Est reading time: 5 min

Happy Friday,

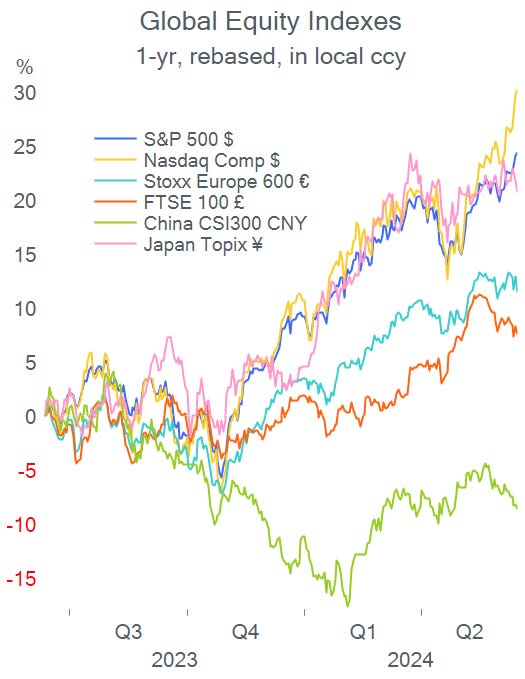

European equities had their worst day in 11 months with the €Stoxx50, Dax, CAC and Italy’s Mibtel indices selling off 2%. Investors reacted to the Fed’s hawkish message and fear that the ECB may wait even longer to ease policy again. The political uncertainty in France also raised concerns about market stability. Financials and Autos were the underperformers but every sector ended lower.

Equity prices fell evenly as there was no specific single name that led the declines, with Santander (mcap €70bn) as the worst among the Stoxx 50 members, with a 4% fall. Stocks in Paris are significantly underperforming their neighbours this year, with a ~2% increase compared to Amsterdam’s 17%, Milan’s11%, and Madrid and Zurich’s 9% gains.

The Italian government had a poor day in auctioning €9bn worth of BTPs in four tranches and yields rose a few basis points in contrast with other rate markets where bond prices continue to shift higher. Bund yields fell 4bp to 2.49% and UST ended 5bp lower at 4.24%, as US markets focused more on the inflation update rather than Powell’s signals. The spread of French OATs over Bunds is at 69bp for a 3.18% yield versus just 32bp for Dutch government bonds (2.81%).

The € lost its previous day’s gain and fell 0.7% to 1.0735 and is weaker by more than 1% against the $ and £ in the past week, mostly on the result of the EU election and Macron’s gamble.

Wall Street had a volatile session but finished higher to claim yet another record with Nasdaq benchmarks adding 0.6% and accumulating a 16% gain YTD. A notable mover among large-caps was chip maker Broadcom (mcap $778bn) which rallied 12% after beating revenue ($12.5bn) and earnings ($2.1bn) estimates and announcing a 10-for-1 stock split, replicating Nvidia’s recent move.

Today, the Bank of Japan left policy rates steady at a 0-0.10% range and signalled it will soon begin to reduce its bond-buying programme. 2-yr JGBs yields fell a few bps to 0.29% and the ¥ is weakening by 0.5% to 157.75 while stocks are nearly 1% firmer.

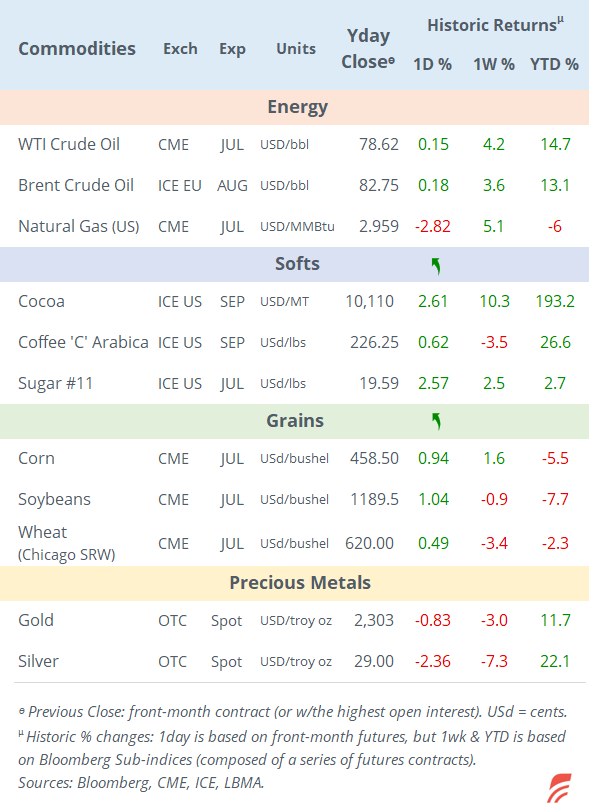

Other Asian markets are trading weaker today with China, Australia and Singapore lower by ~0.5% while Taiwan and Korea are somewhat higher. European futures are pointing to a small recovery from yday’s sell-off. Bund futures are firmer, adding 0.3% to 131.70 in early trading. Crude oil is trading lower with Brent losing 0.5% at $82.36.

Headlines,

-At the G7 Summit in Italy, world leaders agreed on a $50bn aid to Ukraine to fund the war. The funds will come from the returns of Russian sovereign seized funds. Meanwhile, Russia’s main exchange has suspended $ and € dealing following new sanctions from Washington. The rouble appreciated 1.2% yday while equities have lost 9% in the past four weeks.

-Tesla shareholders approved Elon Musk’s record pay package worth $45bn and authorised the reincorporation of the company in Texas, in a victory for the CEO. Shares gained 3% but remain 27% lower YTD.

In data released yday, the latest €-zone industrial production figures show a steep drop, down 3.0% YoY, worse than estimates and significantly weaker than a month earlier. US producer prices decelerated in May, up 2.2% YoY, less than expected and fell -0.2% on a month-to-month basis, the first decline this year. Weekly US jobless claims rose by 242k a 10-month high and higher than consensus. Inflation in Ireland accelerated, with headline HICP up 2.0% YoY in May.

In debt capital markets, corporate bonds in € issued yday include British Tel (10yr @ 3.96%), Reckitt Benckiser (5yr), Dell Technologies (5yr @3.74%), and Heidelberg Materials (10yr @4.20%).

It will be a light day on the data front with US import and export prices; and inflation updates in France, Sweden, Portugal and Israel. In EM, inflation in India, Poland and Russia as well as Peru’s central bank policy meeting (-25bp expected to 5.5%).

That’s all for today, have a nice weekend.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. Please share using the button below, as access is free to all.