fiscal deficit and public spending.

In credit ratings, Caixabank (mcap €40bn) was u/g one notch to A by S&P.

Economic data to be released today include retail sales and industrial production in the US; final inflation updates in France and Italy; GDP, industrial, services and manufacturing activity in the UK; and wholesale prices in Germany.

There are no blue-chip companies scheduled to report earnings today and no central bank policy meetings. Portugal´s and India´s credit ratings will be reviewed today.

It´s a holiday in India and Brazil.

That’s all for this week, thanks for your time.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.