Morning,

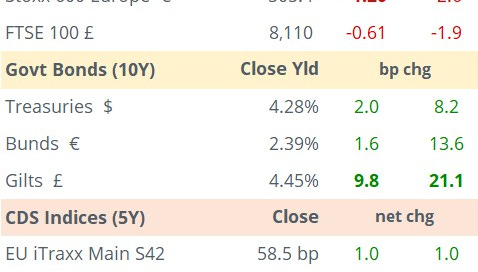

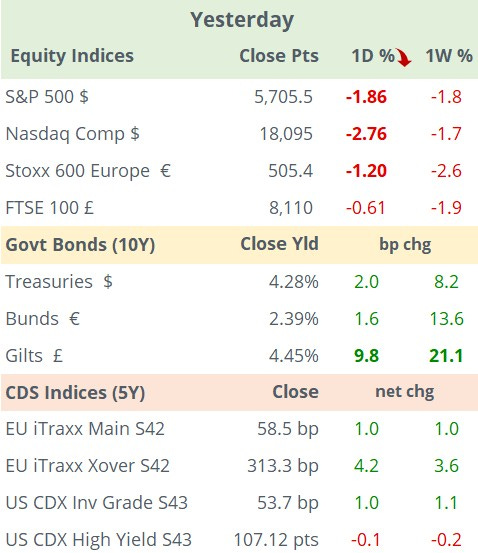

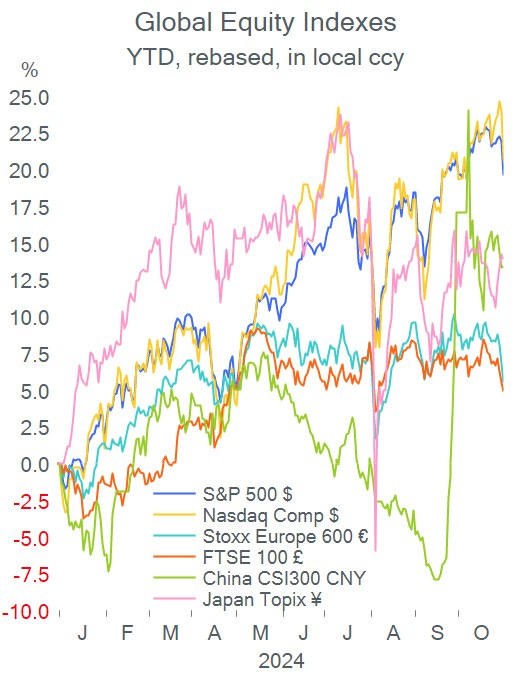

Risk assets sold off sharply on Thursday on both sides of the Atlantic with leading equity indices dropping the most in two months, driven by weak European earnings reports, a higher inflation print and steep falls for Wall Street’s mega-caps. The focus was on the rising costs for tech giants in the artificial intelligence race. Microsoft posted its worst day in two years with a 6% drop following its earnings release late Wednesday which disappointed on its Cloud sales outlook despite beating revenue and profit estimates. Shares are up by 8% this year.

Other tech mega-caps including Nvidia, Meta, Broadcom and Oracle lost around 4% yesterday, pulling the Nasdaq 100 index lower by 2.5%.

Apple reported results last night that beat revenue ($95bn) and net income ($14.7bn, -36% YoY) estimates but earnings plunged due to a one-time tax charge in Europe. Revenues for iPhones, its biggest-selling product rose by 6% to $46bn. Shares traded 2% lower in extended hours driven by the modest growth outlook for iPhone sales.

Amazon shares jumped 6% in after-hours trading after reporting better-than-expected earnings ($15bn) and revenue ($159bn) on robust growth for cloud computing and its advertising business.

Also, Estee Lauder (mcap $25bn) shares plunged 21% to an all-time low after withdrawing its annual forecast and cutting its dividend payout as it continues to face headwinds in China.

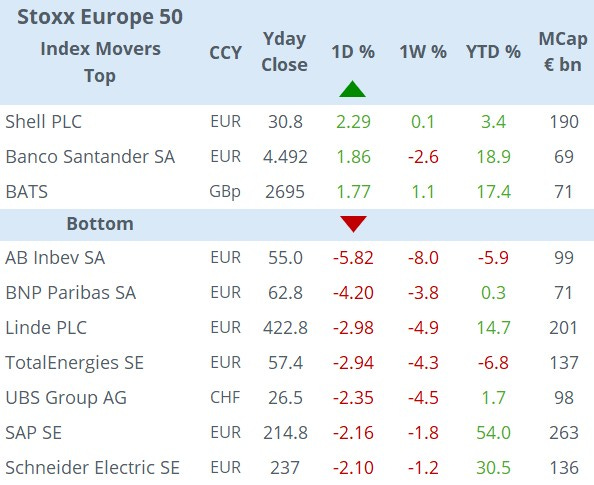

In Europe, brewer AB Inbev (mcap €99bn) reported sales and beer volume well below analysts’ estimates but raised its full-year guidance and announced a $2bn share buyback for the next 12 months. Shares fell 6%, the worst member among the Stoxx 50 index.

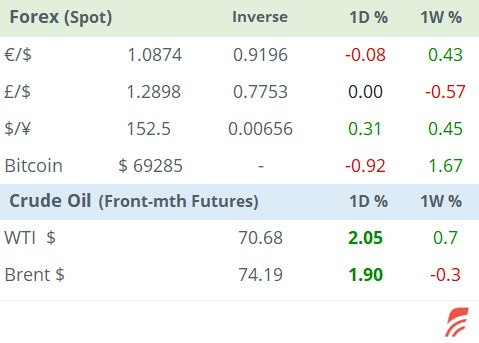

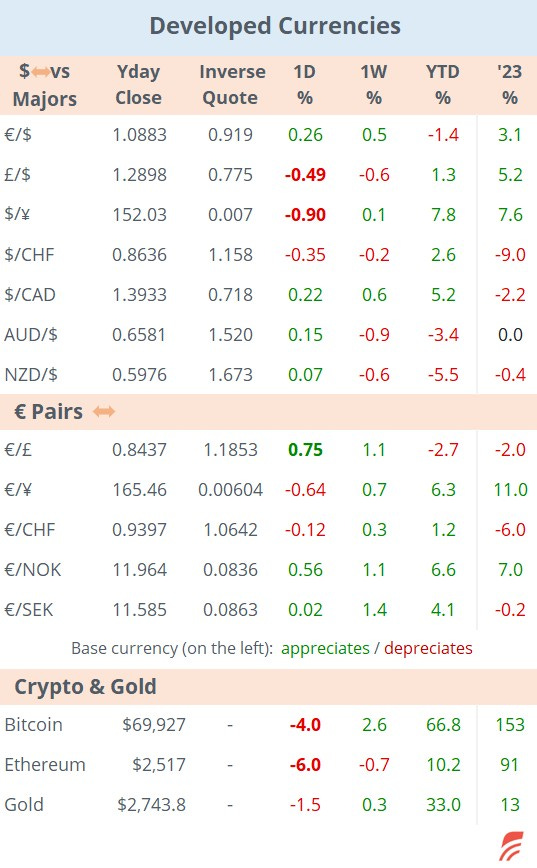

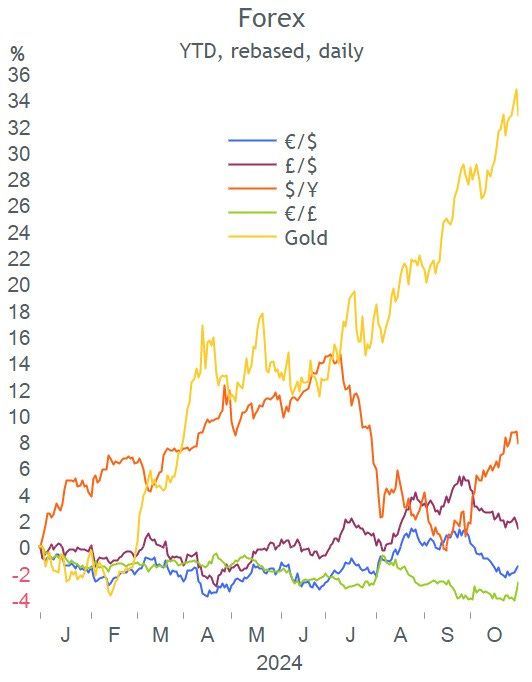

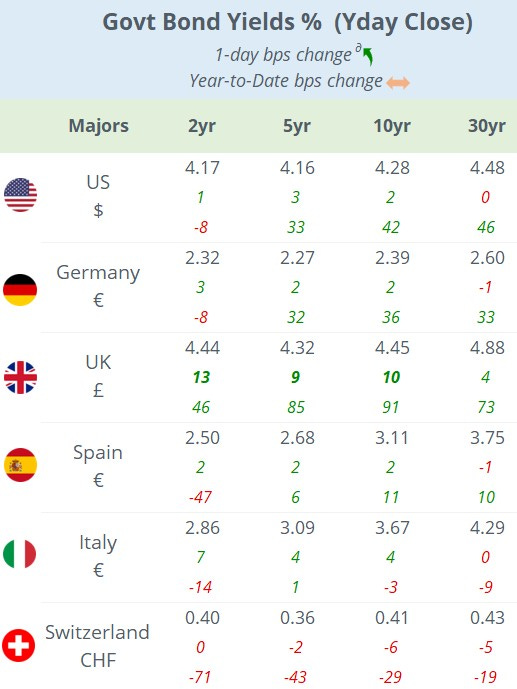

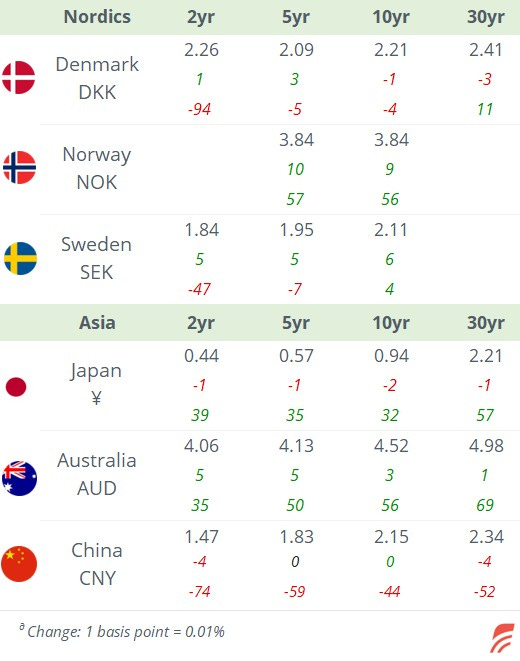

Thursday’s notable mover in fixed income markets was the Gilts sell-off following the Autumn Budget announcement, the first for a Labour government in 14 years, which includes an additional borrowing of £32bn. Short-end Gilts yields rose by 12bp to 4.44%, the yield curve is relatively flat with 10-yr yields at the highest level in one year. In forex, cable fell 0.5% and the € appreciated 0.75% against £.

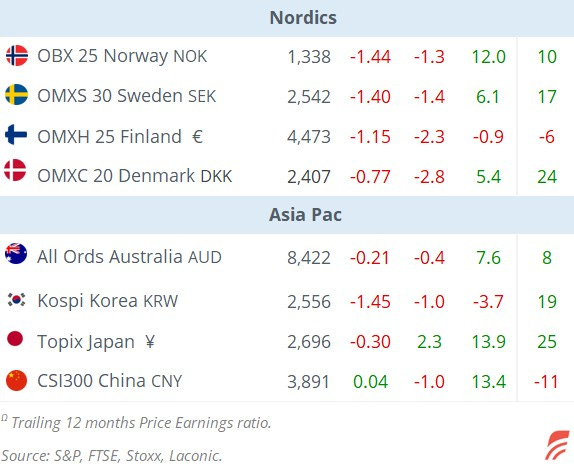

Asian markets are mixed today with China and Hong Kong advancing while Japanese stocks are down sharply following New York’s weakness last night.

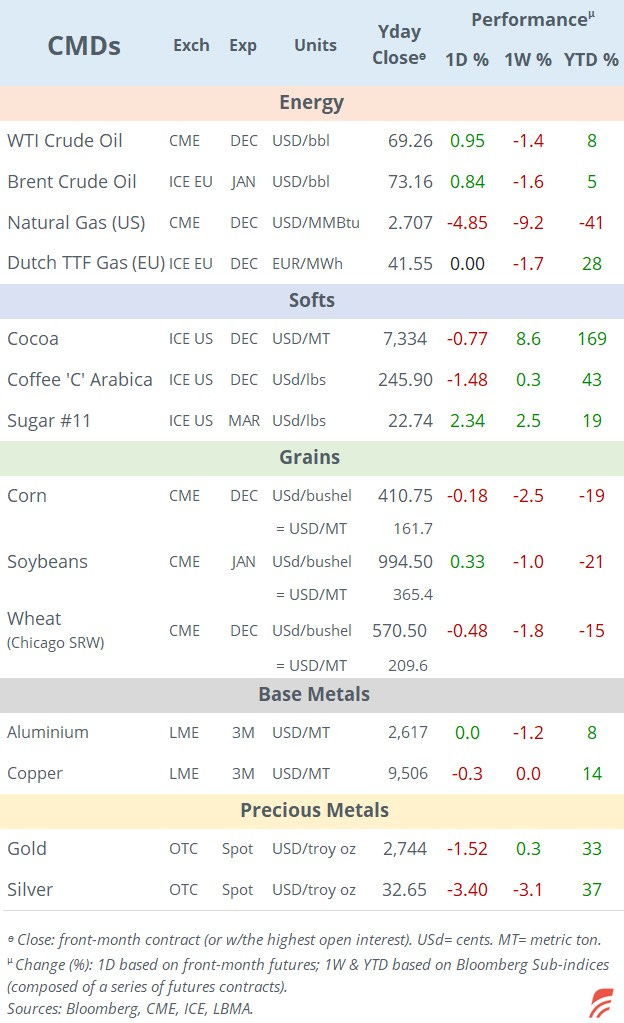

Crude oil is gaining 2% today on headlines suggesting that Iran could be planning another attack on Israel. Brent is trading at $74.20 and WTI is again above 70 this morning.

In economics yesterday, €-zone headline inflation came in at 2% YoY in October, a touch higher than expected and above the 1.7% recorded a month earlier, still meeting the ECB’s target. The core inflation reading rose by 2.7%, steady on the month. The update increased the chances of a low 25bp rate cut in December. The unemployment rate for the €-zone stands at 6.3%.

The US consumption update for September was firmer than a month earlier and marginally above estimates, expanding 0.5% MoM.

China’s NBS Mfg PMI rose to expansion territory for the first time in six months lifted by the stimulus measures but Western consumer companies including Estee Lauder, Carlsberg and Inbev warned of plunging sales in the country.

In M&A, Siemens AG (mcap €140bn) will acquire US industrial software company Altair Engineering (mcap $8.8bn) in a $10bn deal, the German conglomerate’s second-largest acquisition.

In DCM issues, €LVMH 8yr senior, rated AA-, at a 3.16% yield; £EDF 40-yr senior, BBB+ at 170bp over Gilts; $Ford 7-yr, BBB- at 6%.

In ratings, Fitch u/g Unicredit Spa (mcap €63bn) by one notch to BBB+.

Today’s data: US employment report for October with non-farm payrolls expected at +113k, well below the previous month. Also, Swiss inflation and the final Mfg PMI in the US and UK.

Earnings announcements: Exxon, Chevron and Enbridge, all before the market opens.

It’s a holiday in Sweden, India, Chile and Peru.

Thanks for your time and enjoy your weekend.

Copyright © 2024 Laconic. All rights reserved. This publication, 'Markets Dawn Europe', contains proprietary content and is intended solely for the recipient's personal use. Disclaimer: Our service is for informational purposes only and does not constitute personal financial advice.