Good morning,

Wall Street finished sharply lower last night despite inflation confirming the deceleration trend and providing the Fed with more evidence that price pressures are easing. There was a clear investor rotation out of technology names and into small-caps stocks with the Nasdaq 100 index falling 2.2%, its worst day in nine months from its record high and the Russell 2000 index rallying 3.6% to post its best day in eight months. The S&P 500 dropped 0.9%, following seven straight sessions of gains. Mega-caps declined with Nvidia down 5.6%, Tesla 8.4% and Microsoft, Apple, Amazon and Alphabet all ending lower by 2.5-3%. The IT and Communications Services sectors were notably the weakest. On a year-to-date basis, the Russell is up by just 5% while the Nasdaq 100 is still up by 20%.

US CPI inflation fell 0.1% in June, its first negative monthly reading since late 2022 and rose by 3.0% YoY, well below the 3.3% in May and lower than estimates. The core CPI reading also eased modestly to 3.3%. Petrol and housing items contributed to the lower prints. Traders increased their bets of a Fed rate cut at the September meeting to more than 90%.

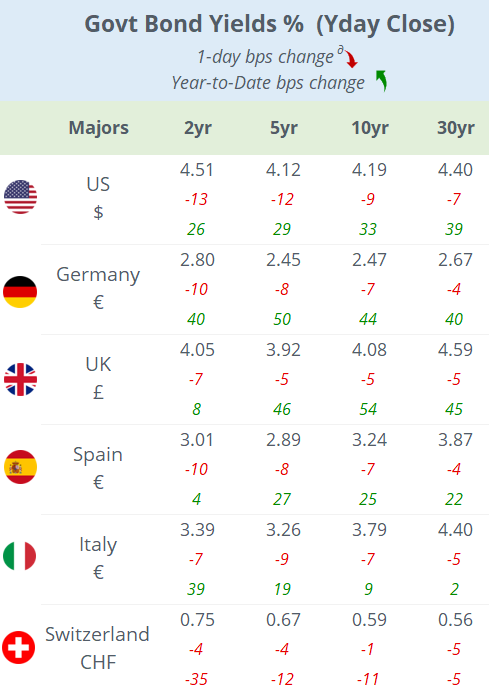

Bonds rallied with yields on the short-end of curves dropping the most as 2-yr US notes closed 13bp lower at 4.51%, the lowest in four months, the German Schatz yield dropped 10bp to 2.80% while 2-yr Gilts ended 7bp lower at 4.05%. The US Treasury (-32bp) and German Bund (-33bp) yield curves remain inverted up to the 10-yr tenor.

The DXY $ index fell to the lowest level in four weeks with £ appreciating 0.5% to 1.2909, its highest level since August. But the biggest currency mover was the ¥ which reacted to domestic factors unrelated to the US inflation update. The ¥ had one of the most volatile sessions this year as it reversed sharply from its nearly four-decade low and appreciated nearly 2% against the $. There was no confirmation of central bank intervention but senior officials announced that authorities were ready to take action as needed in forex markets. It has become standard practice to avoid disclosure of market interventions. The ¥ is trading at 159.20 this morning after touching 157.40 yday.

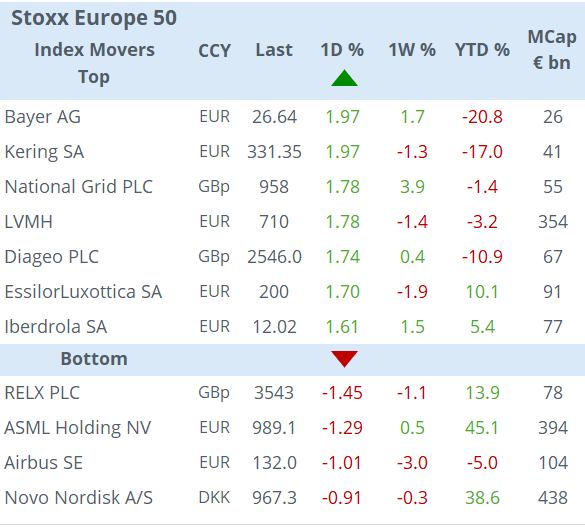

Asian markets are trading mixed today with a strong rally in Hong Kong stocks while Taiwan, Japan and Korea are selling off by more than 1%. Bund and Treasury futures are trading weaker overnight while equity futures are flat.

In other data released yday, the UK’s GDP estimate (1.4% YoY), manufacturing (+0.6% YoY), industrial (+0.4% YoY) and construction (+0.8% YoY) output all improved in May. Also, Germany’s HICP final inflation reading for June was confirmed at 2.5%, below May’s 2.8% print.

Headlines:

-President Biden had a series of gaffes during his NATO Summit speech. He confused his vice-president Harris with Trump and mixed Zelensky with Putin, increasing concerns about his fitness.

-Chinese exports rose more than expected in June, up 8.6% YoY while imports surprisingly dropped 2.3% YoY sending the trade balance to a $99bn surplus.

In corporate credit ratings, French tyre maker Michelin (mcap €25bn) was upgraded one notch to A2, outlook stable, by Moody’s.

Today’s data releases include US PPI inflation; Germany’s wholesale inflation and CPI inflation updates in France, Spain and Sweden.

On the earnings front, JP Morgan, Citigroup, Wells Fargo and Bank of New York Mellon will kick off the Q2 season before the market opens.

Have a nice weekend.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe,' contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.