Markets Dawn Europe is ads-free. To survive, it needs to grow, receive feedback & support. If you value it, 🙏 share it with colleagues, give it a like, and email us with suggestions so we can improve. A BIG thanks to those who already have! 🙌

Morning,

This week’s positive momentum for risk assets extended yesterday driven by the ECB’s policy meeting and the wholesale inflation update in the U.S. Leading stock indices on both sides of the Atlantic advanced ~1% as traders renewed their hopes for a significant rate cut by the Fed next week. Futures are now pricing in a 43% probability of a 50bp rate cut. This would be the first rate cut in four and half years.

The ECB cut its deposit rate by 25bp as expected to 3.5% and the refinancing rate by 60bp to 3.65% in a unanimous decision, as inflation nears the central bank’s 2% target and the economy shows signs of deceleration. The ECB signalled more rate reductions in the near term but could pause at its next meeting as it remains data-dependent. The bank said ‘financial conditions remain restrictive and economic activity is still subdued, reflecting weak consumption and investment’. The inflation forecast for this year remained steady at 2.5% and 2.2% for next year.

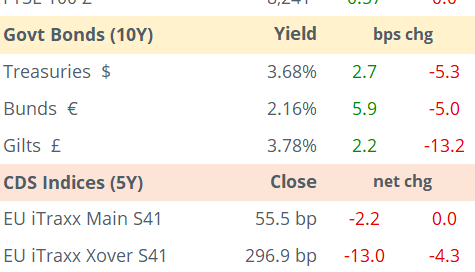

The € appreciated by 0.6% and short-end German yields rose by 10bp to 2.23% in an otherwise calm session for interest rate markets. Gold jumped 2% to a record high and is even firmer today at $2,565, as the $ weakens.

U.S. PPI or producer inflation came in at 1.7% YoY in August, marginally below estimates and lower than the 2.1% recorded in July. However, the month-on-month print was 0.2%, a touch higher than estimates. Also, CPI inflation in Spain was confirmed at 2.4% YoY in August.

WTI crude oil prices rose 2.5% on the back of offshore disruptions due to Hurricane Francine in the Gulf of Mexico. The IEA chief forecasts lower prices in the medium term driven by excess supply as global demand weakens.

In private markets, OpenA.I., the owner of ChatGPT and one of the most successful start-ups ever, aims to raise $5bn at a $150bn valuation, 80% higher than at the start of the year.

In monetary policy meetings, Peru cut its benchmark rate by 25bp to 5.25% on Thursday, the lowest level since May 2022.

HPE was the notable corporate bond issuer, placing 7-yr (at T+130bp), 10-yr (+145) and 30-yr (+175) senior investment grade bonds in $.

It will be a light day for data with inflation in France and industrial production in the €-zone as the key releases. Russia’s central bank meets today (current policy rate 18%).

Asian equities are mixed today with Japan falling almost 1% while Hong Kong is gaining 1.2%. The ¥ is strengthening 0.5% and broke the 141 support level.

That’s all for this week, enjoy your weekend.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.

This daily is great stuff. V useful... to the point. well done

Thx!