Podcast ↑↑↑↑ Scroll down for the script.

Good Friday,

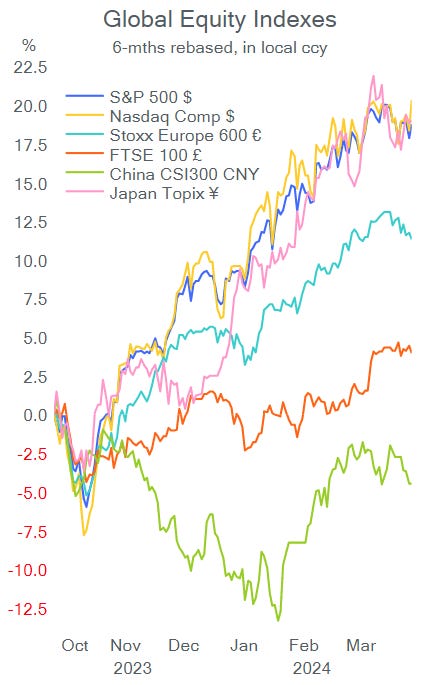

US equities posted a strong rebound yesterday with the Information Technology sector outperforming driven by the 4% gains for Apple and Nvidia. The main catalyst was the softer wholesale inflation update. The S&P 500 added 0.7% and the Nasdaq Composite rallied 1.7%. Today’s kick-off of the Q1 earnings season with large-cap banks will set the tone for next week.

European stocks ended lower with the Stoxx 600 down by 0.4% and the Spanish and Irish benchmarks as the weakest, down more than 1%. The bank sector was hit hard, falling 2.3% from its 7-year high.

As widely anticipated, the ECB kept policy interest rates steady yesterday and signalled a rate cut at its next meeting in early June. There was a minority of ECB policymakers who preferred to cut rates yesterday. The refinancing rate remains at 4.5% and the deposit at 4%. The central bank is concerned that wages are still high although it recognized the slowdown in inflation.

President Lagarde said that the ECB was data-dependent and not Fed-dependent, meaning that policy decisions will be based on Eurozone data irrespective of Fed actions. She said that it would be appropriate to lower rates if the ECB had enough evidence that inflation would continue to fall towards 2%, from the actual 2.4%.

This brings a new scenario to what traders were expecting earlier this year, where the Fed cuts rates much later than the ECB. More Fed officials are using language that supports a delay in cutting rates.

Headlines,

In geopolitics, Western governments are trying to avoid a potential Iranian attack on Israel following the bombing of the consulate in Damascus.

Russia has destroyed Ukraine’s biggest power plant located 50km south of the capital and Zelenskyy urged Western nations to provide more air support as Kyiv is running out of military supplies.

In data updates, Ireland’s harmonised inflation fell to 1.7% YoY. US producer prices or PPI printed at 0.2% MoM, lower than expected and below February’s reading, providing a mixed inflation signal following the consumer inflation surprise on Wednesday.

In corporate deals, pharma giant Novartis is acquiring German biotech MorphoSys, a developer of cancer treatments for a total equity value of $2.6bn or €68 per share in cash. MorphoSys shares nearly doubled YTD.

In the US biotech sector, Vertex Pharma is buying Alpine Immune Sciences, a clinical-stage biotech co, for nearly $5bn in cash or $65 per share, representing a 67% premium to Alpine’s undisturbed price, which rallied 37% yesterday to its all-time high.

SocGen agreed to sell its professional equipment financing unit for €1.1bn to domestic rival BPCE. The division provides equipment financing and leasing solutions to manufacturers, and brokers in several sectors.

In IPOs, PACS Group, a US post-acute healthcare company, raised $450mn on the NYSE, was priced at $21, and shares gained 10% on their debut to a total market value of $4bn.

The Bank of Korea maintained its policy rate steady for the 10th consecutive meeting at 3.5% today, as inflation remains above target at 3.1% YoY. Singapore’s MAS also left its policy strategy unchanged.

Today’s data front brings China’s international trade figures, US import and export prices as well as the University of Michigan Sentiment indicator, the final reading of consumer inflation in Germany, France, Spain and Sweden, and finally UK’s GDP, industrial and manufacturing output. The earnings season for Q1 begins today with JP Morgan, Citigroup and Wells Fargo reporting.

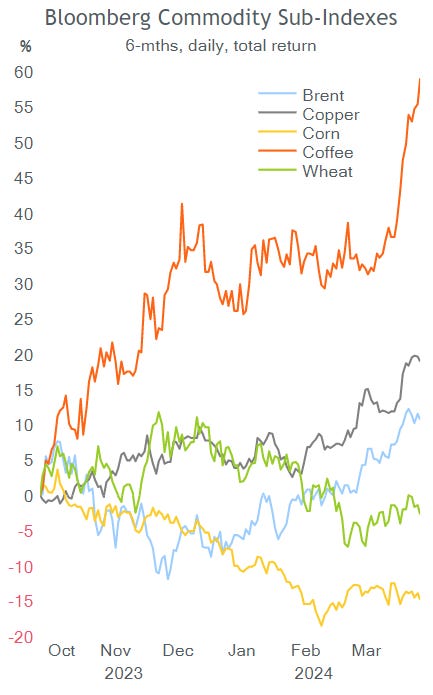

In Asia this morning, most stock markets are falling with Hong Kong down by 1.7% and Korea lower by 1% while Japan is trading firmer. European equity futures are pointing to a strong open, up by more than 0.5%. Brent oil is above $90 and Bitcoin is now at $71,000.

Have a nice weekend.