Morning,

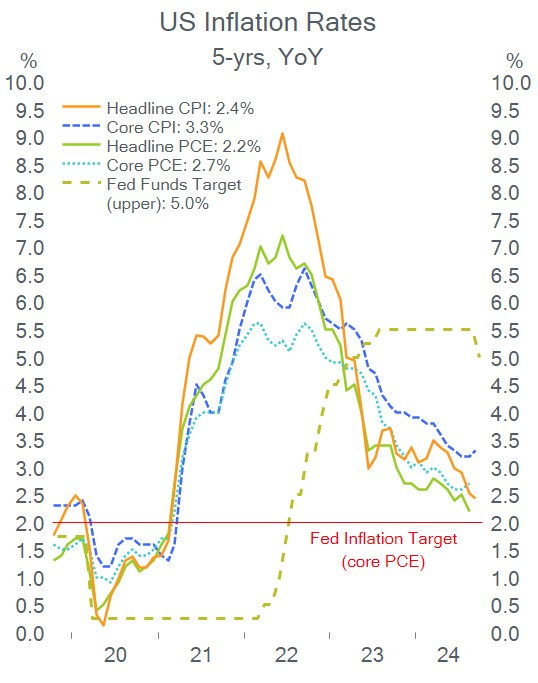

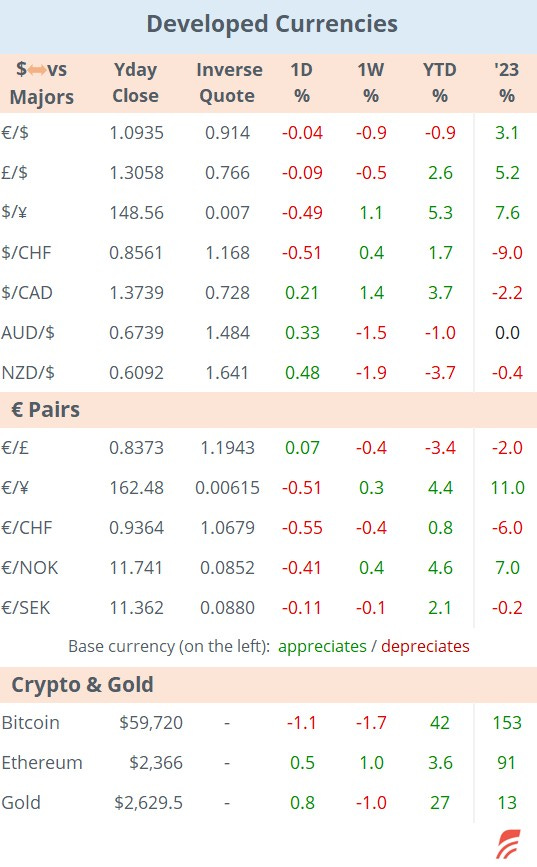

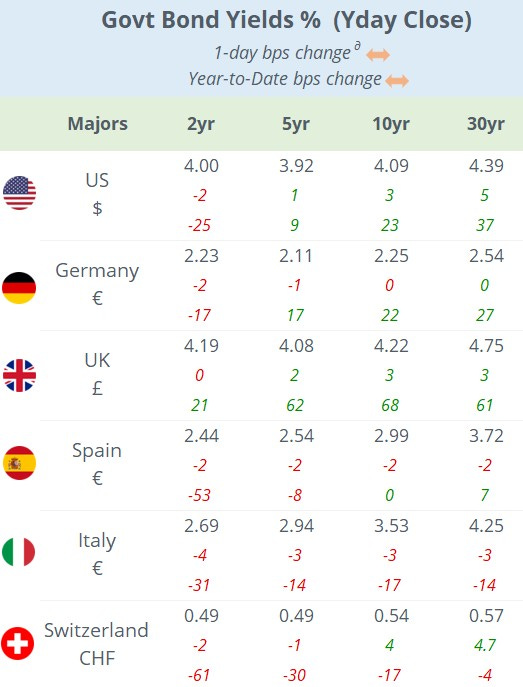

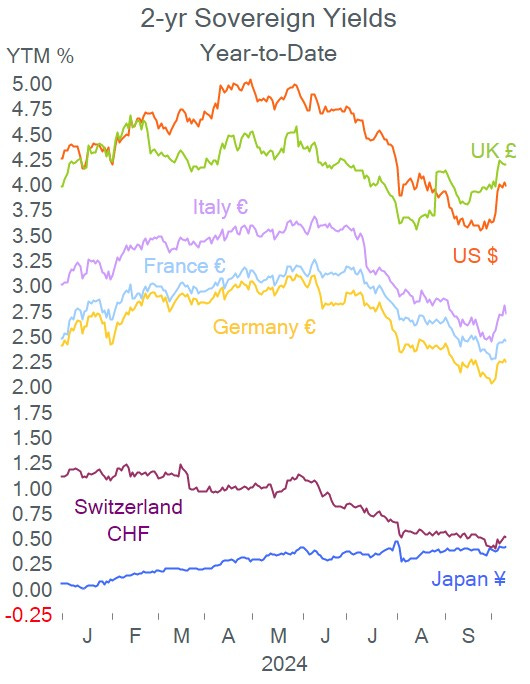

Thursday's key market event was the U.S. CPI inflation update for September showing a modest deceleration to 2.4% (vs 2.5% in August), the lowest since early 2021 but slightly above consensus. The core CPI reading came in at 3.3%, a touch higher than a month earlier and also above estimates (see chart). Overall, these figures suggest that the Fed remains on track to cut rates again next month. Markets are pricing in an 85% chance for a 25bp rate cut versus a 15% prob of no rate change at the Nov 7 meeting.

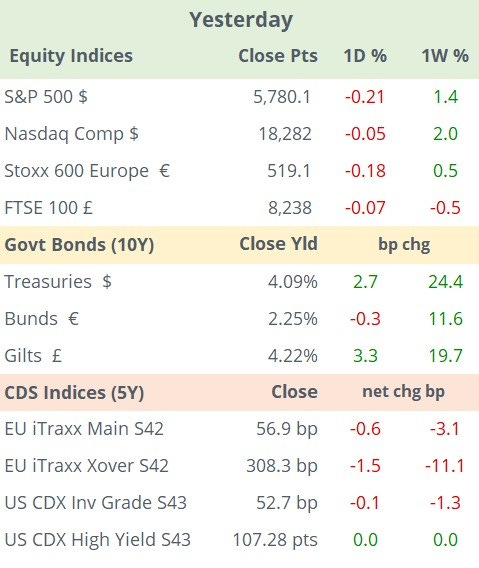

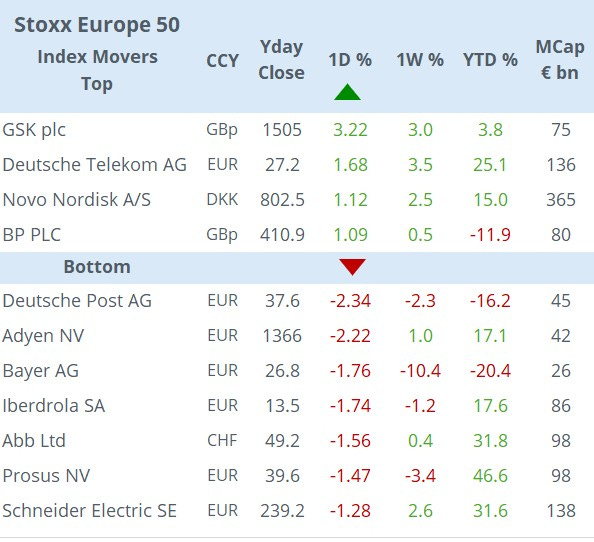

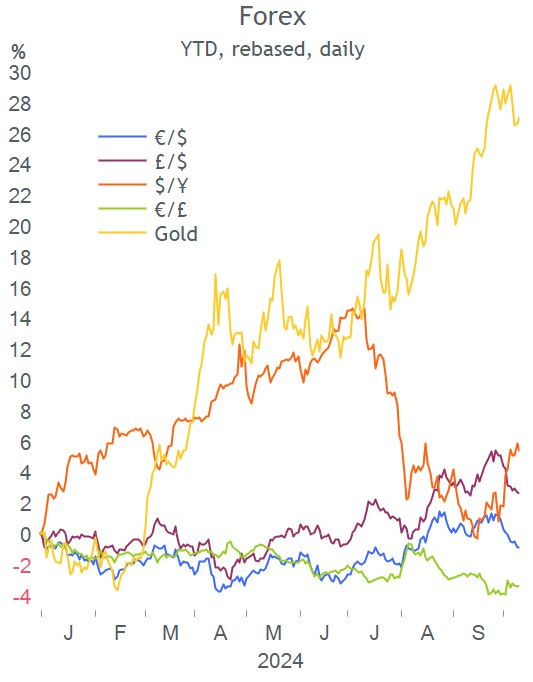

Market sentiment was somewhat muted with U.S. equities closing modestly lower, the $ and bond yields barely moving yesterday. On a week-to-date basis, the greenback is ~1% higher against majors, yields are little changed and stocks are firmer by >1%.

Fed officials' reaction to the inflation update was mixed to dovish. Chicago Fed President Goolsbee said interest rates need to drop a 'fair amount', NY Fed President Williams said he expects monetary policy to move to a more neutral setting while Atlanta’s Bostic said he was comfortable with keeping rates steady at the next meeting depending on how data developed.

The minutes from the last ECB meeting showed a cautious mood on further policy easing due to still stubborn price pressures and disappointing growth. The ECB next meets on Oct 17 and a 25bp rate cut to 3.25% is almost fully priced in with a similar move in Dec also widely expected.

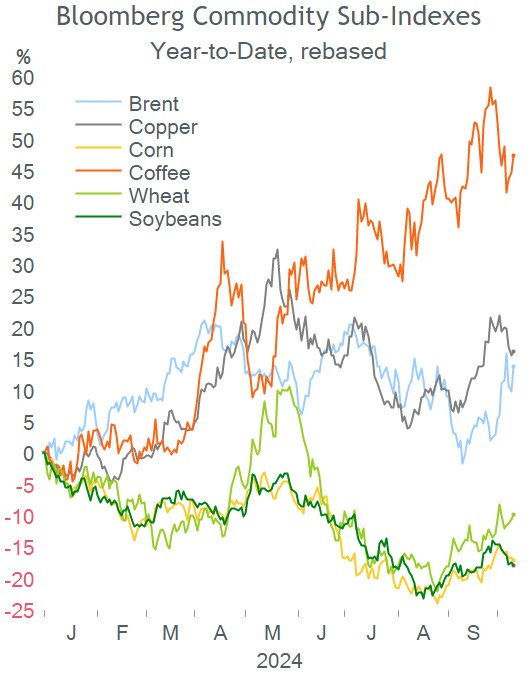

In weather updates, Florida avoided the worst-case scenario as Hurricane Milton did not trigger a catastrophic rise in seawater levels as it crossed the state into the Atlantic but left over 3mn homes and businesses without power and at least 14 casualties. Fitch estimates the insurers' losses at $30-50bn from Milton’s damage alone which added to Hurricane Helene’s losses would take the total to over $100bn in Florida for a 5th consecutive year.

The French government delivered next year’s budget with a target to cut the deficit to 5% of GDP (from 6.1%) via spending cuts of €60bn and tax increases to the wealthy and businesses. It needs the approval of a divided parliament. The country’s debt is expected to reach 115% of GDP next year with interest payments as the number one government expenditure. Fitch will review France’s sovereign rating today and Moody’s will do the same in two weeks. The 10-year OAT yield spread over Bunds has widened 24bp this year to +77bp for a 3.02% yield, in line with Spain but wider than Portugal.

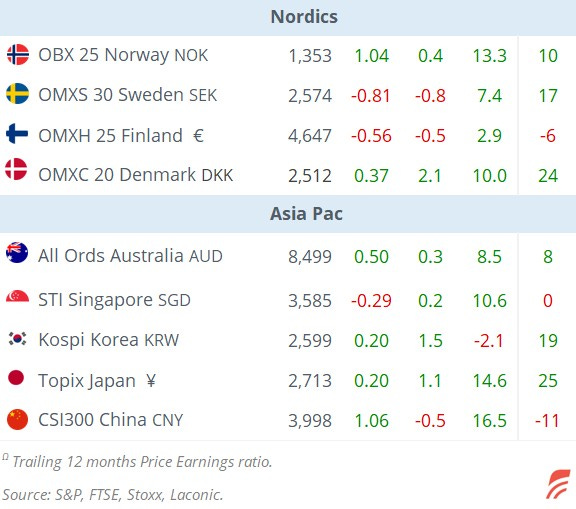

The Bank of Korea cut interest rates by 25bp today to 3.25% as expected, its first rate cut in more than 4-yrs to revive growth as a deteriorating economy slowed inflation pressures. Also, Peru kept policy rates unch at 5.25% versus expectations for a 25bp cut.

In business news, Tesla unveiled its two-door robotaxi ‘Cybercab’ which plans to produce in 2026 with a tag price of less than $30k. The EV maker also announced a 66% annual increase in sales in China’s domestic market (72k units).

In DCM, Belgium’s postal co BPOST issued 5 and 7-yr senior bonds in €, rated A-.

Economic data today: GDP, industrial, manufacturing and services output in the UK; final inflation reading in Germany; PPI inflation and Michigan’s sentiment indicator in the U.S.

The U.S. Q3 earnings season kicks off today with JP Morgan, Wells Fargo, Blackrock and Bank New York Mellon reporting before the market opens.

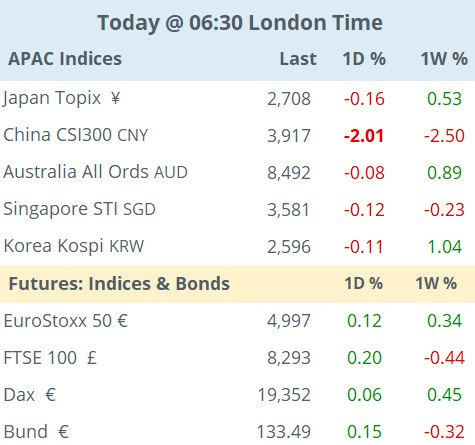

European futures are pointing to a positive opening in early trading. In Asia, China’s equity rollercoaster continues today with a 2% drop while other markets are little changed. It’s a holiday in Hong Kong.

That’s all for this week, thanks for your time and enjoy your weekend.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.